Accounting for Decision Making and Control 8th Edition by Jerold Zimmerman

Edition 8ISBN: 978-0078025747

Accounting for Decision Making and Control 8th Edition by Jerold Zimmerman

Edition 8ISBN: 978-0078025747 Exercise 15

Taylor Chains

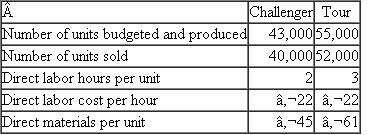

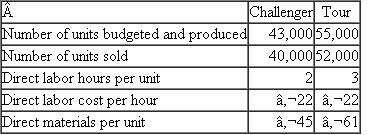

Taylor designs and manufactures high-performance bicycle chains for professional racers and serious amateurs. Two new titanium chain sets, the Challenger and the Tour, sell for €110 and €155, respectively. The following data summarize the cost structure for the two chain sets:

Taylor uses an absorption costing system. Overhead is applied to these two products based on direct labor hours using a flexible budget to calculate the overhead rate before production begins for the year. Taylor budgeted (and produced) 43,000 Challenger chains and 55,000 Tour chains. Fixed manufacturing overhead was estimated to be €1.65 million and variable manufacturing overhead was estimated to be €1.75 per direct labor hour. Actual overhead incurred amounted to €2.1 million. Any over- or underabsorbed overhead is written off to cost of goods sold.

Taylor uses an absorption costing system. Overhead is applied to these two products based on direct labor hours using a flexible budget to calculate the overhead rate before production begins for the year. Taylor budgeted (and produced) 43,000 Challenger chains and 55,000 Tour chains. Fixed manufacturing overhead was estimated to be €1.65 million and variable manufacturing overhead was estimated to be €1.75 per direct labor hour. Actual overhead incurred amounted to €2.1 million. Any over- or underabsorbed overhead is written off to cost of goods sold.

Required:

a. Calculate the overhead rate Taylor used to absorb overhead to the chains.

b. Using the predetermined overhead rate you calculated in ( a ), and assuming any over or underabsorbed overhead is written off to cost of goods sold, calculate Taylor Chains' net income before taxes for both the Challenger and Tour chains and for the entire firm.

c. Instead of using absorption costing, use variable costing to calculate Taylor Chains' net income before taxes for both the Challenger and Tour chains and for the entire firm. Assume that any over- or underabsorbed overhead is treated as a fixed cost and is written off to cost of goods sold.

d. Explain why the net income numbers calculated in parts ( b ) and ( c ) differ and reconcile the difference numerically.

e. Suppose that next year Taylor incurs total manufacturing overhead of €2.3 million and sells all the chains it produces next year as well as the 6,000 chains it had in inventory from the first year of production. How much manufacturing overhead will appear on Taylor's income statement if the company uses (i) absorption costing or (ii) variable costing?

Taylor designs and manufactures high-performance bicycle chains for professional racers and serious amateurs. Two new titanium chain sets, the Challenger and the Tour, sell for €110 and €155, respectively. The following data summarize the cost structure for the two chain sets:

Taylor uses an absorption costing system. Overhead is applied to these two products based on direct labor hours using a flexible budget to calculate the overhead rate before production begins for the year. Taylor budgeted (and produced) 43,000 Challenger chains and 55,000 Tour chains. Fixed manufacturing overhead was estimated to be €1.65 million and variable manufacturing overhead was estimated to be €1.75 per direct labor hour. Actual overhead incurred amounted to €2.1 million. Any over- or underabsorbed overhead is written off to cost of goods sold.

Taylor uses an absorption costing system. Overhead is applied to these two products based on direct labor hours using a flexible budget to calculate the overhead rate before production begins for the year. Taylor budgeted (and produced) 43,000 Challenger chains and 55,000 Tour chains. Fixed manufacturing overhead was estimated to be €1.65 million and variable manufacturing overhead was estimated to be €1.75 per direct labor hour. Actual overhead incurred amounted to €2.1 million. Any over- or underabsorbed overhead is written off to cost of goods sold.Required:

a. Calculate the overhead rate Taylor used to absorb overhead to the chains.

b. Using the predetermined overhead rate you calculated in ( a ), and assuming any over or underabsorbed overhead is written off to cost of goods sold, calculate Taylor Chains' net income before taxes for both the Challenger and Tour chains and for the entire firm.

c. Instead of using absorption costing, use variable costing to calculate Taylor Chains' net income before taxes for both the Challenger and Tour chains and for the entire firm. Assume that any over- or underabsorbed overhead is treated as a fixed cost and is written off to cost of goods sold.

d. Explain why the net income numbers calculated in parts ( b ) and ( c ) differ and reconcile the difference numerically.

e. Suppose that next year Taylor incurs total manufacturing overhead of €2.3 million and sells all the chains it produces next year as well as the 6,000 chains it had in inventory from the first year of production. How much manufacturing overhead will appear on Taylor's income statement if the company uses (i) absorption costing or (ii) variable costing?

Explanation

Absorption costing

Under absorption cos...

Accounting for Decision Making and Control 8th Edition by Jerold Zimmerman

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255