Deck 19: Information for Decisions: Relevant Costs and Benefits

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/116

Play

Full screen (f)

Deck 19: Information for Decisions: Relevant Costs and Benefits

1

Which of the following statements about relevant information is/are true?

I) An accountant can use past prices, previous market demand and previous cost data to predict future costs when repetitive decisions are made.

Ii) No relevant information is available within an organisation's information system for unique decisions.

Iii) It is important to segregate relevant data from irrelevant data because it is possible to overload management with information.

A) i

B) ii

C) ii and iii

D) i and iii

I) An accountant can use past prices, previous market demand and previous cost data to predict future costs when repetitive decisions are made.

Ii) No relevant information is available within an organisation's information system for unique decisions.

Iii) It is important to segregate relevant data from irrelevant data because it is possible to overload management with information.

A) i

B) ii

C) ii and iii

D) i and iii

D

2

The primary advantage of differential analysis is that it:

A) clearly shows the difference between the costs and benefits of the alternatives.

B) is much easier to formulate than total cost.

C) reduces the cost of one alternative by the cost of another.

D) only considers relevant costs.

A) clearly shows the difference between the costs and benefits of the alternatives.

B) is much easier to formulate than total cost.

C) reduces the cost of one alternative by the cost of another.

D) only considers relevant costs.

A

3

Criteria measured utilising quantitative terms include objectives such as:

A) profit maximisation or cost minimisation.

B) cost minimisation and employee morale.

C) increased sales and improved quality.

D) cost minimisation and employee morale; increased sales and improved quality.

A) profit maximisation or cost minimisation.

B) cost minimisation and employee morale.

C) increased sales and improved quality.

D) cost minimisation and employee morale; increased sales and improved quality.

A

4

When the objectives of the decision are in conflict, one objective may be specified as the decision criterion and the other objectives are established as:

A) differential criteria.

B) irrelevant criteria.

C) constraints.

D) opportunity costs.

A) differential criteria.

B) irrelevant criteria.

C) constraints.

D) opportunity costs.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

5

In order for information to be relevant, the decision to be made must have an effect on:

I) future cost or revenues.

Ii) past cost or revenues.

Iii) the timeliness of information.

A) i

B) ii

C) iii

D) i and ii

I) future cost or revenues.

Ii) past cost or revenues.

Iii) the timeliness of information.

A) i

B) ii

C) iii

D) i and ii

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

6

Decision problems involving accounting data are specified in:

A) qualitative terms.

B) quantitative terms.

C) financial aspects.

D) accounting aspects.

A) qualitative terms.

B) quantitative terms.

C) financial aspects.

D) accounting aspects.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

7

Opportunity cost is best defined as:

A) the amount of money that is paid for something.

B) the amount of money that is paid for something, considering inflation.

C) the highest valued benefit given up in making a choice.

D) all of the benefits that are given up in making a choice.

A) the amount of money that is paid for something.

B) the amount of money that is paid for something, considering inflation.

C) the highest valued benefit given up in making a choice.

D) all of the benefits that are given up in making a choice.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

8

Opportunity cost may also be described as:

A) a foregone benefit.

B) a comparative cost.

C) a frontier cost.

D) an alternative cost.

A) a foregone benefit.

B) a comparative cost.

C) a frontier cost.

D) an alternative cost.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

9

Which of the following statements about the decision-making process is/are true?

I) The first step in the decision-making process is to define or clarify a decision problem into clear terms that can be addressed.

Ii) Before alternatives can be identified, the necessary data must first be collected.

Iii) After the alternatives are identified, the criterion on which a decision will be made must be specified.

A) i

B) ii

C) iii

D) All of the given answers

I) The first step in the decision-making process is to define or clarify a decision problem into clear terms that can be addressed.

Ii) Before alternatives can be identified, the necessary data must first be collected.

Iii) After the alternatives are identified, the criterion on which a decision will be made must be specified.

A) i

B) ii

C) iii

D) All of the given answers

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

10

Which of the following statements is/are true?

I) Accurate but irrelevant information is still useful for decision making.

Ii) Relevant, accurate, but not timely information is not useful in decision making.

Iii) Relevant information that is known to have some weaknesses in accuracy still is useful in decision making.

A) i

B) ii

C) i and ii

D) ii and iii

I) Accurate but irrelevant information is still useful for decision making.

Ii) Relevant, accurate, but not timely information is not useful in decision making.

Iii) Relevant information that is known to have some weaknesses in accuracy still is useful in decision making.

A) i

B) ii

C) i and ii

D) ii and iii

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

11

Which of the following statements about relevant information is/are true?

I) For information to be relevant, it must relate to the future.

Ii) For information to be relevant, it must differ between the alternatives.

Iii) For information to be relevant, it must be completely accurate.

A) i

B) i and ii

C) i and iii

D) All of the given answers

I) For information to be relevant, it must relate to the future.

Ii) For information to be relevant, it must differ between the alternatives.

Iii) For information to be relevant, it must be completely accurate.

A) i

B) i and ii

C) i and iii

D) All of the given answers

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

12

If a management accountant is trying to decide whether a cost is relevant to a decision, he or she should consider the cost relevant if:

A) it is a historical cost precise in nature.

B) it is a historical cost that is the same among all alternatives.

C) it is an expected future cost that is the same for each alternative.

D) it is an expected future cost that is different for each alternative.

A) it is a historical cost precise in nature.

B) it is a historical cost that is the same among all alternatives.

C) it is an expected future cost that is the same for each alternative.

D) it is an expected future cost that is different for each alternative.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

13

What term is used to describe factors in a decision problem that cannot be expressed effectively in numerical terms?

A) Qualitative

B) Quantitative

C) Sensitive

D) Uncertain

A) Qualitative

B) Quantitative

C) Sensitive

D) Uncertain

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

14

The book value of an asset such as equipment is an example of:

A) a future cost.

B) a differential cost.

C) an opportunity cost.

D) a sunk cost.

A) a future cost.

B) a differential cost.

C) an opportunity cost.

D) a sunk cost.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

15

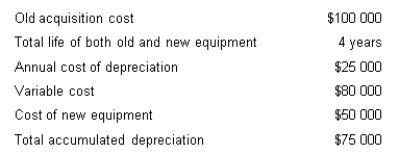

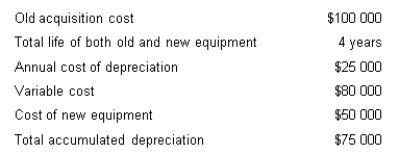

In a decision to keep or replace a piece of equipment, calculate the total yearly expense of keeping the old equipment using the following data.

A) $105 000

B) $25 000

C) $95 000

D) $130 000

A) $105 000

B) $25 000

C) $95 000

D) $130 000

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

16

In decision making, opportunity costs are:

A) unimportant costs.

B) historical costs.

C) relevant costs.

D) future costs.

A) unimportant costs.

B) historical costs.

C) relevant costs.

D) future costs.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

17

Which of the following statements about the management accountant's role in the decision-making process is/are true?

I) The management accountant is primarily responsible for selecting an alternative in the decision-making process.

Ii) The management account is primarily responsible for collecting the data in the decision-making process.

Iii) The management accountant is sometimes involved in developing a decision model in the decision-making process.

A) i

B) i and ii

C) i and iii

D) ii and iii

I) The management accountant is primarily responsible for selecting an alternative in the decision-making process.

Ii) The management account is primarily responsible for collecting the data in the decision-making process.

Iii) The management accountant is sometimes involved in developing a decision model in the decision-making process.

A) i

B) i and ii

C) i and iii

D) ii and iii

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

18

An accounting information system should be designed to provide useful information. To be useful the information must be:

A) qualitative not quantitative.

B) unique and unavailable through other sources.

C) historical in nature and not purport to predict the future.

D) relevant, accurate and timely.

A) qualitative not quantitative.

B) unique and unavailable through other sources.

C) historical in nature and not purport to predict the future.

D) relevant, accurate and timely.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

19

The most common trade-off in a decision situation is between information:

A) accuracy and relevance.

B) relevance and timeliness.

C) accuracy and timeliness.

D) sensitivity and relevance.

A) accuracy and relevance.

B) relevance and timeliness.

C) accuracy and timeliness.

D) sensitivity and relevance.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

20

In order to be relevant to a decision, cost or benefit information must involve ________, rather than ________.

A) a past event; a future event

B) actual data; estimated data

C) a future event; a past event

D) a past event; a current event

A) a past event; a future event

B) actual data; estimated data

C) a future event; a past event

D) a past event; a current event

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

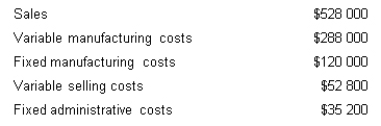

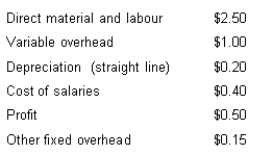

21

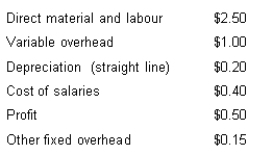

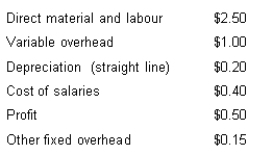

A firm has the following cost data per unit.

Calculate total cost per unit.

A) $3.25

B) $4.25

C) $1.75

D) $2.25

Calculate total cost per unit.

A) $3.25

B) $4.25

C) $1.75

D) $2.25

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

22

Which of the following statements regarding short-term decisions is true?

A) Fixed costs must only be considered on a per unit basis.

B) Fixed costs will actually behave as variable costs when they are unitised for special decisions.

C) Unitised fixed costs are valid only for make or buy decisions.

D) Unitised fixed costs are misleading because they appear to behave as variable costs when in fact they are not.

A) Fixed costs must only be considered on a per unit basis.

B) Fixed costs will actually behave as variable costs when they are unitised for special decisions.

C) Unitised fixed costs are valid only for make or buy decisions.

D) Unitised fixed costs are misleading because they appear to behave as variable costs when in fact they are not.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

23

The manager of Big Mac Ltd is considering the purchase of equipment to make hamburgers that will reduce annual operating costs by $1500. The equipment will cost $6000 and will have a useful life of five years with no resale value. The new equipment will replace equipment purchased five years ago at a cost of $10 000, that has a book value of $5000 and no resale value. What will be the net effect on profit for the next five years in total if the new equipment is purchased? (Ignore tax effects.)

A) $7500 increase

B) $4500 decrease

C) $3500 decrease

D) $1500 increase

A) $7500 increase

B) $4500 decrease

C) $3500 decrease

D) $1500 increase

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

24

Generally, joint costs are not relevant in decision making after split-off because:

A) they do not help increase the sales.

B) they increase the sales margin only marginally.

C) they do not change regardless of any decision.

D) joint costs reflect opportunity costs.

A) they do not help increase the sales.

B) they increase the sales margin only marginally.

C) they do not change regardless of any decision.

D) joint costs reflect opportunity costs.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

25

Jaspar Ltd has 1000 units in inventory that cost $2.00 per unit to produce. Due to changing technology, the sales department is having difficulty selling the product. It will cost $500 to scrap the units. The company should consider any price over:

A) $2000.

B) $2500.

C) $1500.

D) $0.

A) $2000.

B) $2500.

C) $1500.

D) $0.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

26

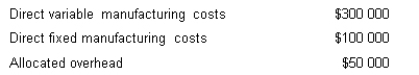

Xebex Pty Ltd is considering whether to make or buy a component used in the production of Faz Machines. The annual cost of producing the 100 000 components used by the company is as follows.

If Xebex were to discontinue production of the component, direct fixed manufacturing costs would be reduced by 80 per cent.

What are the irrelevant costs in the decision?

A) $50 000

B) $70 000

C) $80 000

D) $100 000

If Xebex were to discontinue production of the component, direct fixed manufacturing costs would be reduced by 80 per cent.

What are the irrelevant costs in the decision?

A) $50 000

B) $70 000

C) $80 000

D) $100 000

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

27

Which of the following statements about variable and fixed expenses, as they relate to relevance, is/are true?

I) Variable expenses may or may not be relevant costs.

Ii) Variable expenses are always relevant.

Iii) Fixed expenses are never relevant.

A) i

B) i and iii

C) iii

D) ii and iii

I) Variable expenses may or may not be relevant costs.

Ii) Variable expenses are always relevant.

Iii) Fixed expenses are never relevant.

A) i

B) i and iii

C) iii

D) ii and iii

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

28

A special order generally should be accepted if:

A) its revenue exceeds allocated fixed costs, regardless of the variable costs associated with the order.

B) excess capacity exists and the revenue exceeds all variable costs associated with the order.

C) excess capacity exists and the revenue exceeds allocated fixed costs.

D) the revenue exceeds variable costs, regardless of available capacity.

A) its revenue exceeds allocated fixed costs, regardless of the variable costs associated with the order.

B) excess capacity exists and the revenue exceeds all variable costs associated with the order.

C) excess capacity exists and the revenue exceeds allocated fixed costs.

D) the revenue exceeds variable costs, regardless of available capacity.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

29

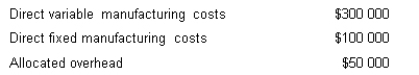

Xebex Pty Ltd is considering whether to make or buy a component used in the production of Faz Machines. The annual cost of producing the 100 000 components used by the company is as follows.

If Xebex were to discontinue production of the component, direct fixed manufacturing costs would be reduced by 80 per cent.

Xebex should buy the 100 000 components if the cost of purchasing per unit is less than what amount?

A) $4.50

B) $4.00

C) $3.80

D) $3.00

If Xebex were to discontinue production of the component, direct fixed manufacturing costs would be reduced by 80 per cent.

Xebex should buy the 100 000 components if the cost of purchasing per unit is less than what amount?

A) $4.50

B) $4.00

C) $3.80

D) $3.00

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

30

Holt Pty Ltd presently makes 20 000 units of a certain part to use in production. The cost to make the part is $20 per unit including $15 in variable costs and $5 in fixed overhead applied. If Holt buys the part from Bricker, the cost would be $18 per unit and the released facilities could not be used for any other activity. Eighty per cent of the fixed overhead would continue. Determine the relevant costs to make the part.

A) $320 000

B) $360 000

C) $380 000

D) $300 000

A) $320 000

B) $360 000

C) $380 000

D) $300 000

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

31

Rapid Growth Pty Ltd is presently operating at full capacity. They received a special order that, if accepted, would require refusing some sales to regular customers. Which of the following factors should management consider when making their decision?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

32

In the relative sales value method, joint costs are allocated between products:

A) in proportion to their sales value at split-off point.

B) in proportion to their profit margin at split-off point.

C) in proportion to the separable costs at split-off point.

D) in proportion to cost of production of a joint product.

A) in proportion to their sales value at split-off point.

B) in proportion to their profit margin at split-off point.

C) in proportion to the separable costs at split-off point.

D) in proportion to cost of production of a joint product.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

33

Mod Clothiers makes women's clothes. It costs $28 000 to produce 5000 pairs of polka-dot polyester pants. They have been unable to sell the pants at their usual price of $50.00. The company is evaluating two alternatives. They could sell the pants 'as is' for a total of $15 000 or they could modify the pants at a cost of $3000 and sell them for a total of $20 000.

What would be the effect on profit of modifying the pants and selling them as opposed to selling 'as is'?

A) $8000 decrease

B) $11 000 decrease

C) $2000 increase

D) $3000 increase

What would be the effect on profit of modifying the pants and selling them as opposed to selling 'as is'?

A) $8000 decrease

B) $11 000 decrease

C) $2000 increase

D) $3000 increase

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

34

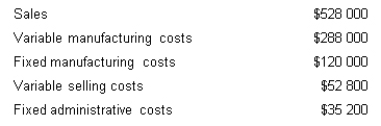

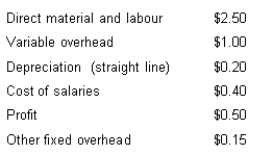

Sound Systems reported the following results from the sale of 24 000 radios:

Sound Systems expects similar operating results during the current year. Rhythm Systems has offered to purchase 3000 radios at $16 each. Sound Systems estimates approximately 5000 additional units could be made with the capacity currently available in the factory. The owner of Sound Systems is in favour of accepting the order. She feels it would be profitable because no variable selling costs will be incurred. The plant manager is against acceptance because his 'full cost' of production is $17.

Determine the change in profit if the special order is accepted.

A) $3000 increase

B) $12 000 increase

C) $12 000 decrease

D) $36 000 decrease

Sound Systems expects similar operating results during the current year. Rhythm Systems has offered to purchase 3000 radios at $16 each. Sound Systems estimates approximately 5000 additional units could be made with the capacity currently available in the factory. The owner of Sound Systems is in favour of accepting the order. She feels it would be profitable because no variable selling costs will be incurred. The plant manager is against acceptance because his 'full cost' of production is $17.

Determine the change in profit if the special order is accepted.

A) $3000 increase

B) $12 000 increase

C) $12 000 decrease

D) $36 000 decrease

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

35

SloGrowth has idle capacity. They have received a special order for 2000 units at a price of $6 per unit. Currently production and sales are budgeted for 20 000 units without considering the special order. Budget information for the year is presented below.

Cost of goods sold includes $20 000 of fixed manufacturing cost. Determine the effect on profit if the special order is accepted.

A) Remains the same

B) Increase by $2000

C) Decrease by $2000

D) Decrease by $1000

Cost of goods sold includes $20 000 of fixed manufacturing cost. Determine the effect on profit if the special order is accepted.

A) Remains the same

B) Increase by $2000

C) Decrease by $2000

D) Decrease by $1000

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

36

Mod Clothiers makes women's clothes. It costs $28 000 to produce 5000 pairs of polka-dot polyester pants. They have been unable to sell the pants at their usual price of $50.00. The company is evaluating two alternatives. They could sell the pants 'as is' for a total $15 000 or they could modify the pants and sell them for a total of $20 000.

At what cost to modify each pair of pants, would Mod Clothiers be indifferent between the two alternatives?

A) $0.40

B) $0.50

C) $0.75

D) $1.00

At what cost to modify each pair of pants, would Mod Clothiers be indifferent between the two alternatives?

A) $0.40

B) $0.50

C) $0.75

D) $1.00

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

37

Sunshine Products is a multiproduct firm. The revenues of a single product are $200 000 when 10 000 units are sold. Variable costs are $16 per unit. Direct fixed expenses of $25 000 consist primarily of depreciation on equipment specialised to the product. By what amount will Sunshine Products' cash flow change if the product is dropped?

A) $200 000 decrease

B) $160 000 decrease

C) $40 000 decrease

D) $15 000 decrease

A) $200 000 decrease

B) $160 000 decrease

C) $40 000 decrease

D) $15 000 decrease

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

38

When excess capacity exists, the only relevant cost associated with a special order will usually be which cost?

A) Fixed cost

B) Variable cost

C) Administrative cost

D) Allocated fixed cost

A) Fixed cost

B) Variable cost

C) Administrative cost

D) Allocated fixed cost

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

39

Manufacturers sometimes sell products at less than full price for a special order. The analysis of such decisions focuses on:

A) fixed cost.

B) relevant benefits.

C) relevant costs.

D) both relevant benefits and relevant costs.

A) fixed cost.

B) relevant benefits.

C) relevant costs.

D) both relevant benefits and relevant costs.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

40

A firm has the following cost data per unit.

Calculate fixed costs per unit.

A) $0.75

B) $1.75

C) $2.25

D) $3.25

Calculate fixed costs per unit.

A) $0.75

B) $1.75

C) $2.25

D) $3.25

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

41

When a joint production process results in two or more products being produced simultaneously, the products are termed:

A) joint products.

B) split-off products.

C) by-products.

D) separable products.

A) joint products.

B) split-off products.

C) by-products.

D) separable products.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

42

The joint cost allocation method that ensures that the gross margin for each product is identical is the:

A) relative sales value method.

B) net realisable value method.

C) joint cost allocation method.

D) constant gross margin method.

A) relative sales value method.

B) net realisable value method.

C) joint cost allocation method.

D) constant gross margin method.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

43

Consider a situation where an activity-based costing system is in use rather than a traditional volume-based costing system. Which of the following statements is/are true?

A) The use of activity-based costing eliminates the need to consider qualitative factors.

B) When an activity-based costing system is used, facility level costs will have to be analysed differently than under a traditional volume-based costing system.

C) When an activity-based costing system is used, unit level costs will have to be analysed differently than when a traditional volume-based costing system is used.

D) None of the given answers

A) The use of activity-based costing eliminates the need to consider qualitative factors.

B) When an activity-based costing system is used, facility level costs will have to be analysed differently than under a traditional volume-based costing system.

C) When an activity-based costing system is used, unit level costs will have to be analysed differently than when a traditional volume-based costing system is used.

D) None of the given answers

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

44

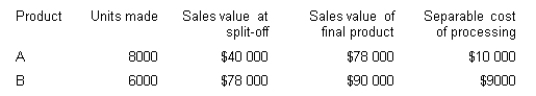

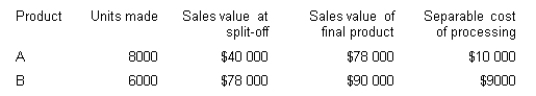

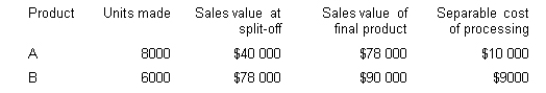

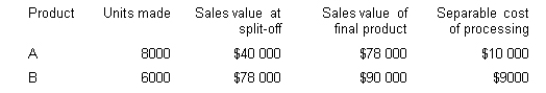

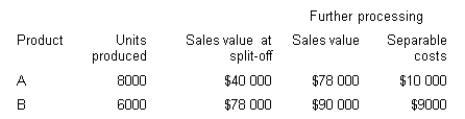

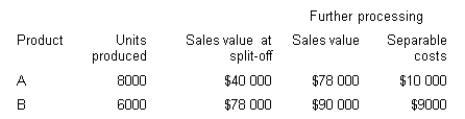

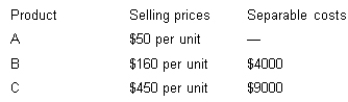

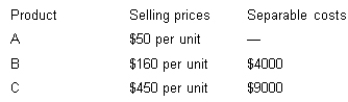

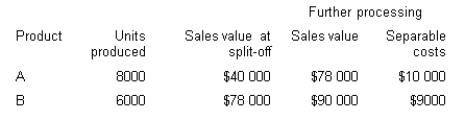

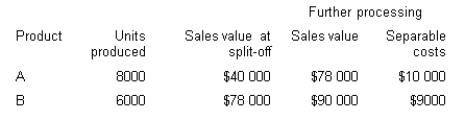

Lipex Pty Ltd produces two products (A and B) from a particular joint process. Each product may be sold at the split-off point or processed further. Additional processing requires no special facilities, and production costs of further processing are entirely variable and traceable to the products involved. Joint production costs for the year were $60 000. Sales values and costs are as follows.

Allocate the joint production costs based on the physical units method. What are the joint costs assigned to product A?

A) $25 714

B) $20 339

C) $34 286

D) $30 000

Allocate the joint production costs based on the physical units method. What are the joint costs assigned to product A?

A) $25 714

B) $20 339

C) $34 286

D) $30 000

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

45

Contribution margin per machine hour can be calculated by dividing:

A) machine hours required per unit by sales margin per unit.

B) contribution margin per unit by machine hours required per unit.

C) machine hours required per unit by contribution margin per unit.

D) total machine hours required by total contribution margin.

A) machine hours required per unit by sales margin per unit.

B) contribution margin per unit by machine hours required per unit.

C) machine hours required per unit by contribution margin per unit.

D) total machine hours required by total contribution margin.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

46

The method under which the relative magnitude of the final products' net realisable values is used to allocate the joint cost is the:

A) net realisable value method.

B) constant gross margin method.

C) relative sales value method.

D) physical units method.

A) net realisable value method.

B) constant gross margin method.

C) relative sales value method.

D) physical units method.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

47

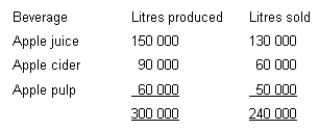

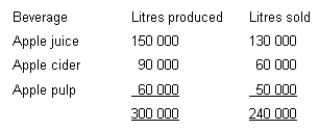

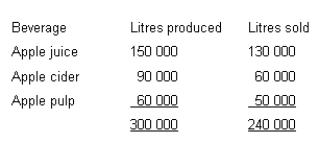

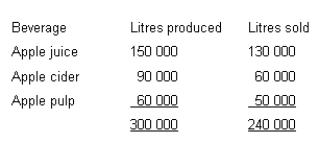

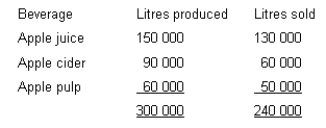

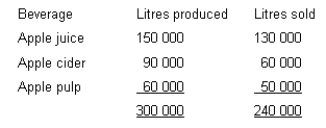

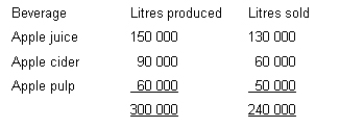

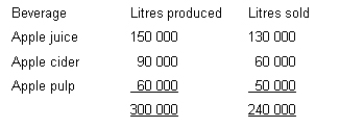

A firm incurs manufacturing costs totalling $240 000 in process 1 to produce the following three beverages emerging from that process at the split-off point.

Apple juice: sold immediately it emerges from Process 1 without further processing for $0.70 litre.

Apple cider: processed further in Process 2 at an additional cost of $0.66667 litre, then sold for $1.50 litre

Apple pulp: processed further in Process 3 at an additional cost of $1.50 litre, then sold for $3.50 litre.

The following data relates to the period in which the joint costs were incurred.

What is the amount of joint cost that would be allocated to apple juice if the net realisable value method had been used?

A) $120 000

B) $80 000

C) $84 000

D) $91 000

Apple juice: sold immediately it emerges from Process 1 without further processing for $0.70 litre.

Apple cider: processed further in Process 2 at an additional cost of $0.66667 litre, then sold for $1.50 litre

Apple pulp: processed further in Process 3 at an additional cost of $1.50 litre, then sold for $3.50 litre.

The following data relates to the period in which the joint costs were incurred.

What is the amount of joint cost that would be allocated to apple juice if the net realisable value method had been used?

A) $120 000

B) $80 000

C) $84 000

D) $91 000

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

48

A firm incurs manufacturing costs totalling $240 000 in process 1 to produce the following three beverages emerging from that process at the split-off point.

Apple juice: sold immediately it emerges from Process 1 without further processing for $0.70 litre.

Apple cider: processed further in Process 2 with an additional cost of $0.66667 litre, then sold for $1.50 litre.

Apple pulp: processed further in Process 3 with an additional cost of $1.50 litre, then sold for $3.50 litre.

The following data relates to the period in which the joint costs were incurred.

What is the amount of joint cost that would be allocated to apple juice if the physical measures method had been used?

A) $120 000

B) $80 000

C) $84 000

D) $130 000

Apple juice: sold immediately it emerges from Process 1 without further processing for $0.70 litre.

Apple cider: processed further in Process 2 with an additional cost of $0.66667 litre, then sold for $1.50 litre.

Apple pulp: processed further in Process 3 with an additional cost of $1.50 litre, then sold for $3.50 litre.

The following data relates to the period in which the joint costs were incurred.

What is the amount of joint cost that would be allocated to apple juice if the physical measures method had been used?

A) $120 000

B) $80 000

C) $84 000

D) $130 000

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

49

A firm incurs manufacturing costs totalling $240 000 in process 1 to produce the following three beverages emerging from that process at the split-off point.

Apple juice: sold immediately it emerges from Process 1 without further processing for $0.70 litre.

Apple cider: processed further in Process 2 at an additional cost of $0.66667 litre, then sold for $1.50 litre.

Apple pulp: processed further in Process 3 at an additional cost of $1.50 litre, then sold for $3.50 litre.

The following data relates to the period in which the joint costs were incurred.

What is the amount of joint cost that would be allocated to apple juice if the relative sales value method had been used?

A) $120 000

B) $80 000

C) $84 000

D) Insufficient information to determine

Apple juice: sold immediately it emerges from Process 1 without further processing for $0.70 litre.

Apple cider: processed further in Process 2 at an additional cost of $0.66667 litre, then sold for $1.50 litre.

Apple pulp: processed further in Process 3 at an additional cost of $1.50 litre, then sold for $3.50 litre.

The following data relates to the period in which the joint costs were incurred.

What is the amount of joint cost that would be allocated to apple juice if the relative sales value method had been used?

A) $120 000

B) $80 000

C) $84 000

D) Insufficient information to determine

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

50

An appropriate way to account for by-products is to:

A) subtract the net realisable value of the by-products from the cost of the joint process.

B) deduct the by-product's sales value at split-off from the production cost of the main products.

C) allocate a portion of the joint cost to the by-product.

D) subtract the net realisable value of the by-products from the cost of the joint process AND/OR deduct the by-product's sales value at split-off from the production cost of the main products.

A) subtract the net realisable value of the by-products from the cost of the joint process.

B) deduct the by-product's sales value at split-off from the production cost of the main products.

C) allocate a portion of the joint cost to the by-product.

D) subtract the net realisable value of the by-products from the cost of the joint process AND/OR deduct the by-product's sales value at split-off from the production cost of the main products.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

51

Lipex Pty Ltd produces two products (A and B) from a particular joint process. Each product may be sold at the split-off point or processed further. Additional processing requires no special facilities, and production costs of further processing are entirely variable and traceable to the products involved. Joint production costs for the year were $60 000. Sales values and costs are as follows.

Allocate the joint production costs based on the physical units method. What are the joint costs assigned to product B?

A) $25 714

B) $20 339

C) $34 286

D) $39 661

Allocate the joint production costs based on the physical units method. What are the joint costs assigned to product B?

A) $25 714

B) $20 339

C) $34 286

D) $39 661

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

52

The joint cost allocation method that is not based on the economic characteristics of the joint products is the:

A) joint cost allocation method.

B) relative sales value method.

C) physical units method.

D) net realisable value method.

A) joint cost allocation method.

B) relative sales value method.

C) physical units method.

D) net realisable value method.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

53

Lido Products produces two products (A and B) from a joint process. The joint cost of production is $80 000. Five thousand units of Product A can be sold at split-off for $20 per unit or processed further at an additional cost of $20 000 and sold for $25 per unit. Ten thousand units of Product B can be sold at split-off for $15 per unit or processed further at an additional cost of $20 000 and sold for $16 per unit.

What is the difference in profit if Lido decides to process further Product A, instead of selling it at split-off?

A) $25 000 increase

B) $5000 increase

C) $21 000 increase

D) $27 000 decrease

What is the difference in profit if Lido decides to process further Product A, instead of selling it at split-off?

A) $25 000 increase

B) $5000 increase

C) $21 000 increase

D) $27 000 decrease

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

54

A chocolate company uses the weight of joint products as the allocation basis. This type of cost allocation is the:

A) relative sales value method.

B) net realisable value method.

C) physical units method.

D) joint cost allocation method.

A) relative sales value method.

B) net realisable value method.

C) physical units method.

D) joint cost allocation method.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

55

A joint product with very little value relative to other joint products is termed a:

A) negligible product.

B) accounted loss.

C) by-product.

D) scrap.

A) negligible product.

B) accounted loss.

C) by-product.

D) scrap.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

56

Which of these statements about joint cost allocation is false?

A) It is useful in deciding whether to process further a joint product after split-off.

B) It is not useful in making accurate profit determination about individual joint products from given data.

C) It can be accomplished using the physical units method approach.

D) It can be used to value inventory.

A) It is useful in deciding whether to process further a joint product after split-off.

B) It is not useful in making accurate profit determination about individual joint products from given data.

C) It can be accomplished using the physical units method approach.

D) It can be used to value inventory.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

57

Product costs incurred after the split-off point are called:

A) separable processing costs.

B) joint product cost.

C) by-product costs.

D) scrap costs.

A) separable processing costs.

B) joint product cost.

C) by-product costs.

D) scrap costs.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

58

Lido Products produces two products (A and B) from a joint process. The joint cost of production is $80 000. Five thousand units of Product A can be sold at split-off for $20 per unit or processed further at an additional cost of $20 000 and sold for $25 per unit. Ten thousand units of Product B can be sold at split-off for $15 per unit or processed further at an additional cost of $20 000 and sold for $16 per unit.

What is the difference in profit if Lido decides to process further Product B, instead of selling it at split-off?

A) $10 000 increase

B) $20 000 increase

C) $10 000 decrease

D) $58 000 decrease

What is the difference in profit if Lido decides to process further Product B, instead of selling it at split-off?

A) $10 000 increase

B) $20 000 increase

C) $10 000 decrease

D) $58 000 decrease

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

59

Consider the situation where an activity-based costing system is in use rather than a traditional volume-based costing system. Which of the following statements is/are true?

A) The relevant cost decision model would be inappropriate if activity-based costing is used.

B) The relevant cost decision model is still appropriate, but a different decision criterion must be used.

C) The data collection and analysis step is going to be affected by the use of non-volume-related cost drivers.

D) The relevant cost decision model would be inappropriate if activity-based costing is used AND the data collection and analysis step is going to be affected by the use of non-volume-related cost drivers.

A) The relevant cost decision model would be inappropriate if activity-based costing is used.

B) The relevant cost decision model is still appropriate, but a different decision criterion must be used.

C) The data collection and analysis step is going to be affected by the use of non-volume-related cost drivers.

D) The relevant cost decision model would be inappropriate if activity-based costing is used AND the data collection and analysis step is going to be affected by the use of non-volume-related cost drivers.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

60

The joint cost allocation method that recognises the revenues at split-off but does not consider any further processing costs is the:

A) relative sales value method.

B) net realisable value method.

C) joint cost allocation method.

D) constant gross margin method.

A) relative sales value method.

B) net realisable value method.

C) joint cost allocation method.

D) constant gross margin method.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

61

Why are joint costs never relevant in deciding whether to sell a product at split-off or process it further?

A) Because they are sunk costs

B) Because they are the same under both alternatives

C) Because they have already been allocated to joint products

D) Because they are sunk costs AND because they are the same under both alternatives

A) Because they are sunk costs

B) Because they are the same under both alternatives

C) Because they have already been allocated to joint products

D) Because they are sunk costs AND because they are the same under both alternatives

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

62

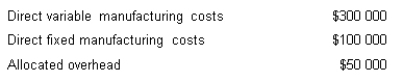

C Limited produces two products (A and B) from a particular joint process. Each product may be sold at split-off or may be further processed. Joint production costs for the year amounted to $60 000. Sales values and costs are as follows.

If the joint production costs were assigned using the relative sales value method the joint costs allocated to A would be:

A) $20 339.

B) $27 383.

C) $27 857.

D) $0: all joint costs are allocated to b

If the joint production costs were assigned using the relative sales value method the joint costs allocated to A would be:

A) $20 339.

B) $27 383.

C) $27 857.

D) $0: all joint costs are allocated to b

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

63

A firm incurs manufacturing costs totalling $240 000 in process 1 to produce the following three beverages emerging from that process at the split-off point:

Apple juice: sold immediately it emerges from Process 1 without further processing for $0.70 litre.

Apple cider: processed further in Process 2 at an additional cost of $0.66667 litre, then sold for $1.50 litre.

Apple pulp: processed further in Process 3 at an additional cost of $1.50 litre, then sold for $3.50 litre.

The following data relates to the period in which the joint costs were incurred.

What is the amount of joint cost that would be allocated to apple juice if the constant gross margin method had been used?

A) $120 000

B) $91 000

C) $84 000

D) $80 000

Apple juice: sold immediately it emerges from Process 1 without further processing for $0.70 litre.

Apple cider: processed further in Process 2 at an additional cost of $0.66667 litre, then sold for $1.50 litre.

Apple pulp: processed further in Process 3 at an additional cost of $1.50 litre, then sold for $3.50 litre.

The following data relates to the period in which the joint costs were incurred.

What is the amount of joint cost that would be allocated to apple juice if the constant gross margin method had been used?

A) $120 000

B) $91 000

C) $84 000

D) $80 000

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

64

An opportunity cost is defined as:

A) the profit of the next best alternative foregone.

B) the additional revenue if we do not drop the product.

C) the additional (incremental) cost of accepting the order.

D) not being relevant if there is excess capacity.

A) the profit of the next best alternative foregone.

B) the additional revenue if we do not drop the product.

C) the additional (incremental) cost of accepting the order.

D) not being relevant if there is excess capacity.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

65

Which of the following is a correct statement regarding the link between decision making and performance evaluation?

A) Managers are rewarded for good decisions; therefore there is always an incentive for mangers to make the best decision for the firm.

B) Where managers are rewarded by financial variables such as bottom-line profit, there is often an incentive for managers to avoid a decision that may be in the best interests of the firm but reduce their segment's bottom line.

C) Managers can be relied on to always make decisions that are in the interests of the firm as a whole.

D) Decision making and performance evaluation are separate issues for the managers of firms and are seldom related.

A) Managers are rewarded for good decisions; therefore there is always an incentive for mangers to make the best decision for the firm.

B) Where managers are rewarded by financial variables such as bottom-line profit, there is often an incentive for managers to avoid a decision that may be in the best interests of the firm but reduce their segment's bottom line.

C) Managers can be relied on to always make decisions that are in the interests of the firm as a whole.

D) Decision making and performance evaluation are separate issues for the managers of firms and are seldom related.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

66

A firm produces three items from a single process in batches containing 40 units A (a by-product); 100 units B; 100 units C. Separable costs and selling prices are:

Joint process costs are $30 000 per batch.

What is the amount of joint costs that would be allocated to B using the net realisable value method and treats by-product revenue as a reduction of the cost of the principal products?

A) $7000

B) $7500

C) $15 000

D) $14 000

Joint process costs are $30 000 per batch.

What is the amount of joint costs that would be allocated to B using the net realisable value method and treats by-product revenue as a reduction of the cost of the principal products?

A) $7000

B) $7500

C) $15 000

D) $14 000

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

67

A firm currently makes a component, and requires 30 000 of them for the coming year's production. Another supplier has offered the part at a delivered price of $3 per unit. It would cost $3000 to check purchased units for quality. Product costs per unit for the past year were $2.35 variable and $1 fixed based on 30 000 units. If the component was bought, fixed overhead would be reduced by $6000, the cost of leasing specialised equipment. The space vacated by the equipment can be rented for $4000 for the year. Which of the following statements is the correct quantitative analysis of the make or buy decision?

A) The buy option costs $12 500 more than the make option.

B) The buy option costs $12 500 less than the make option.

C) The buy option costs $10 500 more than the make option.

D) The firm is indifferent between the two options.

A) The buy option costs $12 500 more than the make option.

B) The buy option costs $12 500 less than the make option.

C) The buy option costs $10 500 more than the make option.

D) The firm is indifferent between the two options.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

68

Which of the following statements is true of relevant costs?

A) Variable costs are always relevant.

B) Sunk costs are never relevant.

C) If costs are the same under two alternatives, they are not relevant.

D) Sunk costs are never relevant AND if costs are the same under two alternatives, they are not relevant.

A) Variable costs are always relevant.

B) Sunk costs are never relevant.

C) If costs are the same under two alternatives, they are not relevant.

D) Sunk costs are never relevant AND if costs are the same under two alternatives, they are not relevant.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

69

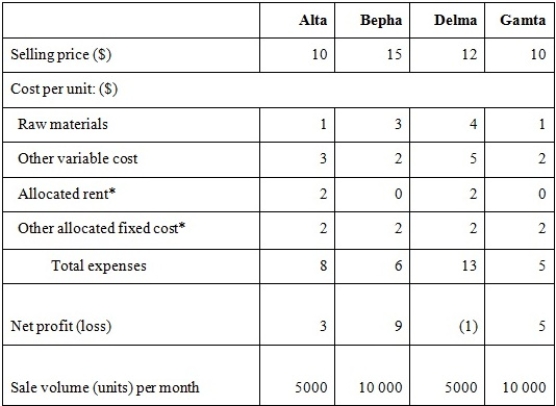

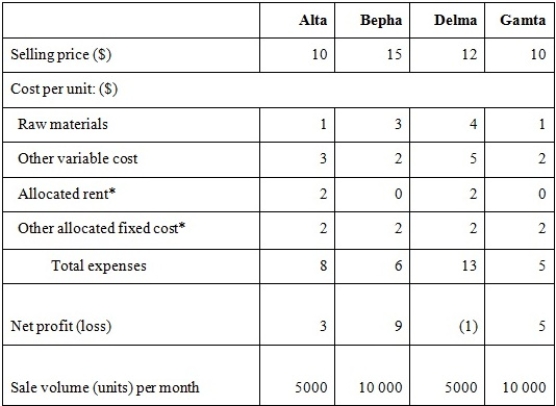

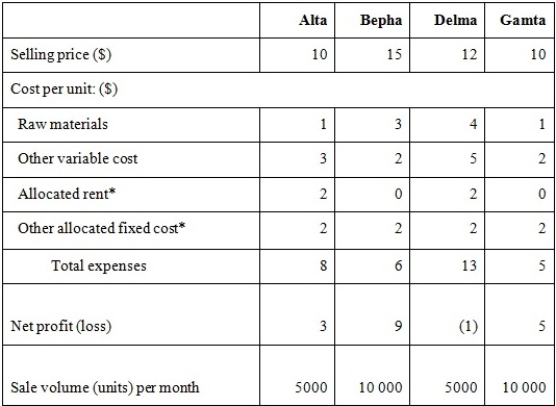

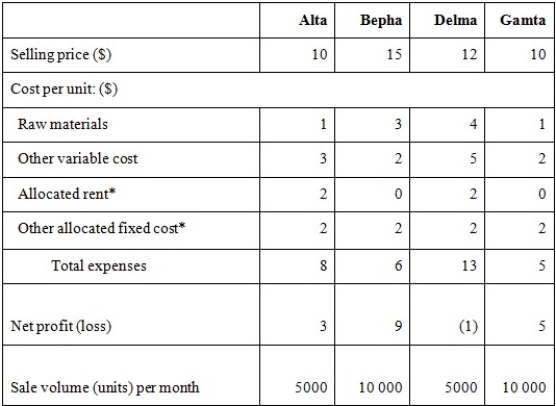

Zoota Ltd makes four products: Alta, Bepha, Delma and Gamta. The selling price and per unit costs are show below.

*Alta and Delma share the same factory; therefore, monthly rent is allocated equally between the two products. Other allocated monthly fixed costs include administrative costs, which are allocated based on a $2/unit charge.

What will be the company's total fixed cost (excluding rent) after Delma is dropped (assuming that sales volume = production volume)?

A) $30 000

B) $40 000

C) $50 000

D) $60 000

*Alta and Delma share the same factory; therefore, monthly rent is allocated equally between the two products. Other allocated monthly fixed costs include administrative costs, which are allocated based on a $2/unit charge.

What will be the company's total fixed cost (excluding rent) after Delma is dropped (assuming that sales volume = production volume)?

A) $30 000

B) $40 000

C) $50 000

D) $60 000

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

70

A joint cost is:

A) a cost of a single process that yields two or more products or services simultaneously.

B) a cost that is not directly attributable to the production of any specific good or service.

C) a cost shared by more than one process in a manufacturing cycle.

D) All of the given answers

A) a cost of a single process that yields two or more products or services simultaneously.

B) a cost that is not directly attributable to the production of any specific good or service.

C) a cost shared by more than one process in a manufacturing cycle.

D) All of the given answers

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

71

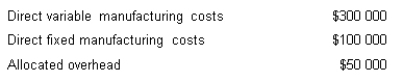

C Limited produces two products (A and B) from a particular joint process. Each product may be sold at split-off or may be further processed. Joint production costs for the year amounted to $60 000. Sales values and costs are as follows.

If the joint production costs were assigned using the net realisable value method, the joint costs allocated to B would be:

A) $23 964.

B) $32 143.

C) $32 617.

D) $39 661.

If the joint production costs were assigned using the net realisable value method, the joint costs allocated to B would be:

A) $23 964.

B) $32 143.

C) $32 617.

D) $39 661.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

72

A firm currently makes a component, and requires 30 000 for the coming year's production. Another supplier has offered the part at a delivered price of $3 per unit. It would cost $3000 to check purchased units for quality. Product costs per unit for the past year were $2.35 variable and $1 fixed based on 30 000 units. If the component was bought, fixed overhead would be reduced by $6000, the cost of leasing specialised equipment. The space vacated by the equipment can be rented for $4000 for the year. At what level of units of production is the firm indifferent between making and buying?

A) 30 000 units

B) 10 769 units

C) 4615 units

D) 20 000 units

A) 30 000 units

B) 10 769 units

C) 4615 units

D) 20 000 units

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

73

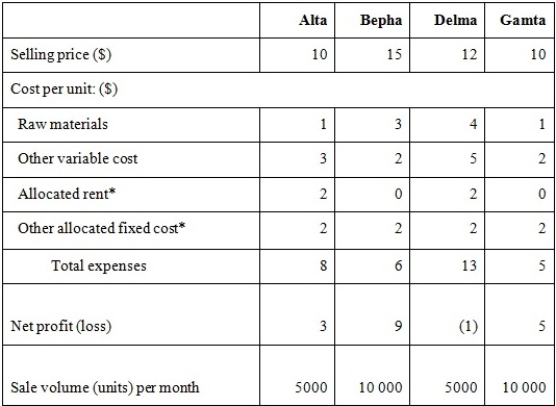

Zoota Ltd makes four products: Alta, Bepha, Delma and Gamta. The selling price and per unit costs are show below.

*Alta and Delma share the same factory; therefore, monthly rent is allocated equally between the two products. Other allocated monthly fixed costs include administrative costs, which are allocated based on a $2/unit charge.

Zoota Ltd decides to drop Delma because it is unprofitable. Christina Bobo, the management accountant of Zoota Ltd, suggests that by dropping Delma the company can save $1 x 5000 = $5000 a month. Your assessment of Christina's suggestion is:

A) Christina is correct in her quantitative assessment; although she needs to also consider the qualitative factors.

B) Christina is incorrect because by dropping Delma, the company actually loses $3 per unit.

C) Christina is incorrect, because by dropping Delma, the company actually loses $1 per unit.

D) Christina is incorrect, because Delma is currently at break-even point.

*Alta and Delma share the same factory; therefore, monthly rent is allocated equally between the two products. Other allocated monthly fixed costs include administrative costs, which are allocated based on a $2/unit charge.

Zoota Ltd decides to drop Delma because it is unprofitable. Christina Bobo, the management accountant of Zoota Ltd, suggests that by dropping Delma the company can save $1 x 5000 = $5000 a month. Your assessment of Christina's suggestion is:

A) Christina is correct in her quantitative assessment; although she needs to also consider the qualitative factors.

B) Christina is incorrect because by dropping Delma, the company actually loses $3 per unit.

C) Christina is incorrect, because by dropping Delma, the company actually loses $1 per unit.

D) Christina is incorrect, because Delma is currently at break-even point.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

74

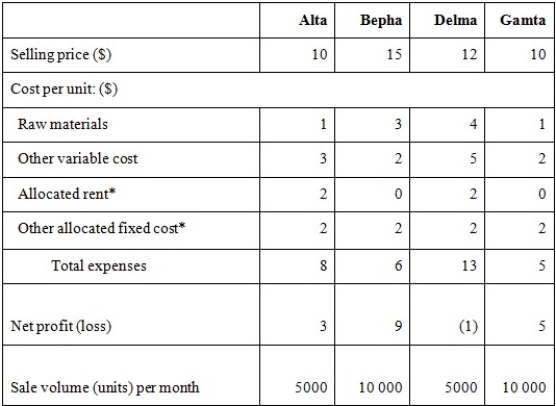

Zoota Ltd makes four products: Alta, Bepha, Delma and Gamta. The selling price and per unit costs are show below.

*Alta and Delma share the same factory; therefore, monthly rent is allocated equally between the two products. Other allocated monthly fixed costs include administrative costs, which are allocated based on a $2/unit charge.

Zoota Ltd is planning to downsize by focusing on the two most profitable products, Bepha and Gamta, while discontinuing Alta and Delma. Which of the following are the correct assessments of the relevance of the items listed?

A) Raw materials for both products (relevant), selling price of both products (relevant), allocated fixed cost for both products (relevant)

B) Raw materials for both products (relevant), selling price of both products (relevant), allocated rent for both products (relevant)

C) Raw materials for both products (relevant), selling price of both products (irrelevant), allocated rent for both products (irrelevant)

D) Raw materials for both products (relevant), allocated rent for both products (irrelevant), allocated fixed cost for both products (relevant)

*Alta and Delma share the same factory; therefore, monthly rent is allocated equally between the two products. Other allocated monthly fixed costs include administrative costs, which are allocated based on a $2/unit charge.

Zoota Ltd is planning to downsize by focusing on the two most profitable products, Bepha and Gamta, while discontinuing Alta and Delma. Which of the following are the correct assessments of the relevance of the items listed?

A) Raw materials for both products (relevant), selling price of both products (relevant), allocated fixed cost for both products (relevant)

B) Raw materials for both products (relevant), selling price of both products (relevant), allocated rent for both products (relevant)

C) Raw materials for both products (relevant), selling price of both products (irrelevant), allocated rent for both products (irrelevant)

D) Raw materials for both products (relevant), allocated rent for both products (irrelevant), allocated fixed cost for both products (relevant)

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

75

When considering the allocation of joint costs, which of the following statements (if any) is false?

A) If there are no beginning inventories and all products are sold at the split-off point, the relative sales value method and the constant gross margin percentage methods yield the same results.

B) In order to use the actual sales value at split-off method, management does not have to determine which products will be produced beyond the split-off point or what separable costs will be incurred.

C) A problem with the physical measures method of allocation is that it may not be related to the product's ability to produce revenue.

D) The cause-effect criterion is the key principle in allocating costs when joint costing is used.

A) If there are no beginning inventories and all products are sold at the split-off point, the relative sales value method and the constant gross margin percentage methods yield the same results.

B) In order to use the actual sales value at split-off method, management does not have to determine which products will be produced beyond the split-off point or what separable costs will be incurred.

C) A problem with the physical measures method of allocation is that it may not be related to the product's ability to produce revenue.

D) The cause-effect criterion is the key principle in allocating costs when joint costing is used.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

76

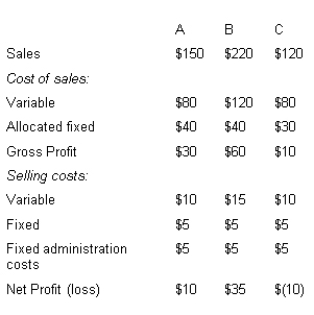

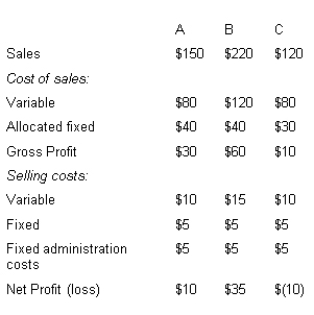

A company produces products A, B and C and the profit and loss statement for the past twelve months shows the following (in thousands) details.

The company is considering dropping Product C. If it does this, the fixed costs will remain the same except that the firm will be able to rent out excess factory space at $30 000 per annum. If other revenue and cost figures remained the same, what would be the effect on annual profit of dropping Product C?

A) 0

B) Increase of $30 000

C) Increase of $40 000

D) Decrease of $10 000

The company is considering dropping Product C. If it does this, the fixed costs will remain the same except that the firm will be able to rent out excess factory space at $30 000 per annum. If other revenue and cost figures remained the same, what would be the effect on annual profit of dropping Product C?

A) 0

B) Increase of $30 000

C) Increase of $40 000

D) Decrease of $10 000

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

77

For which of the following should joint costs and joint cost allocations not be used?

A) Inventory valuation

B) Comparing profitability of joint products

C) Rewarding managers of processes beyond split-off point

D) Both comparing profitability of joint products AND rewarding managers of processes beyond split-off point

A) Inventory valuation

B) Comparing profitability of joint products

C) Rewarding managers of processes beyond split-off point

D) Both comparing profitability of joint products AND rewarding managers of processes beyond split-off point

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

78

For a firm that currently makes a particular component, which of the following are qualitative factors that would be considered following a quantitative analysis in favour of buying?

A) Buying increases uncertainty, in particular with respect to timely availability of the component.

B) Buying surrenders control over product design and quality.

C) Employee morale would be affected if a decision to buy meant dismissing staff.

D) All of the given answers

A) Buying increases uncertainty, in particular with respect to timely availability of the component.

B) Buying surrenders control over product design and quality.

C) Employee morale would be affected if a decision to buy meant dismissing staff.

D) All of the given answers

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

79

One method of treating by-products is to:

A) treat the by-product in the same way as the main products.

B) allocate all joint costs to both products and by-products.

C) adjust the cost of the joint products by subtracting the net realisable value of the by-product from the joint costs.

D) adjust the cost of the joint products by subtracting the cost of the by-product from the joint costs.

A) treat the by-product in the same way as the main products.

B) allocate all joint costs to both products and by-products.

C) adjust the cost of the joint products by subtracting the net realisable value of the by-product from the joint costs.

D) adjust the cost of the joint products by subtracting the cost of the by-product from the joint costs.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

80

Which of the following is a correct quantitative decision-rule with respect to whether to drop a product?

A) If the product has a positive contribution margin, then do not drop the product.

B) If the product is showing a net loss, the product should be dropped.

C) If the profit of the firm without the product is higher than with the product, the product should be dropped.

D) If the product has a positive contribution margin, then do not drop the product AND if the profit of the firm without the product is higher than with the product, the product should be dropped.

A) If the product has a positive contribution margin, then do not drop the product.

B) If the product is showing a net loss, the product should be dropped.

C) If the profit of the firm without the product is higher than with the product, the product should be dropped.

D) If the product has a positive contribution margin, then do not drop the product AND if the profit of the firm without the product is higher than with the product, the product should be dropped.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck