Deck 5: Appendix--Price Elasticity and Tax Incidence

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/32

Play

Full screen (f)

Deck 5: Appendix--Price Elasticity and Tax Incidence

1

Levying a tax on a good when demand is very elastic will generate a large amount of tax revenue for the government.

False

2

If demand is elastic, a tax increase will shift the demand curve to the right.

False

3

If there is a $1 per box tax imposed on the sale of tea and the price paid by consumers increases by $0.50, what may we conclude about the price elasticities of demand and supply?

A)The elasticity of supply must be less than the price elasticity of demand

B)The amount exchanged in the market will remain the same

C)The elasticity of supply must be greater than the price elasticity of demand

D)The elasticity of supply must be equal to the elasticity of demand

E)We need more information to answer the question

A)The elasticity of supply must be less than the price elasticity of demand

B)The amount exchanged in the market will remain the same

C)The elasticity of supply must be greater than the price elasticity of demand

D)The elasticity of supply must be equal to the elasticity of demand

E)We need more information to answer the question

The elasticity of supply must be equal to the elasticity of demand

4

The more inelastic the supply, the less of a tax is paid by producers

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

5

If the government is interested in generating a large revenue from placing a tax on the consumption of a particular good, it should choose a good for which

A)the demand is price elastic

B)the demand is unit elastic with respect to price

C)the supply is perfectly elastic

D)the demand is price inelastic

E)there are many good substitutes

A)the demand is price elastic

B)the demand is unit elastic with respect to price

C)the supply is perfectly elastic

D)the demand is price inelastic

E)there are many good substitutes

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

6

The more elastic is the supply, the less of a tax is paid by consumers

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

7

The more elastic is the supply, the less of a tax is paid by producers

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

8

If the demand for a good is very price inelastic, the imposition of a tax on that good

A)places the burden of the tax equally on buyers and sellers

B)permits sellers to pass most of the cost increase resulting from the tax on to the consumers of the product

C)reduces the profits earned by sellers since they must write the check to pay the tax

D)makes the demand more inelastic

E)makes the demand more elastic

A)places the burden of the tax equally on buyers and sellers

B)permits sellers to pass most of the cost increase resulting from the tax on to the consumers of the product

C)reduces the profits earned by sellers since they must write the check to pay the tax

D)makes the demand more inelastic

E)makes the demand more elastic

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

9

Historically salt has been one of the most commonly taxed items.Which of the following do you think best explains this fact?

A)Since salt is a necessity, levying a tax on it imposed a hardship on no one

B)The burden of the tax will be shared by everyone since everyone uses salt

C)Because salt is used more by those with higher incomes, a tax will decrease their consumption

D)The demand for salt is inelastic

E)The demand for salt is elastic

A)Since salt is a necessity, levying a tax on it imposed a hardship on no one

B)The burden of the tax will be shared by everyone since everyone uses salt

C)Because salt is used more by those with higher incomes, a tax will decrease their consumption

D)The demand for salt is inelastic

E)The demand for salt is elastic

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

10

The more price elastic is demand, the larger the portion of a tax that is paid by sellers

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

11

If supply is inelastic, the imposition of a tax will

A)fall more heavily on producers

B)fall more heavily on consumers

C)fall more heavily on profit making firms relative to non-profit firms

D)be equally distributed between buyers and sellers

E)change consumer expectations because they do not know what sellers will do

A)fall more heavily on producers

B)fall more heavily on consumers

C)fall more heavily on profit making firms relative to non-profit firms

D)be equally distributed between buyers and sellers

E)change consumer expectations because they do not know what sellers will do

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

12

If demand is price inelastic, a tax will largely be paid by consumers.

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

13

If the demand for a good is very price elastic, the imposition of a tax on that good

A)places the largest portion of the burden on the sellers of that product

B)places the burden of the tax equally on buyers and sellers

C)places the largest portion of the tax on consumers

D)will make demand more elastic than it was before the tax

E)will make demand more inelastic than it was before the tax

A)places the largest portion of the burden on the sellers of that product

B)places the burden of the tax equally on buyers and sellers

C)places the largest portion of the tax on consumers

D)will make demand more elastic than it was before the tax

E)will make demand more inelastic than it was before the tax

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

14

The more price inelastic is demand, the more likely it is that a tax will fall on sellers.

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

15

If supply is elastic, the imposition of a tax

A)falls more heavily on consumers

B)falls more heavily on producers

C)falls more heavily on monopoly sellers than competitive sellers

D)will alter both buyer and seller plans equally

E)change seller expectations about consumer tastes

A)falls more heavily on consumers

B)falls more heavily on producers

C)falls more heavily on monopoly sellers than competitive sellers

D)will alter both buyer and seller plans equally

E)change seller expectations about consumer tastes

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

16

On which of the following goods would you expect the revenue generated from the imposition of a tax to be the greatest?

A)A prescription drug ordered by your doctor

B)Bayer aspirin

C)An over-the-counter cough medicine

D)A specific brand of vitamin pills

E)Rubbing alcohol

A)A prescription drug ordered by your doctor

B)Bayer aspirin

C)An over-the-counter cough medicine

D)A specific brand of vitamin pills

E)Rubbing alcohol

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

17

If demand is more elastic than supply is, the

A)smaller the portion of the tax that will be paid by producers

B)larger the portion of the tax that will be paid by consumers

C)more likely it is that the tax will be spread equally between producers and consumers

D)more likely it will be subject to tax evasion by those in the underground economy

E)larger the portion of the tax that will be paid by producers

A)smaller the portion of the tax that will be paid by producers

B)larger the portion of the tax that will be paid by consumers

C)more likely it is that the tax will be spread equally between producers and consumers

D)more likely it will be subject to tax evasion by those in the underground economy

E)larger the portion of the tax that will be paid by producers

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

18

For which of the following goods would you expect the demand to be most price elastic?

A)Cigarettes

B)Meat

C)Vegetables

D)Beer

E)Coors Lite Beer

A)Cigarettes

B)Meat

C)Vegetables

D)Beer

E)Coors Lite Beer

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

19

Levying a tax on a good when demand is very inelastic will generate a large amount of tax revenue for the government.

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

20

On which of the following goods would you expect the revenue generated from the imposition of a tax to be the greatest?

A)milk

B)gasoline

C)bread

D)a specific brand of beer

E)all beer

A)milk

B)gasoline

C)bread

D)a specific brand of beer

E)all beer

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

21

If supply is more inelastic than demand is, the

A)more the tax will fall on producers

B)more the tax will fall on consumers

C)less likely that a tax will have an impact on market transactions

D)less likely it a tax will lead to tax avoidance

E)greater the impact that a tax has on consumer expectations

A)more the tax will fall on producers

B)more the tax will fall on consumers

C)less likely that a tax will have an impact on market transactions

D)less likely it a tax will lead to tax avoidance

E)greater the impact that a tax has on consumer expectations

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

22

If supply is more elastic than demand is, the

A)less the impact it will have on the consumers before tax income

B)more likely it is to lead to tax avoidance

C)less likely it will have any impact on market transactions

D)more the tax will fall on consumers

E)more the tax will fall on producers

A)less the impact it will have on the consumers before tax income

B)more likely it is to lead to tax avoidance

C)less likely it will have any impact on market transactions

D)more the tax will fall on consumers

E)more the tax will fall on producers

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

23

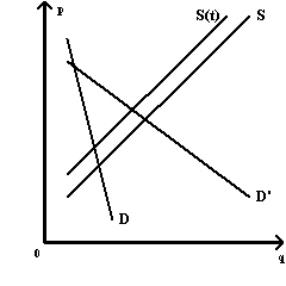

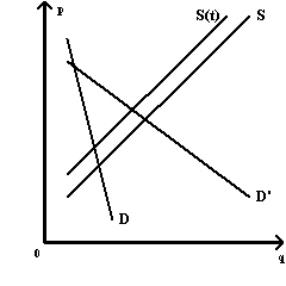

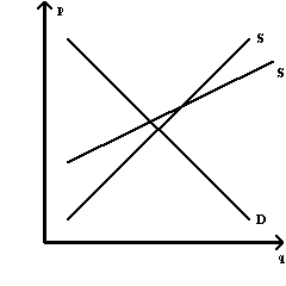

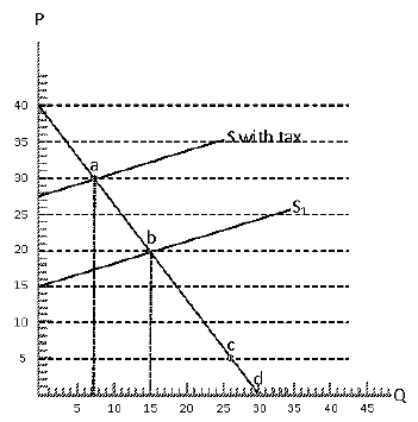

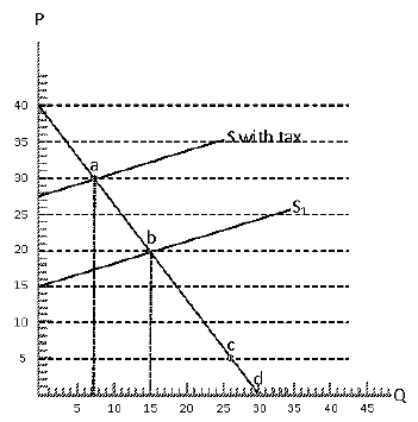

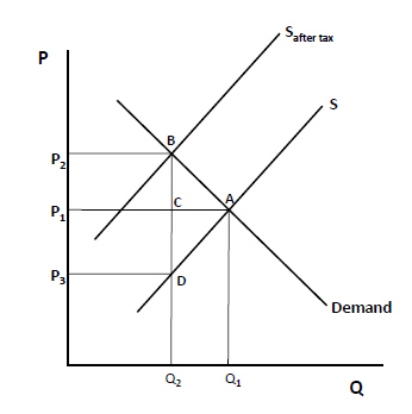

Exhibit 5-29  Refer to Exhibit 5-29.The supply curve decreases from S to S(t)because a tax is imposed.Under demand curve D' as opposed to demand curve D, consumers will pay more of the tax.

Refer to Exhibit 5-29.The supply curve decreases from S to S(t)because a tax is imposed.Under demand curve D' as opposed to demand curve D, consumers will pay more of the tax.

Refer to Exhibit 5-29.The supply curve decreases from S to S(t)because a tax is imposed.Under demand curve D' as opposed to demand curve D, consumers will pay more of the tax.

Refer to Exhibit 5-29.The supply curve decreases from S to S(t)because a tax is imposed.Under demand curve D' as opposed to demand curve D, consumers will pay more of the tax.

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

24

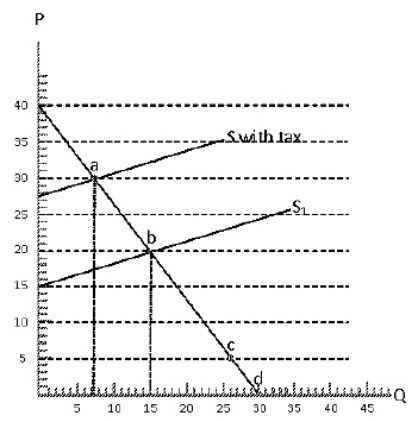

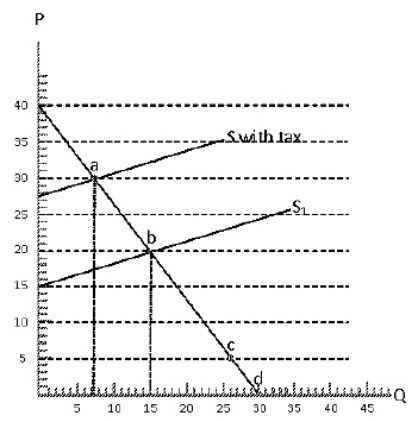

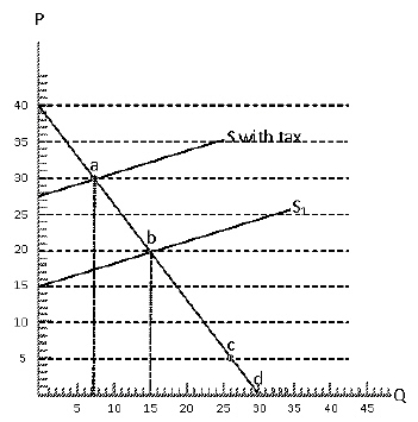

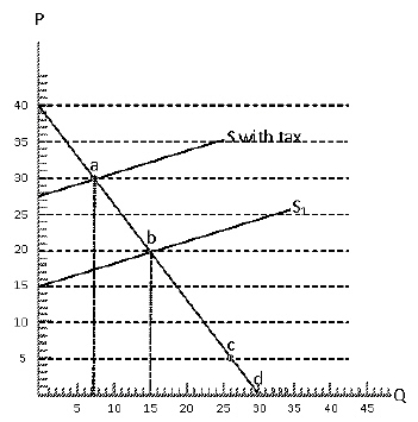

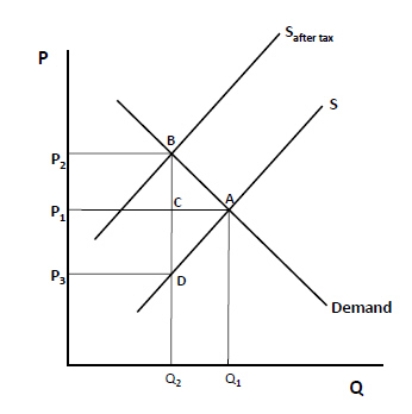

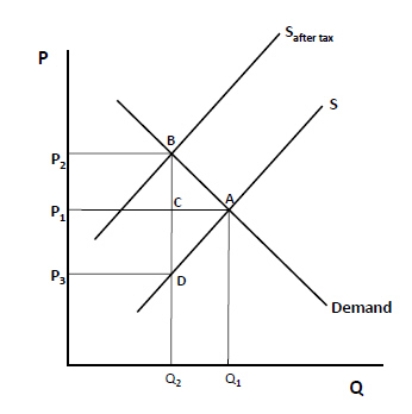

Exhibit 5-32  Refer to Exhibit 5-32.The tax burden borne by producers is:

Refer to Exhibit 5-32.The tax burden borne by producers is:

A)$5.50

B)$9.50

C)$14.50

D)$19.50

E)$20.50

Refer to Exhibit 5-32.The tax burden borne by producers is:

Refer to Exhibit 5-32.The tax burden borne by producers is:A)$5.50

B)$9.50

C)$14.50

D)$19.50

E)$20.50

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

25

Exhibit 5-32  Refer to Exhibit 5-32.The revenue generated by the $12.50 tax is:

Refer to Exhibit 5-32.The revenue generated by the $12.50 tax is:

A)$12.50

B)$25.00

C)$37.50

D)$62.60

E)$87.50

Refer to Exhibit 5-32.The revenue generated by the $12.50 tax is:

Refer to Exhibit 5-32.The revenue generated by the $12.50 tax is:A)$12.50

B)$25.00

C)$37.50

D)$62.60

E)$87.50

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

26

An excise tax will generate more revenue to the government, the more price elastic the demand for the product is.

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

27

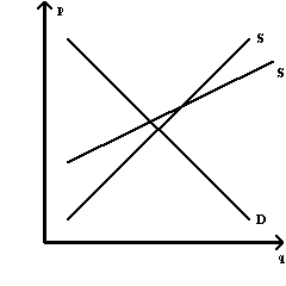

Exhibit 5-30  Refer to Exhibit 5-30.Consumers will pay a greater share of a new tax under supply curve S' than under supply curve S.

Refer to Exhibit 5-30.Consumers will pay a greater share of a new tax under supply curve S' than under supply curve S.

Refer to Exhibit 5-30.Consumers will pay a greater share of a new tax under supply curve S' than under supply curve S.

Refer to Exhibit 5-30.Consumers will pay a greater share of a new tax under supply curve S' than under supply curve S.

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

28

Exhibit 5-32  Refer to Exhibit 5-32.The tax burden borne by consumers is:

Refer to Exhibit 5-32.The tax burden borne by consumers is:

A)$50

B)$60

C)$70

D)$75

E)$80

Refer to Exhibit 5-32.The tax burden borne by consumers is:

Refer to Exhibit 5-32.The tax burden borne by consumers is:A)$50

B)$60

C)$70

D)$75

E)$80

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

29

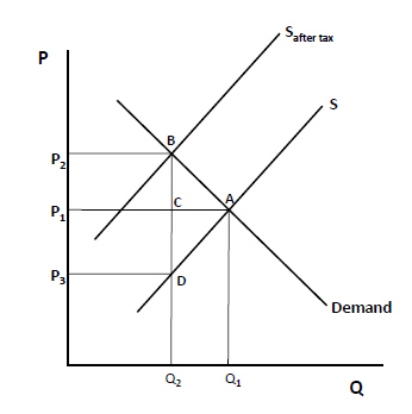

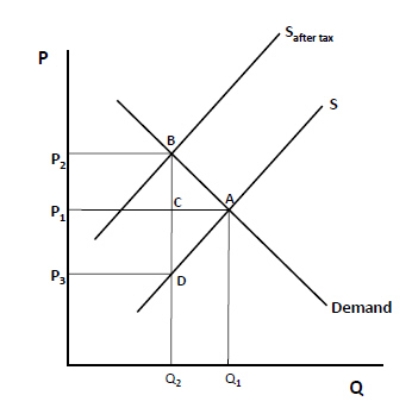

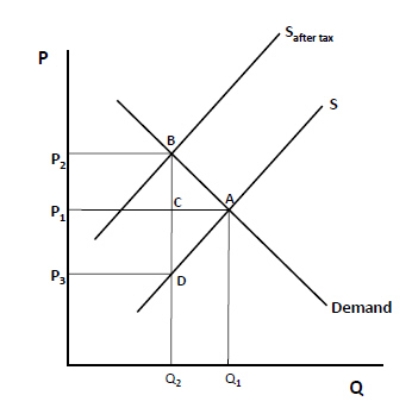

Exhibit 5-31  Refer to Exhibit 5-31.The tax burden borne by sellers is:

Refer to Exhibit 5-31.The tax burden borne by sellers is:

A)P3DCP1

B)P2BDP3

C)Q2CAQ1

D)b and c

E)P2BCP1

Refer to Exhibit 5-31.The tax burden borne by sellers is:

Refer to Exhibit 5-31.The tax burden borne by sellers is:A)P3DCP1

B)P2BDP3

C)Q2CAQ1

D)b and c

E)P2BCP1

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

30

Exhibit 5-31  Refer to Exhibit 5-31.The tax burden borne by consumers is:

Refer to Exhibit 5-31.The tax burden borne by consumers is:

A)P3DCP1

B)P2BDP3

C)Q2CAQ1

D)b and c

E)P2BCP1

Refer to Exhibit 5-31.The tax burden borne by consumers is:

Refer to Exhibit 5-31.The tax burden borne by consumers is:A)P3DCP1

B)P2BDP3

C)Q2CAQ1

D)b and c

E)P2BCP1

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

31

Exhibit 5-31  Refer to Exhibit 5-31.The revenue generated by the tax is:

Refer to Exhibit 5-31.The revenue generated by the tax is:

A)P3DCP1

B)P2BDP3

C)Q2CAQ1

D)b and c

E)P2BCP1

Refer to Exhibit 5-31.The revenue generated by the tax is:

Refer to Exhibit 5-31.The revenue generated by the tax is:A)P3DCP1

B)P2BDP3

C)Q2CAQ1

D)b and c

E)P2BCP1

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

32

If demand is more inelastic than supply is, the

A)larger the portion of the tax that will be paid by producers

B)larger the portion of the tax that will be paid by consumers

C)more likely it is that the tax will be spread equally between producers and consumers

D)smaller the portion of the tax that will be paid by consumers

E)smaller the impact that an income tax will have on consumer preferences

A)larger the portion of the tax that will be paid by producers

B)larger the portion of the tax that will be paid by consumers

C)more likely it is that the tax will be spread equally between producers and consumers

D)smaller the portion of the tax that will be paid by consumers

E)smaller the impact that an income tax will have on consumer preferences

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck