Deck 3: Business Income and Expenses, Part I

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/114

Play

Full screen (f)

Deck 3: Business Income and Expenses, Part I

1

For an expense to qualify as a travel expense, the taxpayer must be away from home for at least 24 hours.

False

2

A taxpayer who adopts the LIFO method of inventory valuation for tax purposes may use the FIFO method for preparing financial statements.

False

3

Schedule C or Schedule C-EZ may be used to report the net profit or loss from a partnership with business expenses of $2,500 or less.

False

4

Once the election to use the LIFO inventory method has been made by a taxpayer, the inventory method may be changed only with the consent of the IRS.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

5

The cost of a subscription to the New England Journal of Medicine is a deductible expense for a hospital intern.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

6

The expense of travel as a form of education is not deductible.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

7

The standard mileage rate for automobiles in 2014 is 56 cents per mile.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

8

A business gift with a value of $35 presented to a client and his nonclient spouse is fully deductible by the donor.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

9

The taxpayer must use either the FIFO or LIFO method of valuing inventory, depending upon which method reflects the actual goods the taxpayer has on hand.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

10

When a taxpayer uses the FIFO inventory valuation method, the assumption on which the method is based is that the inventory on hand at the end of the year consists of the most recently acquired items.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

11

If a taxpayer takes a trip within the United States which is primarily for business, the cost of travel to and from the destination need not be prorated between the business and personal portion of the trip.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

12

If a taxpayer works at two or more jobs during the same day, he or she may deduct the cost of transportation from one job to the other.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

13

The cost of transportation from New York to London for a trip that is for both business and pleasure may be deducted in full as a travel expense.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

14

The expense of a sales luncheon may be deductible (50 percent in 2014) even if no sale is made.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

15

Taxpayers who use their country club more than 50 percent for business may deduct the total amount of their membership dues.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

16

If the taxpayer does not maintain adequate records of the car expenses (i.e., gas, tires, car insurance, etc.), the standard mileage rate cannot be used.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

17

If an employee is transferred to a distant location for an indefinite period of time, the new location typically will be considered the employee's new tax home.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

18

Once a taxpayer uses the standard mileage method to determine the deduction for automobile expenses for the tax year, the standard mileage method must be used in all subsequent years.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

19

The IRS has approved only two per diem methods to substantiate travel expenses, the high-low method and the meals and incidental expenses method.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

20

The cost of a blue wool suit for an accountant is a deductible expense.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

21

Under the specific charge-off method, a deduction for a bad debt is taken when the debt is determined to be worthless.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

22

Maria runs a small business out of her home. She has expenses of $2,000 per year and uses the cash basis method of accounting. Her only employee is her cousin who works for her part-time. What form should she use to report her business income?

A)Schedule A

B)Schedule C

C)Schedule F

D)Schedule C-EZ

E)Schedule B

A)Schedule A

B)Schedule C

C)Schedule F

D)Schedule C-EZ

E)Schedule B

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

23

A gift to a foreman by a worker is considered business related and therefore subject to the $25 limit.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

24

Jasper owns a small retail store as a sole proprietor. The business records show that the cost of the store's inventory items has been steadily increasing. The cost of the end of the year inventory is $200,000 and the cost of the beginning of the year inventory was $250,000. Jasper uses the FIFO method of inventory valuation. Which of the following statements is true?

A)Jasper purchased more inventory during the year than he sold during the same one-year period.

B)Jasper would have a higher net income if he used the LIFO method of inventory valuation instead of the FIFO method.

C)Jasper has apparently decreased the volume of items in his ending inventory as compared to the number of items in his beginning inventory.

D)Since the cost of the store's inventory items is increasing, Jasper will have a greater cost of goods sold figure under FIFO than LIFO.

E)None of the above.

A)Jasper purchased more inventory during the year than he sold during the same one-year period.

B)Jasper would have a higher net income if he used the LIFO method of inventory valuation instead of the FIFO method.

C)Jasper has apparently decreased the volume of items in his ending inventory as compared to the number of items in his beginning inventory.

D)Since the cost of the store's inventory items is increasing, Jasper will have a greater cost of goods sold figure under FIFO than LIFO.

E)None of the above.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

25

Which of the following taxpayers may not use the standard mileage method of calculating transportation costs?

A)A self-employed CPA who drives a computer-equipped minivan to visit clients.

B)A taxpayer who has a fleet of 10 business automobiles.

C)A real estate salesperson who drives a $70,000 Mercedes while showing houses.

D)An attorney who uses his Yaris for calling on clients.

E)All of the above taxpayers may use the standard mileage method.

A)A self-employed CPA who drives a computer-equipped minivan to visit clients.

B)A taxpayer who has a fleet of 10 business automobiles.

C)A real estate salesperson who drives a $70,000 Mercedes while showing houses.

D)An attorney who uses his Yaris for calling on clients.

E)All of the above taxpayers may use the standard mileage method.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

26

Net operating losses may be carried forward indefinitely.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

27

Greg, a self-employed plumber, commutes from his home to his office which is 10 miles away. He loads his truck for the day with the parts that he needs. Then he is off to see his first customer of the day, Mr. Smith. Mr. Smith is 5 miles away from the office. After Mr. Smith's job, Greg goes to his next job, Martin's Dry Cleaning, which is 21 miles away from Mr. Smith. Greg spends the rest of the day at Martin's Dry Cleaning. From Martin's Dry Cleaning, Greg goes home which is now only 7 miles away. How much can Greg count as deductible transportation miles?

A)None of it

B)21 miles

C)26 miles

D)43 miles

A)None of it

B)21 miles

C)26 miles

D)43 miles

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

28

If a home office is used for both business and personal purposes, the home office expenses, such as rent or depreciation, should be allocated between the business and personal use and then deducted.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

29

Deductible transportation expenses:

A)Include meals and lodging.

B)Include only costs incurred while away from home.

C)Do not include the normal costs of commuting.

D)Do not include daily expenses for transportation between the taxpayer's home and temporary work locations if the taxpayer has a regular place of business.

A)Include meals and lodging.

B)Include only costs incurred while away from home.

C)Do not include the normal costs of commuting.

D)Do not include daily expenses for transportation between the taxpayer's home and temporary work locations if the taxpayer has a regular place of business.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

30

Most taxpayers must use the specific charge-off method in calculating the bad debt deduction.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

31

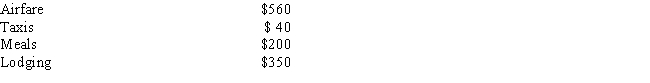

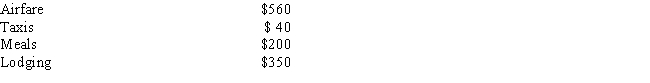

Barry is a self-employed attorney who travels to New York on a business trip during 2014. Barry's expenses were as follows: How much may Barry deduct as travel expenses for the trip?

A)$0

B)$950

C)$1,000

D)$1,050

E)None of the above

A)$0

B)$950

C)$1,000

D)$1,050

E)None of the above

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

32

Stone Pine Corporation, a calendar year taxpayer, has ending inventory of $160,000 on December 31, 2014. During the year, the corporation purchased additional inventory of $375,000. If cost of goods sold for 2014 is $470,000, what was the beginning inventory at January 1, 2014?

A)$55,000

B)$215,000

C)$255,000

D)$310,000

E)None of the above

A)$55,000

B)$215,000

C)$255,000

D)$310,000

E)None of the above

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

33

Janine is a sole proprietor owning a small specialty store. The business records show that the cost of the store's individual inventory items has been steadily increasing. The cost of the end of the year inventory is $125,000 and the cost of the beginning of the year inventory was $150,000. Janine uses the LIFO method of inventory valuation. Which of the following statements is true?

A)Janine purchased more inventory during the year than she sold during the same one-year period.

B)Janine would have a higher net income if she used the FIFO method of inventory valuation instead of the LIFO method.

C)Janine has apparently increased the volume of items in her ending inventory as compared to the number of items in her beginning inventory.

D)Since the cost of the store's inventory items is increasing, Janine will have a smaller cost of goods sold amount on a LIFO basis than on a FIFO basis.

E)None of the above.

A)Janine purchased more inventory during the year than she sold during the same one-year period.

B)Janine would have a higher net income if she used the FIFO method of inventory valuation instead of the LIFO method.

C)Janine has apparently increased the volume of items in her ending inventory as compared to the number of items in her beginning inventory.

D)Since the cost of the store's inventory items is increasing, Janine will have a smaller cost of goods sold amount on a LIFO basis than on a FIFO basis.

E)None of the above.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

34

Patricia is a business owner who is trying to determine her cost of goods sold for 2014. She bought 20 units of inventory at $11, then 26 units at $10, and finally 18 units at $14. She sold 30 units at an average price of $16 per unit in 2014 and uses FIFO for her inventory valuation. What was her cost of goods sold in 2014, assuming that there was no inventory at the beginning of the year?

A)$320

B)$330

C)$480

D)$732

E)None of the above

A)$320

B)$330

C)$480

D)$732

E)None of the above

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

35

There is a limitation of $25 per donee on the deduction of gifts to employees for length of service.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

36

A deduction for a business bad debt is allowed to the extent that income related to the debt was previously included in taxable income.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

37

To file a Schedule C-EZ, the taxpayer must:

A)Have gross receipts of $25,000 or less from the business.

B)Have business expenses of $5,000 or less.

C)Have inventory of less than $2,000 during the year.

D)Have no more than 2 businesses.

E)Have no more than 5 employees during the year.

A)Have gross receipts of $25,000 or less from the business.

B)Have business expenses of $5,000 or less.

C)Have inventory of less than $2,000 during the year.

D)Have no more than 2 businesses.

E)Have no more than 5 employees during the year.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

38

The home office deduction is an easy way for a taxpayer to show a loss on his or her tax return.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

39

What income tax form does a self-employed sole proprietor usually use to report business income and expense?

A)Schedule A, Miscellaneous Itemized Deductions

B)Schedule B

C)Schedule C

D)Form 2106, Employee Business Expenses

E)None of the above

A)Schedule A, Miscellaneous Itemized Deductions

B)Schedule B

C)Schedule C

D)Form 2106, Employee Business Expenses

E)None of the above

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

40

In the current year, Johnice started a profitable bookkeeping business as a sole proprietor. Johnice made $38,000 in her first year of operation. What two forms must Johnice file for her business?

A)Schedules A and C

B)Schedules D and E

C)Schedule SE and C

D)Schedules B and C

E)None of the above

A)Schedules A and C

B)Schedules D and E

C)Schedule SE and C

D)Schedules B and C

E)None of the above

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

41

Gary is a self-employed accountant who pays $2,000 for business meals. How much of a deduction can he claim for the meals and where should the deduction be claimed?

A)50 percent, miscellaneous itemized deduction

B)50 percent, Schedule C deduction

C)100 percent, miscellaneous itemized deduction

D)100 percent, Schedule C deduction

A)50 percent, miscellaneous itemized deduction

B)50 percent, Schedule C deduction

C)100 percent, miscellaneous itemized deduction

D)100 percent, Schedule C deduction

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

42

Which of the following does not give rise to a business expense for uniforms or special clothing?

A)An accountant buys a business suit.

B)A mascot buys his costume.

C)A baseball player buys his team uniform.

D)A scientist buys his hazmat suit.

E)All of the above are deductible.

A)An accountant buys a business suit.

B)A mascot buys his costume.

C)A baseball player buys his team uniform.

D)A scientist buys his hazmat suit.

E)All of the above are deductible.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

43

To be deductible as the cost of special work clothing or uniforms:

A)The clothing must not be suitable for everyday use and must be required as a condition of the job.

B)The clothing must be required as a condition of the job, but can also be suitable for everyday use.

C)The clothing need not be required as a condition of the job, but must not be suitable for everyday use.

D)Only the cost of the clothing is included; upkeep is not deductible.

A)The clothing must not be suitable for everyday use and must be required as a condition of the job.

B)The clothing must be required as a condition of the job, but can also be suitable for everyday use.

C)The clothing need not be required as a condition of the job, but must not be suitable for everyday use.

D)Only the cost of the clothing is included; upkeep is not deductible.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

44

Which of the following items incurred while on travel is not considered a travel expense?

A)The cost of meals

B)The cost of lodging

C)Transportation costs

D)Cost of entertaining clients

E)None of the above

A)The cost of meals

B)The cost of lodging

C)Transportation costs

D)Cost of entertaining clients

E)None of the above

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

45

Linda is self-employed and spends $600 for business meals and $1,000 for business entertainment in 2014. What is Linda allowed to deduct in 2014 for these expenses?

A)$200

B)$500

C)$800

D)$1,000

E)None of the above

A)$200

B)$500

C)$800

D)$1,000

E)None of the above

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

46

Which of the following is deductible as dues, subscriptions or publications?

A)Dues to a health club for a doctor

B)Subscription to "Vogue" magazine for a corporate president

C)Dues to the drama club for a student

D)Subscription to the "Journal of Taxation" for a tax attorney

E)None of the above

A)Dues to a health club for a doctor

B)Subscription to "Vogue" magazine for a corporate president

C)Dues to the drama club for a student

D)Subscription to the "Journal of Taxation" for a tax attorney

E)None of the above

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

47

During 2014, Harry, a self-employed accountant, travels from Kansas City to Miami for a 1-week business trip. While in Miami, Harry decides to stay for an additional 5 days of vacation. Harry pays $600 for airfare, $200 for meals, and $500 for lodging while on business. The cost of meals and lodging while on vacation was $300 and $500, respectively. How much may Harry deduct as travel expenses for the trip?

A)$600

B)$1,100

C)$1,200

D)$1,300

E)None of the above

A)$600

B)$1,100

C)$1,200

D)$1,300

E)None of the above

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

48

Jack is a lawyer who is a member at Ocean Spray Country Club where he spends $7,200 in dues, $4,000 in meals, and $2,000 in green fees to entertain clients. He is also a member of the local Rotary club where he meets potential clients. The dues for the Rotary club are $1,200 a year. How much of the above expenses can Jack deduct as business expenses?

A)$4,200

B)$6,000

C)$7,200

D)$14,400

E)None of the above

A)$4,200

B)$6,000

C)$7,200

D)$14,400

E)None of the above

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

49

Choose the correct statement:

A)If a taxpayer does a lot of business travel, the taxpayer may deduct the amount paid for an airline club membership.

B)Membership dues to a golf club are deductible as long as there is a business purpose.

C)In order to be deductible, dues and subscriptions must be related to the taxpayer's occupation.

D)If a financial planner becomes certified, then he/she may not deduct the Certified Financial Planner (CFP) dues because it is not necessary to be certified in order to engage in the business of being a financial planner.

A)If a taxpayer does a lot of business travel, the taxpayer may deduct the amount paid for an airline club membership.

B)Membership dues to a golf club are deductible as long as there is a business purpose.

C)In order to be deductible, dues and subscriptions must be related to the taxpayer's occupation.

D)If a financial planner becomes certified, then he/she may not deduct the Certified Financial Planner (CFP) dues because it is not necessary to be certified in order to engage in the business of being a financial planner.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

50

Which of the following expenses, incurred while on travel, does not qualify as a travel expense?

A)Tips

B)Dry cleaning of suit

C)Dinner at a steak house

D)Gift purchased for a prospective customer ($20)

E)None of the above

A)Tips

B)Dry cleaning of suit

C)Dinner at a steak house

D)Gift purchased for a prospective customer ($20)

E)None of the above

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

51

If a per diem method is not used, which of the following items is not required as substantiation for the deduction of a travel expense?

A)Amount spent

B)Destination

C)Business reason for the trip

D)Departure and return dates

E)All of the above must be substantiated

A)Amount spent

B)Destination

C)Business reason for the trip

D)Departure and return dates

E)All of the above must be substantiated

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

52

Nancy owns a small dress store. During 2014, Nancy gives business gifts having the indicated cost to the following individuals: What is the amount of Nancy's deduction for business gifts?

A)$0

B)$50

C)$53

D)$62

E)None of the above

A)$0

B)$50

C)$53

D)$62

E)None of the above

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

53

Mikey is a self-employed computer game software designer. He takes a week-long trip to Maui, primarily for business. He takes 2 personal days at the beach. How should he treat the expenses related to this trip?

A)None of the expenses are deductible since there was an element of personal enjoyment in the trip.

B)100 percent of the trip should be deducted as a business expense since the trip was primarily for business.

C)50 percent of the trip should be deducted as a business expense.

D)The cost of all of the airfare and the expenses related to the business days should be deducted, while the expenses related to the personal days are not deductible.

A)None of the expenses are deductible since there was an element of personal enjoyment in the trip.

B)100 percent of the trip should be deducted as a business expense since the trip was primarily for business.

C)50 percent of the trip should be deducted as a business expense.

D)The cost of all of the airfare and the expenses related to the business days should be deducted, while the expenses related to the personal days are not deductible.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

54

If an employer chooses a per diem method of substantiation for travel expenses,

A)The Regular Federal Rate method allows employees the same per diem rate no matter where they travel in the United States.

B)The high-low method averages the high-cost locality and low-cost locality per diem rates to arrive at an average rate.

C)The meals and incidental expenses method requires actual cost records to substantiate lodging expenses.

D)Actual expense records substantiating the business reason for the trip and the dates of arrival and departure are not required.

E)The employer need not use an accountable plan for reimbursing employees for travel expenses.

A)The Regular Federal Rate method allows employees the same per diem rate no matter where they travel in the United States.

B)The high-low method averages the high-cost locality and low-cost locality per diem rates to arrive at an average rate.

C)The meals and incidental expenses method requires actual cost records to substantiate lodging expenses.

D)Actual expense records substantiating the business reason for the trip and the dates of arrival and departure are not required.

E)The employer need not use an accountable plan for reimbursing employees for travel expenses.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

55

During the 2014 holiday season, Bob, a barber, gave business gifts to 34 customers. The values of the gifts, which were not of a promotional nature, were as follows:

8 at $10 each

8 at $25 each

8 at $50 each

10 at $100 each

For 2014, what is the amount of Bob's business gift deduction?

A)$0

B)$280

C)$730

D)$850

E)None of the above

8 at $10 each

8 at $25 each

8 at $50 each

10 at $100 each

For 2014, what is the amount of Bob's business gift deduction?

A)$0

B)$280

C)$730

D)$850

E)None of the above

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

56

Carlos drives to Oregon to consult with a client. He works for 1 day and spends 3 days enjoying Oregon since the consultation was right before a 3-day weekend. His expenses were $175 to drive to Oregon and back, $600 for lodging, $50 for food on the day that he worked, and $125 for food on the other 3 days. How much of his travel expenses are deductible?

A)$0

B)$175

C)$200

D)$350

E)$800

A)$0

B)$175

C)$200

D)$350

E)$800

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

57

Sue is a small business owner who often gives gifts to clients. She gives a $40 gift to her client, Mr. Smith, and his wife. Sue spent $6 to wrap the gift. She also gave out 400 calendars with her company name on them. Each calendar cost $1. Sue also gave her secretary a $370 watch for his 10 years of service. How much of the above expenses may she deduct?

A)$816

B)$446

C)$795

D)$801

E)None of the above

A)$816

B)$446

C)$795

D)$801

E)None of the above

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

58

In which of the following situations may the taxpayer take an education expense on Schedule C?

A)John, a plumber by trade, is taking classes to qualify as an electrician so he may become a more well-rounded plumber.

B)Henry, an administrative assistant, is taking an advanced Word computer program class through an adult school program.

C)Barbie is flying on numerous commercial airplanes in order to observe the flight attendants so that she may improve her public relations skills.

D)Ann Marie is taking a review course in order to pass the certified financial planner examination.

A)John, a plumber by trade, is taking classes to qualify as an electrician so he may become a more well-rounded plumber.

B)Henry, an administrative assistant, is taking an advanced Word computer program class through an adult school program.

C)Barbie is flying on numerous commercial airplanes in order to observe the flight attendants so that she may improve her public relations skills.

D)Ann Marie is taking a review course in order to pass the certified financial planner examination.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

59

Taxpayers who make a combined business and pleasure trip:

A)Must allocate the travel cost between the business and pleasure parts of the trip if the travel is within the United States.

B)Must allocate the travel cost between the business and pleasure parts of the trip if the travel is outside the United States.

C)Can deduct the cost of meals, lodging, local transportation, and incidental expenses in full.

D)Can take a tax deduction only for the personal part of the trip.

A)Must allocate the travel cost between the business and pleasure parts of the trip if the travel is within the United States.

B)Must allocate the travel cost between the business and pleasure parts of the trip if the travel is outside the United States.

C)Can deduct the cost of meals, lodging, local transportation, and incidental expenses in full.

D)Can take a tax deduction only for the personal part of the trip.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

60

Choose the correct answer.

A)Education expenses are deductible on Schedule C even if the education qualifies the taxpayer for a new trade or business.

B)Expenses required for education to maintain skills for the taxpayer's current business are not deductible.

C)The cost of a CPA review course is deductible by a bookkeeper on his Schedule C.

D)Expenses for travel as a form of education are not deductible.

A)Education expenses are deductible on Schedule C even if the education qualifies the taxpayer for a new trade or business.

B)Expenses required for education to maintain skills for the taxpayer's current business are not deductible.

C)The cost of a CPA review course is deductible by a bookkeeper on his Schedule C.

D)Expenses for travel as a form of education are not deductible.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

61

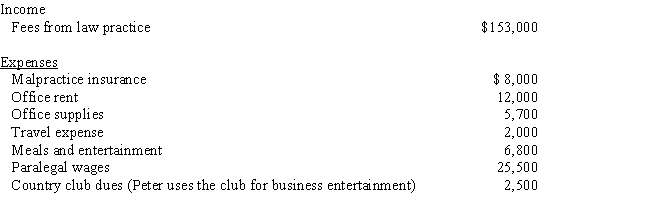

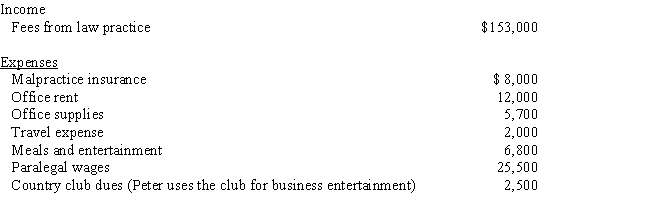

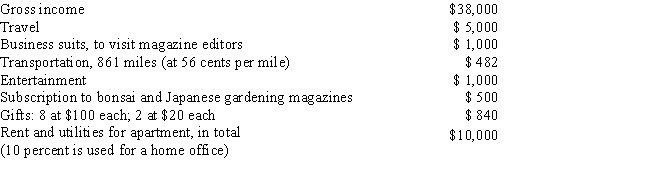

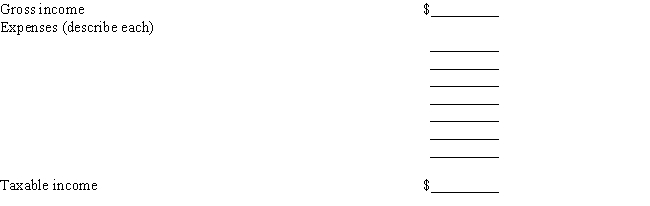

Peter is a self-employed attorney. He gives the following information about his business to his CPA for use in preparing his 2014 tax return:

Peter also drove his car 5,191 miles for business and used the standard mileage method for computing transportation costs. How much will Peter show on his Schedule C for 2014 for:

a.Income

b.Tax deductible expenses

c.Taxable income

Peter also drove his car 5,191 miles for business and used the standard mileage method for computing transportation costs. How much will Peter show on his Schedule C for 2014 for:

a.Income

b.Tax deductible expenses

c.Taxable income

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

62

Which of the following factors are considered by the IRS in evaluating whether an activity is classified as a business or a hobby?

A)The expertise of the taxpayer

B)The time and effort expended by the taxpayer

C)Financial status of the taxpayer

D)Income and loss history from the activity

E)All of the above

A)The expertise of the taxpayer

B)The time and effort expended by the taxpayer

C)Financial status of the taxpayer

D)Income and loss history from the activity

E)All of the above

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

63

Ellen loans Nicole $45,000 to start a hair salon. Unfortunately, the business fails in 2014 and she is unable to pay back Ellen. In 2014, Ellen also had $20,000 of income from her part-time job and $12,000 of capital gain from the sale of stock. How much of the $45,000 bad debt can Ellen claim as a capital loss in 2014?

A)$45,000, with $33,000 carried forward to 2015

B)$12,000

C)$32,000

D)$15,000, with $30,000 carried forward to 2015

E)$0

A)$45,000, with $33,000 carried forward to 2015

B)$12,000

C)$32,000

D)$15,000, with $30,000 carried forward to 2015

E)$0

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

64

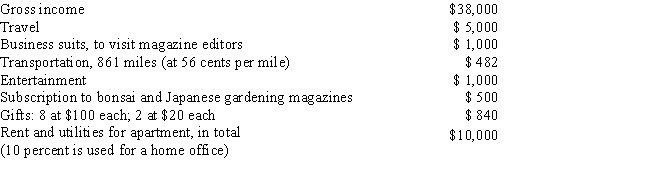

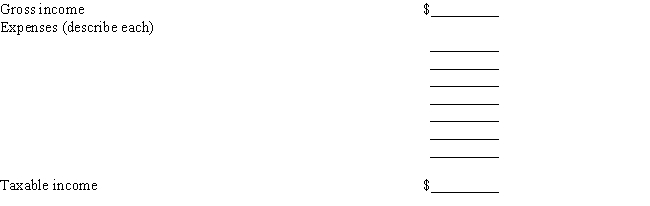

Lew started a business writing a popular syndicated Japanese gardening column in the current year and will report a profit for his first year. His results of operations are as follows:

What is the net income Lew should show on his Schedule C? Show the calculation of his taxable income.

What is the net income Lew should show on his Schedule C? Show the calculation of his taxable income.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

65

Patrick has a business net operating loss of $70,000 in 2014. Patrick's business generated significant taxable profits in 2012 and in 2013. Which of the following is true?

A)Patrick may offset income he generated in 2012 and 2013 with 2014's net operating loss by carrying the net operating loss back to each of those tax years. The remaining net operating loss (if any) can be carried forward and used to offset future taxable income.

B)Patrick may use the net operating loss to offset income from any year he chooses.

C)Net operating losses can offset only future income.

D)Patrick may elect to offset the income he generated in 2013 with 2014's net operating loss. The remaining net operating loss (if any) can be used to offset future taxable income.

E)None of the above.

A)Patrick may offset income he generated in 2012 and 2013 with 2014's net operating loss by carrying the net operating loss back to each of those tax years. The remaining net operating loss (if any) can be carried forward and used to offset future taxable income.

B)Patrick may use the net operating loss to offset income from any year he chooses.

C)Net operating losses can offset only future income.

D)Patrick may elect to offset the income he generated in 2013 with 2014's net operating loss. The remaining net operating loss (if any) can be used to offset future taxable income.

E)None of the above.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

66

In determining whether an activity should be classified as a hobby, the tax law provides a rebuttable presumption with regard to the profits or losses of an activity. Which of the following statements describes the profit/loss test which must be satisfied in order to meet the presumption that the activity is not a hobby?

A)The activity shows a profit for 3 of the 5 previous years.

B)The activity shows a loss for 3 of the 5 previous years.

C)The activity shows a profit for 3 of the 7 previous years.

D)The activity shows a loss for 3 of the 7 previous years.

E)None of the above.

A)The activity shows a profit for 3 of the 5 previous years.

B)The activity shows a loss for 3 of the 5 previous years.

C)The activity shows a profit for 3 of the 7 previous years.

D)The activity shows a loss for 3 of the 7 previous years.

E)None of the above.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

67

In his spare time, Fred likes to restore old furniture and sell it to his friends. He is a lawyer by trade. During 2014, he sells $500 worth of furniture and has $21,000 worth of expenses. Which one of the following is true?

A)Fred may deduct all $21,000 of his expenses because Fred is engaged in a hobby.

B)Fred may deduct all $21,000 of his expenses because Fred is engaged in a trade or business.

C)Fred cannot deduct any of the expenses because he is engaged in a hobby.

D)Fred's deductions are limited to the income from selling furniture because he is engaged in a hobby.

E)None of the above.

A)Fred may deduct all $21,000 of his expenses because Fred is engaged in a hobby.

B)Fred may deduct all $21,000 of his expenses because Fred is engaged in a trade or business.

C)Fred cannot deduct any of the expenses because he is engaged in a hobby.

D)Fred's deductions are limited to the income from selling furniture because he is engaged in a hobby.

E)None of the above.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

68

Splashy Fish Store allows qualified customers to purchase items on credit. During 2014, Lisa, the owner of the store, determines that $3,500 of accounts receivable are not collectible. Which of the following statements is true with respect to Splashy Fish Store's deduction for the uncollectible accounts receivable?

A)Splashy is not allowed a deduction for the uncollectible accounts if the income arising from the accounts has not been previously included in taxable income.

B)Any deduction for the uncollectible accounts receivable will be treated as a short-term capital loss.

C)Only $3,000 of the uncollectible accounts receivable may be deducted in the current year.

D)All of the above statements are true.

E)Two of the above statements are true.

A)Splashy is not allowed a deduction for the uncollectible accounts if the income arising from the accounts has not been previously included in taxable income.

B)Any deduction for the uncollectible accounts receivable will be treated as a short-term capital loss.

C)Only $3,000 of the uncollectible accounts receivable may be deducted in the current year.

D)All of the above statements are true.

E)Two of the above statements are true.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

69

Tim loaned a friend $4,000 to buy a used car. In the current year, Tim's friend declares bankruptcy and the debt is considered totally worthless. What amount may Tim deduct on his individual income tax return for the current year as a result of the worthless debt, assuming he has no other capital gains or losses for the year?

A)$4,000 ordinary loss

B)$4,000 short-term capital loss

C)$2,000 short-term capital loss

D)$3,000 ordinary loss

E)$3,000 short-term capital loss

A)$4,000 ordinary loss

B)$4,000 short-term capital loss

C)$2,000 short-term capital loss

D)$3,000 ordinary loss

E)$3,000 short-term capital loss

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

70

Vinnie has a small retail store and sells one product. His beginning inventory consisted of 1,000 products at $4 each for a total of $4,000. During the year, Vinnie made the following purchases of the product:

March 1 5,000 products at $5 each = $25,000

August 1 1,000 products at $6 each = $ 6,000

Vinnie uses the FIFO method of inventory valuation and he sells 5,000 products during the current year.

a. Calculate the total cost of goods available for sale.

b. Calculate the cost of the ending inventory.

c. Calculate the cost of goods sold.

March 1 5,000 products at $5 each = $25,000

August 1 1,000 products at $6 each = $ 6,000

Vinnie uses the FIFO method of inventory valuation and he sells 5,000 products during the current year.

a. Calculate the total cost of goods available for sale.

b. Calculate the cost of the ending inventory.

c. Calculate the cost of goods sold.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

71

Which of the following would be a business bad debt if it were uncollectible?

A)A taxpayer loans his father $1,000 to start a business.

B)A taxpayer loans his son $10,000 to purchase a rental house.

C)A dentist, using the accrual basis of accounting, records income when it is earned and extends credit to a patient for services provided.

D)A taxpayer loans his brother $3,000 to purchase a truck for use in his brother's business.

E)None of the above.

A)A taxpayer loans his father $1,000 to start a business.

B)A taxpayer loans his son $10,000 to purchase a rental house.

C)A dentist, using the accrual basis of accounting, records income when it is earned and extends credit to a patient for services provided.

D)A taxpayer loans his brother $3,000 to purchase a truck for use in his brother's business.

E)None of the above.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

72

Richard operates a hair styling boutique out of his home. The boutique occupies 420 of the home's 1,200 square feet of floor space. Other information is as follows: What amount of income or loss from the boutique should Richard show on his return?

A)$0 income or loss

B)$10,400 loss

C)$3,500 income

D)$1,300 income

E)None of the above

A)$0 income or loss

B)$10,400 loss

C)$3,500 income

D)$1,300 income

E)None of the above

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

73

Peter operates a dental office in his home. The office occupies 250 square feet of his residence, which is a total of 1,500 square feet. During 2014, Peter pays rent for his home of $12,000, utilities of $4,800, and maintenance expenses of $1,200. What amount of the total expenses should be allocated to the home office?

A)$0

B)$2,000

C)$2,500

D)$3,000

E)None of the above

A)$0

B)$2,000

C)$2,500

D)$3,000

E)None of the above

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

74

Kendra is a self-employed taxpayer working exclusively from her home office. Before the home office deduction, Kendra has $6,000 of net income. Her allocable home expenses are $10,000 in total. How are the home office expenses treated on her current year tax return?

A)Only $6,000 home office expenses may be deducted, resulting in net business income of zero. The remaining $4,000 of home office expenses may be carried forward and deducted in a future year against business income.

B)Only $3,000 a year of the home office expenses may be deducted.

C)All home office expenses may be deducted, resulting in a business loss of $4,000.

D)Only $6,000 of home office expenses may be deducted, resulting in a net business income of zero. None of the remaining $4,000 of home office expenses may be carried forward or deducted.

A)Only $6,000 home office expenses may be deducted, resulting in net business income of zero. The remaining $4,000 of home office expenses may be carried forward and deducted in a future year against business income.

B)Only $3,000 a year of the home office expenses may be deducted.

C)All home office expenses may be deducted, resulting in a business loss of $4,000.

D)Only $6,000 of home office expenses may be deducted, resulting in a net business income of zero. None of the remaining $4,000 of home office expenses may be carried forward or deducted.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

75

Gene is a self-employed taxpayer working from his home. His net income is $7,000 before home office expenses. His allocable home office expenses are $8,000 in total. How are the home office expenses treated on his current year tax return?

A)All home office expenses can be deducted and will result in a $1,000 business loss.

B)Only $7,000 of the office expenses can be deducted, the remaining $1,000 cannot be carried forward or deducted.

C)None of the home office expenses can be deducted because Gene's income is too high.

D)Only $7,000 of the office expenses can be deducted; the remaining $1,000 can be carried forward to future tax years.

A)All home office expenses can be deducted and will result in a $1,000 business loss.

B)Only $7,000 of the office expenses can be deducted, the remaining $1,000 cannot be carried forward or deducted.

C)None of the home office expenses can be deducted because Gene's income is too high.

D)Only $7,000 of the office expenses can be deducted; the remaining $1,000 can be carried forward to future tax years.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

76

Bobby is an accountant who uses a portion of his home as his office. His home is 2,500 square feet and his office space occupies 1,500 square feet. Rent expense is $18,000 a year; utilities expense is $2,000 a year; and maintenance expense is $3,000 a year. What is the total amount of these expenses that can be allocated to his home office?

A)$5,800

B)$9,200

C)$9,280

D)$13,800

E)$23,000

A)$5,800

B)$9,200

C)$9,280

D)$13,800

E)$23,000

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

77

Which of the following is not a factor that the IRS looks at to determine if a loss is from a hobby or from a business?

A)Whether the activity is owned and run by the taxpayer alone

B)The history of the income and loss from the activity

C)Whether the business has elements of personal recreation

D)The financial status of the taxpayer

A)Whether the activity is owned and run by the taxpayer alone

B)The history of the income and loss from the activity

C)Whether the business has elements of personal recreation

D)The financial status of the taxpayer

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

78

Martin has a home office for his business as an agent for rock-and-roll bands. The business shows a loss of $2,000 before home office expenses. How should the home office expenses be treated?

A)Because of the business loss, home office expenses cannot be deducted and are lost forever.

B)Because of the business loss, home office expenses (other than mortgage interest and property taxes allocated to the office) cannot be deducted in the current year but can be carried forward to the next year.

C)The home office expenses increase the business loss in the year they are incurred and are fully deductible in that year.

D)The home office expenses increase the business loss in the year they are incurred and are 50 percent deductible in that year.

A)Because of the business loss, home office expenses cannot be deducted and are lost forever.

B)Because of the business loss, home office expenses (other than mortgage interest and property taxes allocated to the office) cannot be deducted in the current year but can be carried forward to the next year.

C)The home office expenses increase the business loss in the year they are incurred and are fully deductible in that year.

D)The home office expenses increase the business loss in the year they are incurred and are 50 percent deductible in that year.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

79

The net operating loss (NOL) provisions of the Internal Revenue Code

A)Apply only to individuals with wages, itemized deductions, and personal exemptions.

B)Require the use of a 2-year carryback in all cases.

C)Are primarily designed to provide relief for trade or business losses.

D)Allow the deduction for home mortgage interest to create an NOL.

E)Would not be necessary if tax rates were progressive.

A)Apply only to individuals with wages, itemized deductions, and personal exemptions.

B)Require the use of a 2-year carryback in all cases.

C)Are primarily designed to provide relief for trade or business losses.

D)Allow the deduction for home mortgage interest to create an NOL.

E)Would not be necessary if tax rates were progressive.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

80

Karen has a net operating loss in 2014. If she does not make any special elections, what is the first year to which Karen can carry the net operating loss?

A)2009

B)2010

C)2011

D)2012

E)2013

A)2009

B)2010

C)2011

D)2012

E)2013

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck