Deck 14: Taxes, Transfers, and Income Distribution

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/180

Play

Full screen (f)

Deck 14: Taxes, Transfers, and Income Distribution

1

If the average tax rate falls as income rises, the tax is called a

A) sales tax.

B) progressive tax.

C) flat tax.

D) proportional tax.

E) regressive tax.

A) sales tax.

B) progressive tax.

C) flat tax.

D) proportional tax.

E) regressive tax.

regressive tax.

2

If the average tax rate is the same for all levels of income, the tax is called a

A) progressive tax.

B) regressive tax.

C) sales tax.

D) proportional tax.

E) flat tax.

A) progressive tax.

B) regressive tax.

C) sales tax.

D) proportional tax.

E) flat tax.

proportional tax.

3

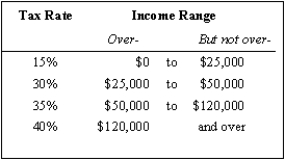

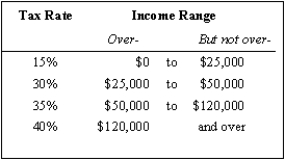

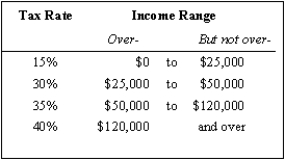

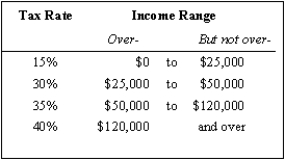

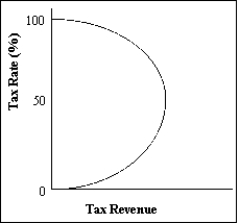

Exhibit 14-1

Refer to Exhibit 14-1. The tax system is considered to be

A) progressive.

B) regressive.

C) egalitarian.

D) proportional.

E) flat.

Refer to Exhibit 14-1. The tax system is considered to be

A) progressive.

B) regressive.

C) egalitarian.

D) proportional.

E) flat.

progressive.

4

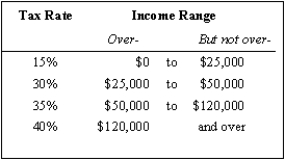

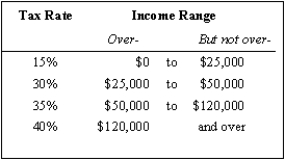

Exhibit 14-1

Refer to Exhibit 14-1. If an individual is earning $38,500 in taxable income, that individual will be able to keep how much of one more dollar earned?

A) $.60

B) $.65

C) $.55

D) $.85

E) $.70

Refer to Exhibit 14-1. If an individual is earning $38,500 in taxable income, that individual will be able to keep how much of one more dollar earned?

A) $.60

B) $.65

C) $.55

D) $.85

E) $.70

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

5

A tax on individuals' incomes is called a(n)

A) payroll tax.

B) earnings tax.

C) excise tax.

D) personal income tax.

E) tariff.

A) payroll tax.

B) earnings tax.

C) excise tax.

D) personal income tax.

E) tariff.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

6

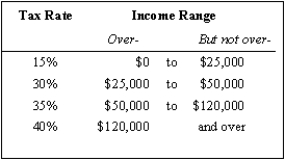

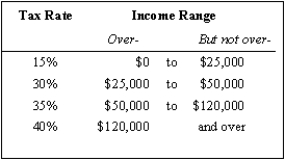

Exhibit 14-1

Refer to Exhibit 14-1. If an individual is earning $135,000 of gross income and is allowed income exemptions and adjustments in the amount of $12,500, what is this individual's total income tax?

A) $36,750

B) $40,125

C) $37,150

D) $36,625

E) $49,000

Refer to Exhibit 14-1. If an individual is earning $135,000 of gross income and is allowed income exemptions and adjustments in the amount of $12,500, what is this individual's total income tax?

A) $36,750

B) $40,125

C) $37,150

D) $36,625

E) $49,000

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

7

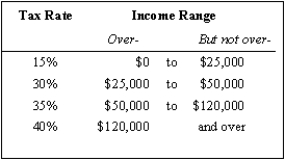

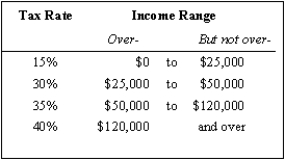

Exhibit 14-1

Refer to Exhibit 14-1. An individual making $75,000 pays an average tax rate of

A) 40 percent.

B) 15 percent.

C) 27 percent.

D) 35 percent.

E) 30 percent.

Refer to Exhibit 14-1. An individual making $75,000 pays an average tax rate of

A) 40 percent.

B) 15 percent.

C) 27 percent.

D) 35 percent.

E) 30 percent.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

8

If a person's income tax rate decreases by 10 percent when her income increases by 100 percent, then the tax system is

A) a head tax system.

B) progressive.

C) flat.

D) proportional.

E) regressive.

A) a head tax system.

B) progressive.

C) flat.

D) proportional.

E) regressive.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

9

If an individual earns an additional $300 and has to pay an additional $93 in income tax, his or her marginal tax rate is

A) 93 percent.

B) 9.3 percent.

C) 3.0 percent.

D) 31 percent.

E) 30 percent.

A) 93 percent.

B) 9.3 percent.

C) 3.0 percent.

D) 31 percent.

E) 30 percent.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

10

Which of the following formulas correctly represents taxable income under the U.S. tax system?

A) Total wages + interest

B) Total personal income -emptions - deductions

C) Total personal income + exemptions - deductions

D) Total personal income + dividends-deductions

E) Total wages - exemptions - deductions

A) Total wages + interest

B) Total personal income -emptions - deductions

C) Total personal income + exemptions - deductions

D) Total personal income + dividends-deductions

E) Total wages - exemptions - deductions

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

11

A tax bracket is a(n)

A) figurative term used to describe punishments for failure to pay taxes.

B) illegal scheme to avoid income taxes.

C) range of income to which a particular tax rate applies.

D) range of taxes that different individuals with the same incomes might pay.

E) list of things taxpayers can do to reduce their taxes.

A) figurative term used to describe punishments for failure to pay taxes.

B) illegal scheme to avoid income taxes.

C) range of income to which a particular tax rate applies.

D) range of taxes that different individuals with the same incomes might pay.

E) list of things taxpayers can do to reduce their taxes.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

12

If an individual earns an additional $300 and has to pay an additional $93 in income tax, his or her average tax rate is

A) 3.1 percent.

B) There is not enough information provided to answer this question.

C) 31 percent.

D) 93 percent.

E) 9.3 percent.

A) 3.1 percent.

B) There is not enough information provided to answer this question.

C) 31 percent.

D) 93 percent.

E) 9.3 percent.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

13

A flat tax system that does not allow for deductions or exemptions is a

A) marginal tax.

B) constant tax.

C) progressive tax.

D) regressive tax.

E) proportional tax.

A) marginal tax.

B) constant tax.

C) progressive tax.

D) regressive tax.

E) proportional tax.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

14

The amount of income tax that must be paid on an additional dollar of income is determined by the

A) total tax rate.

B) highest tax rate.

C) payroll tax rate.

D) marginal tax rate.

E) average tax rate.

A) total tax rate.

B) highest tax rate.

C) payroll tax rate.

D) marginal tax rate.

E) average tax rate.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

15

If the average tax rate rises as income rises, the tax is called a

A) proportional tax.

B) regressive tax.

C) flat tax.

D) progressive tax.

E) sales tax.

A) proportional tax.

B) regressive tax.

C) flat tax.

D) progressive tax.

E) sales tax.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

16

Which of the following forms of income is not taxed under the personal income tax?

A) Inheritance

B) Capital gains

C) Salaries

D) Royalties

E) Dividends

A) Inheritance

B) Capital gains

C) Salaries

D) Royalties

E) Dividends

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

17

Under the income tax system in the United States, the portion of personal income that can be taxed is called

A) net income.

B) allowable income.

C) personal income.

D) taxable income.

E) gross income.

A) net income.

B) allowable income.

C) personal income.

D) taxable income.

E) gross income.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

18

If the average tax rate falls as income rises, the tax is called a

A) sales tax.

B) progressive tax.

C) flat tax.

D) proportional tax.

E) regressive tax.

A) sales tax.

B) progressive tax.

C) flat tax.

D) proportional tax.

E) regressive tax.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

19

Exhibit 14-1

Refer to Exhibit 14-1. If an individual's taxable income is $75,000, how much income tax will that individual have to pay?

A) $26,250

B) $22,500

C) $21,000

D) $20,000

E) $11,250

Refer to Exhibit 14-1. If an individual's taxable income is $75,000, how much income tax will that individual have to pay?

A) $26,250

B) $22,500

C) $21,000

D) $20,000

E) $11,250

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

20

The amount of tax an individual pays divided by the individual's total income is the

A) approximate tax rate.

B) marginal tax rate.

C) net tax rate.

D) gross tax rate.

E) average tax rate.

A) approximate tax rate.

B) marginal tax rate.

C) net tax rate.

D) gross tax rate.

E) average tax rate.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

21

In a progressive tax system, anyone earning a positive amount of income must pay some income tax.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

22

A household's income tax is zero even though its income is greater than zero because

A) the taxable income is negative.

B) the household income is less than the taxable income.

C) the household income is more than the sum of exemptions and deductions.

D) the household income is less than the sum of exemptions and deductions.

E) the household has no exemptions or deductions.

A) the taxable income is negative.

B) the household income is less than the taxable income.

C) the household income is more than the sum of exemptions and deductions.

D) the household income is less than the sum of exemptions and deductions.

E) the household has no exemptions or deductions.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

23

In a progressive tax system, the tax rate increases as income increases.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

24

As a taxpayer's income rises, the amount of income tax paid falls under the regressive tax system but rises under the progressive tax system.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

25

Employees contribute to most of the payroll taxes.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

26

When a merchant charges an extra 5 percent of a good's purchase price to be paid to the government, this is an example of a(n)

A) income tax.

B) proportional tax.

C) property tax.

D) tariff.

E) excise tax.

A) income tax.

B) proportional tax.

C) property tax.

D) tariff.

E) excise tax.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

27

A flat tax system that allows for exemptions and deductions is a

A) regressive tax.

B) zero tax.

C) constant tax.

D) proportional tax.

E) progressive tax.

A) regressive tax.

B) zero tax.

C) constant tax.

D) proportional tax.

E) progressive tax.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

28

Which of the following is not true of a payroll tax?

A) It is the same as personal income tax.

B) It includes Medicare tax.

C) It includes Social Security tax.

D) It includes unemployment tax.

E) It is a tax based on wages and salary income.

A) It is the same as personal income tax.

B) It includes Medicare tax.

C) It includes Social Security tax.

D) It includes unemployment tax.

E) It is a tax based on wages and salary income.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

29

With a proportional tax, the average tax rate and marginal tax rate are equal.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

30

A corporate income tax is based on employees' income in a corporation.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

31

An excise tax is the same as a sales tax that consumers pay on the amount they spend in retail stores.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

32

The average tax rate is the amount of tax an individual would have to pay on one more dollar of income.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

33

Which of the following types of tax is more often used at the local level of government?

A) Tariff

B) Corporate income

C) Personal income

D) Excise

E) Property

A) Tariff

B) Corporate income

C) Personal income

D) Excise

E) Property

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

34

Under the flat tax system, taxpayers have to pay more as their incomes increase.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

35

An excise tax levied on all goods and services imported into a country is called a(n)

A) buyer tax.

B) incoming levy.

C) import tax.

D) sales tax.

E) tariff.

A) buyer tax.

B) incoming levy.

C) import tax.

D) sales tax.

E) tariff.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

36

How much of the U.S. payroll tax is an employee informed of?

A) Half of it

B) Most of it

C) None of it

D) 25 percent of it

E) All of it

A) Half of it

B) Most of it

C) None of it

D) 25 percent of it

E) All of it

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

37

According to current U.S. tax law,

A) the employer pays all the 15.3-percent payroll tax on the employee's wage and salary income.

B) the employee pays all the 15.3-percent payroll tax on his or her wage and salary income.

C) the employer and employee each pay half of the 15.3-percent payroll tax on the employee's wage and salary income.

D) the employer and employee each pay the 15.3-percent payroll tax on the employee's wage and salary income.

E) neither the employer nor the employee pays the payroll tax.

A) the employer pays all the 15.3-percent payroll tax on the employee's wage and salary income.

B) the employee pays all the 15.3-percent payroll tax on his or her wage and salary income.

C) the employer and employee each pay half of the 15.3-percent payroll tax on the employee's wage and salary income.

D) the employer and employee each pay the 15.3-percent payroll tax on the employee's wage and salary income.

E) neither the employer nor the employee pays the payroll tax.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

38

Which of the following statements about the effects of a tax on a good is true?

A) A 10-cent tax charged to a merchant for every bag of potato chips the merchant sells is paid entirely by the merchant.

B) When price elasticity of supply is very high, the deadweight loss from a per-unit tax on a good is relatively low.

C) When price elasticity of demand is very low, the deadweight loss from a per-unit tax on a good is relatively high.

D) The greater the price elasticity of demand for a good, the greater the cost to society of a tax on that good.

E) A $1,000 tax imposed on car dealers for every car sold will cause the prices of cars to rise $1,000.

A) A 10-cent tax charged to a merchant for every bag of potato chips the merchant sells is paid entirely by the merchant.

B) When price elasticity of supply is very high, the deadweight loss from a per-unit tax on a good is relatively low.

C) When price elasticity of demand is very low, the deadweight loss from a per-unit tax on a good is relatively high.

D) The greater the price elasticity of demand for a good, the greater the cost to society of a tax on that good.

E) A $1,000 tax imposed on car dealers for every car sold will cause the prices of cars to rise $1,000.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

39

Property taxes are the largest sources of revenue for local governments.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

40

Payroll taxes and personal income taxes are the same thing.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

41

Tax incidence is how much

A) the government receives from taxpayers.

B) buyers and sellers actually bear the burden of a tax.

C) taxpayers evade taxes illegally.

D) the government spends using tax revenues.

E) businesses get in tax credits from the government.

A) the government receives from taxpayers.

B) buyers and sellers actually bear the burden of a tax.

C) taxpayers evade taxes illegally.

D) the government spends using tax revenues.

E) businesses get in tax credits from the government.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

42

Which of the following is not a reason that tax revenue might fall at very high tax rates?

A) People have a greater incentive to practice tax avoidance.

B) Government officials fail to enforce tax laws.

C) People tend to commit more tax evasion.

D) People work less in the case of a personal income tax.

E) Corporations inflate expenses in the case of a corporate income tax.

A) People have a greater incentive to practice tax avoidance.

B) Government officials fail to enforce tax laws.

C) People tend to commit more tax evasion.

D) People work less in the case of a personal income tax.

E) Corporations inflate expenses in the case of a corporate income tax.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

43

All other things being equal, which of the following results in the most tax burden for consumers in the case of a per-unit tax on a good?

A) Perfectly elastic demand

B) Relatively elastic demand

C) Unit-elastic demand

D) Relatively inelastic demand

E) Perfectly inelastic demand

A) Perfectly elastic demand

B) Relatively elastic demand

C) Unit-elastic demand

D) Relatively inelastic demand

E) Perfectly inelastic demand

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

44

If the demand for a good is very price-elastic, then the imposition of a per-unit tax on that good will cause

A) the buyers to bear a larger portion of the tax burden.

B) the sellers to bear a larger portion of the tax burden.

C) no one to bear any tax burden.

D) the buyers and sellers to bear the tax burden evenly.

E) no effect on the market for that good.

A) the buyers to bear a larger portion of the tax burden.

B) the sellers to bear a larger portion of the tax burden.

C) no one to bear any tax burden.

D) the buyers and sellers to bear the tax burden evenly.

E) no effect on the market for that good.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

45

Which of the following is not true about the personal income tax?

A) It reduces the number of individuals working.

B) It reduces the amount of labor demanded.

C) It shifts the labor demand curve.

D) It reduces the supply of labor.

E) It drives up wages.

A) It reduces the number of individuals working.

B) It reduces the amount of labor demanded.

C) It shifts the labor demand curve.

D) It reduces the supply of labor.

E) It drives up wages.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

46

For a tax on a good, the deadweight loss is small when price elasticity of demand is low because of

A) a large difference between the efficient quantity of demand and the quantity demanded with the tax.

B) a small difference between the efficient quantity of demand and the quantity demanded with the tax.

C) a large difference between the efficient quantity of demand and the efficient quantity of supply.

D) a small difference between the efficient quantity of demand and the efficient quantity of supply.

E) a small difference between the efficient quantity of supply and the quantity supplied with the tax.

A) a large difference between the efficient quantity of demand and the quantity demanded with the tax.

B) a small difference between the efficient quantity of demand and the quantity demanded with the tax.

C) a large difference between the efficient quantity of demand and the efficient quantity of supply.

D) a small difference between the efficient quantity of demand and the efficient quantity of supply.

E) a small difference between the efficient quantity of supply and the quantity supplied with the tax.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

47

In the case of a per-unit tax on a good, which of the following situations will lead to the greatest change in price?

A) Supply and demand are relatively inelastic.

B) Supply and demand are relatively elastic.

C) Demand is relatively elastic and supply is relatively inelastic.

D) Demand is relatively inelastic and supply is relatively elastic.

E) Both supply and demand do not exist.

A) Supply and demand are relatively inelastic.

B) Supply and demand are relatively elastic.

C) Demand is relatively elastic and supply is relatively inelastic.

D) Demand is relatively inelastic and supply is relatively elastic.

E) Both supply and demand do not exist.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

48

Which of the following situations will result in the greatest deadweight loss due to a per-unit tax on a good?

A) Supply and demand are both relatively price-inelastic.

B) Supply is relatively price-inelastic and demand is relatively price-elastic.

C) Supply and demand are both relatively price-elastic.

D) Supply is relatively price-elastic and demand is relatively price-inelastic.

E) Both supply and demand do not exist.

A) Supply and demand are both relatively price-inelastic.

B) Supply is relatively price-inelastic and demand is relatively price-elastic.

C) Supply and demand are both relatively price-elastic.

D) Supply is relatively price-elastic and demand is relatively price-inelastic.

E) Both supply and demand do not exist.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

49

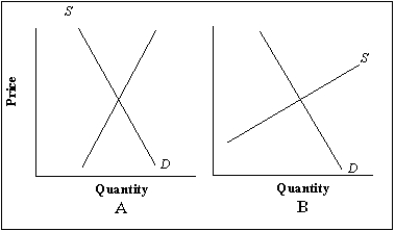

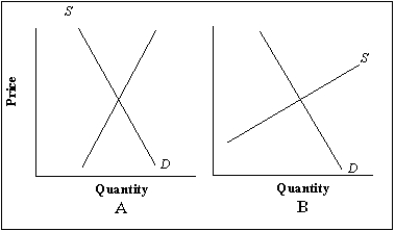

Refer to the figure below. Which of the following statements is true?

A) A per-unit tax will result in the greatest reduction of output in the market illustrated in Figure B.

B) No deadweight loss from a per-unit tax will result in either of the markets illustrated.

C) A per-unit tax will result in the greatest deadweight loss in the market illustrated in Figure A.

D) A per-unit tax will result in the greatest loss of consumer surplus in the market illustrated in Figure A.

E) A per-unit tax will result in the smallest price change in the market illustrated in Figure A.

A) A per-unit tax will result in the greatest reduction of output in the market illustrated in Figure B.

B) No deadweight loss from a per-unit tax will result in either of the markets illustrated.

C) A per-unit tax will result in the greatest deadweight loss in the market illustrated in Figure A.

D) A per-unit tax will result in the greatest loss of consumer surplus in the market illustrated in Figure A.

E) A per-unit tax will result in the smallest price change in the market illustrated in Figure A.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

50

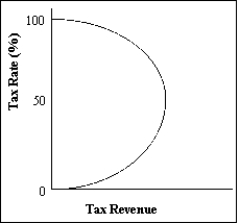

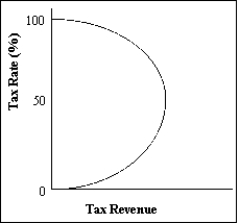

Exhibit 14-2

Refer to Exhibit 14-2. At a tax rate between 50 percent and 100 percent, a small reduction in the tax rate results in ____ in tax revenue.

A) an increase

B) a decrease

C) no change

D) a decrease and then an increase

E) either an increase or a decrease

Refer to Exhibit 14-2. At a tax rate between 50 percent and 100 percent, a small reduction in the tax rate results in ____ in tax revenue.

A) an increase

B) a decrease

C) no change

D) a decrease and then an increase

E) either an increase or a decrease

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

51

All other things being equal, which of the following results in the most tax burden for consumers in the case of a per-unit tax on a good?

A) Perfectly elastic supply

B) Relatively elastic supply

C) Unit-elastic supply

D) Relatively inelastic supply

E) Perfectly inelastic supply

A) Perfectly elastic supply

B) Relatively elastic supply

C) Unit-elastic supply

D) Relatively inelastic supply

E) Perfectly inelastic supply

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

52

According to the Laffer curve, it is possible for the government to

A) raise tax revenues by reducing the tax rate.

B) raise tax revenues without changing the tax rate.

C) raise tax revenues by not imposing any tax.

D) lose only tax revenues by imposing a tax.

E) do nothing to raise tax revenues.

A) raise tax revenues by reducing the tax rate.

B) raise tax revenues without changing the tax rate.

C) raise tax revenues by not imposing any tax.

D) lose only tax revenues by imposing a tax.

E) do nothing to raise tax revenues.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

53

The employee pays the greatest amount of the payroll tax when

A) labor supply is relatively inelastic.

B) labor demand is inelastic.

C) the employee and employer each write a check to the government for half of the tax.

D) the employee writes the check to the government.

E) the employer writes the check to the government.

A) labor supply is relatively inelastic.

B) labor demand is inelastic.

C) the employee and employer each write a check to the government for half of the tax.

D) the employee writes the check to the government.

E) the employer writes the check to the government.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

54

Exhibit 14-2

Refer to Exhibit 14-2. To give workers incentives to work more, the government should

A) increase the tax rate if it is between 50 percent and 100 percent.

B) decrease the tax rate if it is between 50 percent and 100 percent.

C) decrease the tax rate if it is between 0 percent and 50 percent.

D) either increase or decrease the tax rate to produce the same result.

E) do nothing.

Refer to Exhibit 14-2. To give workers incentives to work more, the government should

A) increase the tax rate if it is between 50 percent and 100 percent.

B) decrease the tax rate if it is between 50 percent and 100 percent.

C) decrease the tax rate if it is between 0 percent and 50 percent.

D) either increase or decrease the tax rate to produce the same result.

E) do nothing.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

55

The effect of the personal income tax on the amount of labor employed in the economy is greatest when

A) demand and supply are both relatively elastic.

B) demand and supply are both relatively inelastic.

C) demand is relatively inelastic and supply is relatively elastic.

D) demand is relatively elastic and supply is relatively inelastic.

E) both supply and demand do not exist.

A) demand and supply are both relatively elastic.

B) demand and supply are both relatively inelastic.

C) demand is relatively inelastic and supply is relatively elastic.

D) demand is relatively elastic and supply is relatively inelastic.

E) both supply and demand do not exist.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

56

Taxes cause deadweight losses because they

A) raise market prices.

B) lower firm profits.

C) distort economic incentives.

D) increase revenue for the government.

E) benefit firms at the expense of consumers.

A) raise market prices.

B) lower firm profits.

C) distort economic incentives.

D) increase revenue for the government.

E) benefit firms at the expense of consumers.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

57

Which of the following statements is true?

A) When the employer writes the check for a payroll tax, the employee pays only a small portion in lost wages.

B) When the employer writes the check for a payroll tax, the employee pays nothing.

C) Both employee and employer pay a payroll tax, and their shares do not depend on which party directly pays the government.

D) Payroll taxes are designed to make employers pay for government programs to aid workers and, in fact, employers bear the full cost of such taxes.

E) When the employee writes the check for a payroll tax, the employer pays by having to pay higher wages in the amount of the tax.

A) When the employer writes the check for a payroll tax, the employee pays only a small portion in lost wages.

B) When the employer writes the check for a payroll tax, the employee pays nothing.

C) Both employee and employer pay a payroll tax, and their shares do not depend on which party directly pays the government.

D) Payroll taxes are designed to make employers pay for government programs to aid workers and, in fact, employers bear the full cost of such taxes.

E) When the employee writes the check for a payroll tax, the employer pays by having to pay higher wages in the amount of the tax.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

58

Which of the following conditions results in the highest deadweight loss from a tax?

A) Low price elasticity of demand and low price elasticity of supply

B) Low price elasticity of demand and high price elasticity of supply

C) High price elasticity of demand and low price elasticity of supply

D) High price elasticity of demand and high price elasticity of supply

E) Price elasticity of demand is equal to price elasticity of supply

A) Low price elasticity of demand and low price elasticity of supply

B) Low price elasticity of demand and high price elasticity of supply

C) High price elasticity of demand and low price elasticity of supply

D) High price elasticity of demand and high price elasticity of supply

E) Price elasticity of demand is equal to price elasticity of supply

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

59

Exhibit 14-2

Refer to Exhibit 14-2. The curve is referred to as the ____ curve.

A) tax rate yield

B) yield

C) Laffer

D) revenue

E) Friedman

Refer to Exhibit 14-2. The curve is referred to as the ____ curve.

A) tax rate yield

B) yield

C) Laffer

D) revenue

E) Friedman

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

60

If the government imposes a tax on snack food, which has a higher elasticity of demand than non-snack food, then the deadweight loss from the tax

A) is zero.

B) is larger for snack food than it would be if the same tax were imposed on non-snack food.

C) is the same for snack food as it would be if the same tax were imposed on non-snack food.

D) is lower for snack food than it would be if the same tax were imposed on non-snack food.

E) cannot be determined.

A) is zero.

B) is larger for snack food than it would be if the same tax were imposed on non-snack food.

C) is the same for snack food as it would be if the same tax were imposed on non-snack food.

D) is lower for snack food than it would be if the same tax were imposed on non-snack food.

E) cannot be determined.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

61

Which of the following is not a characteristic of an ideal tax system, according to the text?

A) Fairness

B) Taxing of items with high price elasticities

C) Low marginal tax rates

D) Simplicity

E) High proportion of taxable sums subject to tax

A) Fairness

B) Taxing of items with high price elasticities

C) Low marginal tax rates

D) Simplicity

E) High proportion of taxable sums subject to tax

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

62

Which of the following statements is true?

A) Redistribution of income through taxation results in greater income for everyone.

B) There is no tradeoff between efficiency and equity.

C) If taxes are so high that people work a lot less, the redistribution of income could make everyone worse off.

D) The pursuit of greater equity through taxation and redistribution may promote efficiency by making everyone happier.

E) Only the rich are negatively affected by very high tax rates.

A) Redistribution of income through taxation results in greater income for everyone.

B) There is no tradeoff between efficiency and equity.

C) If taxes are so high that people work a lot less, the redistribution of income could make everyone worse off.

D) The pursuit of greater equity through taxation and redistribution may promote efficiency by making everyone happier.

E) Only the rich are negatively affected by very high tax rates.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

63

An efficient tax system should include all the following except

A) minimum deadweight losses.

B) a low marginal tax rate.

C) minimal wasting of resources.

D) taxing at a rate that is positively related to price elasticity of demand.

E) taxing at a rate that is inversely related to price elasticity of supply.

A) minimum deadweight losses.

B) a low marginal tax rate.

C) minimal wasting of resources.

D) taxing at a rate that is positively related to price elasticity of demand.

E) taxing at a rate that is inversely related to price elasticity of supply.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

64

Of the two classes of participants in a market, buyers and sellers, the one who pays most of an excise tax is the one with the greater elasticity.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

65

According to economic theory, the personal income tax reduces the amount of income-producing work done in an economy.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

66

It does not matter whether a worker or an employer physically pays a payroll tax; the net effect on wages is the same.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

67

The more price-elastic the demand, the greater the portion paid by producers for a per-unit tax on a good.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

68

To minimize inefficiency from taxes on goods,

A) a good with low elasticity of demand should be taxed at the same rate as a good with high elasticity of demand.

B) a good with low elasticity of demand should be taxed at a lesser rate than a good with high elasticity of demand.

C) a good with low elasticity of demand should be taxed at a greater rate than a good with high elasticity of demand.

D) a good with low elasticity of demand should never be taxed.

E) the government should always impose the maximum amount of tax.

A) a good with low elasticity of demand should be taxed at the same rate as a good with high elasticity of demand.

B) a good with low elasticity of demand should be taxed at a lesser rate than a good with high elasticity of demand.

C) a good with low elasticity of demand should be taxed at a greater rate than a good with high elasticity of demand.

D) a good with low elasticity of demand should never be taxed.

E) the government should always impose the maximum amount of tax.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

69

The argument that individuals should pay taxes according to how much they can afford is called the

A) benefits principle.

B) equity principle.

C) ability-to-pay principle.

D) proportional principle.

E) egalitarian principle.

A) benefits principle.

B) equity principle.

C) ability-to-pay principle.

D) proportional principle.

E) egalitarian principle.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

70

The more price-elastic the demand, the larger the increase in tax revenues resulting from a per-unit tax on a good.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

71

The deadweight loss of a tax is larger if the price elasticity of demand is higher.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

72

The efficiency of a tax system could be measured by observing

A) the costs it imposes on taxpayers.

B) the amount of tax revenues relative to the amount of government spending.

C) whether the tax burden is distributed equally among taxpayers.

D) whether taxpayers are happy or not.

E) whether it is fair for individuals to pay taxes based on the benefits they receive from the government.

A) the costs it imposes on taxpayers.

B) the amount of tax revenues relative to the amount of government spending.

C) whether the tax burden is distributed equally among taxpayers.

D) whether taxpayers are happy or not.

E) whether it is fair for individuals to pay taxes based on the benefits they receive from the government.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

73

Tax incidence refers to who bears the tax burden.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

74

Which of the following are tradeoffs in the design of a tax system?

A) Fairness and equity

B) Equity and corruption

C) Corruption and efficiency

D) Equity and efficiency

E) Taxing one income class versus another income class

A) Fairness and equity

B) Equity and corruption

C) Corruption and efficiency

D) Equity and efficiency

E) Taxing one income class versus another income class

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

75

An excise tax on a good will always produce a deadweight loss.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

76

Taxes cause deadweight losses because of their effects on individuals' behavior.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

77

In designing a tax system, the government considers the conflicting goals of efficiency and equity.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

78

According to the ability-to-pay principle,

A) those with lower incomes should pay just as great a percentage of their income in taxes as those with higher incomes.

B) foreigners who trade with the United States should pay taxes.

C) those with higher incomes should pay more in total taxes.

D) those with higher incomes should pay higher tax rates.

E) those with higher incomes should pay the same amount of taxes as those with lower incomes.

A) those with lower incomes should pay just as great a percentage of their income in taxes as those with higher incomes.

B) foreigners who trade with the United States should pay taxes.

C) those with higher incomes should pay more in total taxes.

D) those with higher incomes should pay higher tax rates.

E) those with higher incomes should pay the same amount of taxes as those with lower incomes.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

79

The Laffer curve indicates that very high rates of taxation can actually reduce tax revenue.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck

80

Which of the following violates the ability-to-pay principle as defined by the text?

A) Progressive income tax

B) Flat rate income tax

C) Proportional income tax

D) A regressive tax that taxes the first $20,000 in income at 20 percent and all income above that at 10 percent

E) None of the options given violates the ability-to-pay principle because those with higher incomes always pay more.

A) Progressive income tax

B) Flat rate income tax

C) Proportional income tax

D) A regressive tax that taxes the first $20,000 in income at 20 percent and all income above that at 10 percent

E) None of the options given violates the ability-to-pay principle because those with higher incomes always pay more.

Unlock Deck

Unlock for access to all 180 flashcards in this deck.

Unlock Deck

k this deck