Accounting for Decision Making and Control 8th Edition by Jerold Zimmerman

Edition 8ISBN: 978-0078025747

Accounting for Decision Making and Control 8th Edition by Jerold Zimmerman

Edition 8ISBN: 978-0078025747 Exercise 2

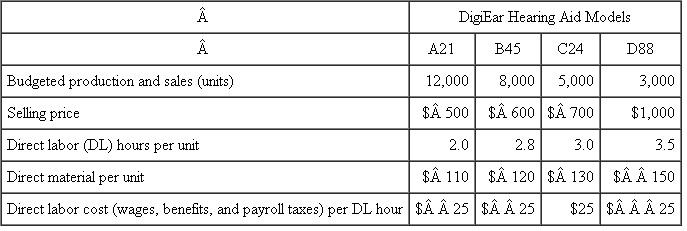

DigiEar

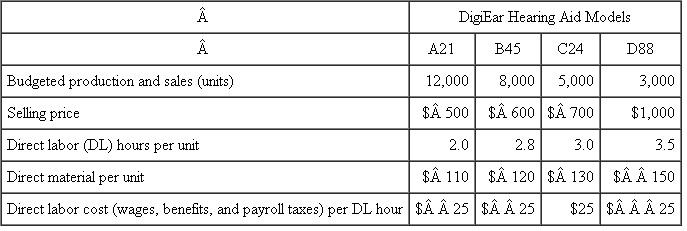

DigiEar has invented and patented a new digital behind-the-ear hearing aid with adaptive noise reduction and automatic feedback cancellation. DigiEar produces four different models of its DigiEar device. The following table summarizes the planned production levels, costs, and selling prices for the four DigiEar devices for this year:

DigiEar allocates both fixed and variable manufacturing overhead to the four devices using a single overhead rate, which includes both fixed and variable manufacturing overhead. The number of direct labor hours in each device is used as the allocation base for assigning overhead to hearing aids. Budgeted volume measured using direct labor hours is calculated using the budgeted sales of each device. Variable manufacturing overhead is budgeted at $12.00 per direct labor hour and fixed manufacturing overhead is budgeted this year at $2,157,000.

DigiEar allocates both fixed and variable manufacturing overhead to the four devices using a single overhead rate, which includes both fixed and variable manufacturing overhead. The number of direct labor hours in each device is used as the allocation base for assigning overhead to hearing aids. Budgeted volume measured using direct labor hours is calculated using the budgeted sales of each device. Variable manufacturing overhead is budgeted at $12.00 per direct labor hour and fixed manufacturing overhead is budgeted this year at $2,157,000.

Required:

a. Calculate DigiEar's budgeted manufacturing overhead rate per direct labor hour for this year.

b. Using absorption costing, calculate the budgeted manufacturing cost per unit for each of DigiEar's four hearing aid devices.

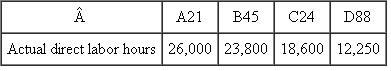

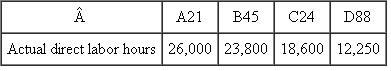

c. During the year, actual manufacturing overhead incurred (fixed plus variable) was $3,110,000, and the actual number of direct labor hours used producing the four hearing aids was:

Calculate the over- or underabsorbed overhead DigiEar has for this year.

Calculate the over- or underabsorbed overhead DigiEar has for this year.

d. Assuming that the entire over- or underabsorbed overhead you calculated in part ( c ) is written off to cost of goods sold, does this write-off increase or decrease net income before taxes? Explain.

DigiEar has invented and patented a new digital behind-the-ear hearing aid with adaptive noise reduction and automatic feedback cancellation. DigiEar produces four different models of its DigiEar device. The following table summarizes the planned production levels, costs, and selling prices for the four DigiEar devices for this year:

DigiEar allocates both fixed and variable manufacturing overhead to the four devices using a single overhead rate, which includes both fixed and variable manufacturing overhead. The number of direct labor hours in each device is used as the allocation base for assigning overhead to hearing aids. Budgeted volume measured using direct labor hours is calculated using the budgeted sales of each device. Variable manufacturing overhead is budgeted at $12.00 per direct labor hour and fixed manufacturing overhead is budgeted this year at $2,157,000.

DigiEar allocates both fixed and variable manufacturing overhead to the four devices using a single overhead rate, which includes both fixed and variable manufacturing overhead. The number of direct labor hours in each device is used as the allocation base for assigning overhead to hearing aids. Budgeted volume measured using direct labor hours is calculated using the budgeted sales of each device. Variable manufacturing overhead is budgeted at $12.00 per direct labor hour and fixed manufacturing overhead is budgeted this year at $2,157,000.Required:

a. Calculate DigiEar's budgeted manufacturing overhead rate per direct labor hour for this year.

b. Using absorption costing, calculate the budgeted manufacturing cost per unit for each of DigiEar's four hearing aid devices.

c. During the year, actual manufacturing overhead incurred (fixed plus variable) was $3,110,000, and the actual number of direct labor hours used producing the four hearing aids was:

Calculate the over- or underabsorbed overhead DigiEar has for this year.

Calculate the over- or underabsorbed overhead DigiEar has for this year.d. Assuming that the entire over- or underabsorbed overhead you calculated in part ( c ) is written off to cost of goods sold, does this write-off increase or decrease net income before taxes? Explain.

Explanation

Allocation of manufacturing overhead

In...

Accounting for Decision Making and Control 8th Edition by Jerold Zimmerman

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255