Accounting for Decision Making and Control 8th Edition by Jerold Zimmerman

Edition 8ISBN: 978-0078025747

Accounting for Decision Making and Control 8th Edition by Jerold Zimmerman

Edition 8ISBN: 978-0078025747 Exercise 1

Houston Milling

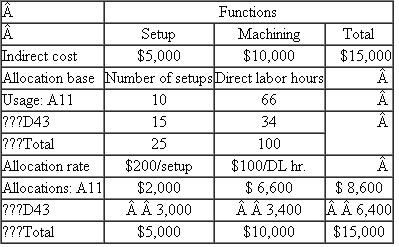

Houston Milling is a subcontractor to Pratt Whitney, which makes jet engines. Houston Milling makes two different fuel pump housings for two Pratt Whitney jet engines: the A11 housing and the D43. These pump housings are received from Pratt Whitney, which buys them from an outside (independent) foundry and ships them to Houston for precision machining. Houston performs two machining operations on the housings. These are performed in two separate machining departments (Department 1 and Department 2). Both housings, A11 and D43, require machining in both Departments 1 and 2. Before the parts are machined, the machines must first be set up, which includes cleaning the machine, checking the tools in the machine, adjusting the tolerances, and then finally machining some trial parts. Houston's current accounting system tracks the number of setups and direct labor hours used by each part. Table 1 summarizes the indirect costs of producing A11 and D43. (The direct costs such as direct labor and materials are ignored to simplify the computations.)

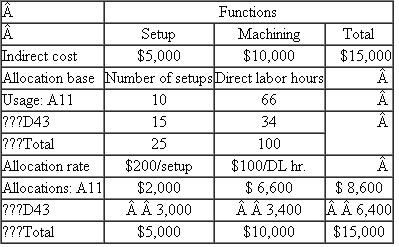

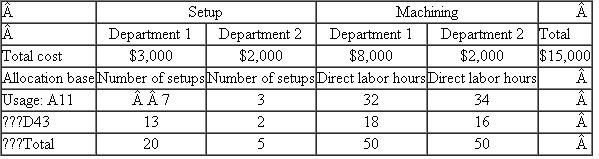

Setup and machine hours in the two departments are pooled into two cost pools: setup and machining. Table 1 allocates the costs in these two pools to the two products. Under this accounting system, A11 has indirect costs of $8,600 and D43 has indirect costs of $6,400. Management believes that the current accounting system is not producing accurate costs for the two products because the two cost pools are too aggregated. They decide to disaggregate the data and use four cost pools. They collect some additional data, which are summarized in Table 2.

Required:

a. Calculate revised cost allocations based on the disaggregated data in Table 2. Number of setups is used to allocate the indirect cost of setups in both Departments 1 and 2 and direct labor hours are used to allocate the machining costs in Departments 1 and 2.

b. Prepare a short memo describing the pros and cons of the revised allocated indirect costs in ( a ) compared to those in Table 1.

TABLE 1 Houston Milling Allocated Indirect Costs of Producing Parts A11 and D43

TABLE 2 Houston Milling Disaggregated Cost Pool Data

TABLE 2 Houston Milling Disaggregated Cost Pool Data

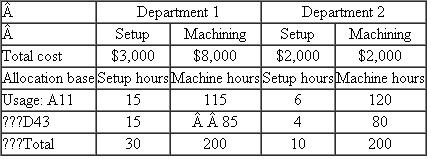

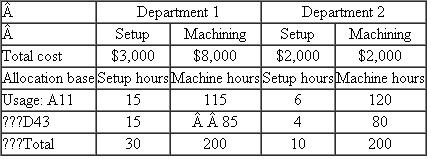

TABLE 3 Houston Milling Setup Hours and Machine Hours in Departments 1 and 2

TABLE 3 Houston Milling Setup Hours and Machine Hours in Departments 1 and 2

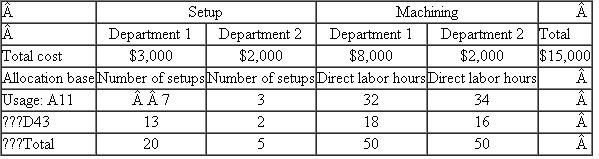

c. After completing the analysis in ( a ) and ( b ), some additional data are collected from a special study of setup hours and machine hours in the two departments. These data are presented in Table 3. In particular, setup hours and machine hours are collected in the two departments. Management now believes that setup hours and machine hours more accurately reflect the true cause-and-effect relations of setup costs and machining costs in Departments 1 and 2 than number of setups and direct labor hours, respectively.

c. After completing the analysis in ( a ) and ( b ), some additional data are collected from a special study of setup hours and machine hours in the two departments. These data are presented in Table 3. In particular, setup hours and machine hours are collected in the two departments. Management now believes that setup hours and machine hours more accurately reflect the true cause-and-effect relations of setup costs and machining costs in Departments 1 and 2 than number of setups and direct labor hours, respectively.

Based on the data presented in Table 3, calculate revised cost allocations for A11 and D43. Setup costs in Departments 1 and 2 are to be allocated based on setup hours, and machining costs in Departments 1 and 2 are to be allocated based on machine hours.

d. Compare the total product costs for A11 and D43 in Table 1 and parts ( a ) and ( c ). What conclusions can you draw?

Houston Milling is a subcontractor to Pratt Whitney, which makes jet engines. Houston Milling makes two different fuel pump housings for two Pratt Whitney jet engines: the A11 housing and the D43. These pump housings are received from Pratt Whitney, which buys them from an outside (independent) foundry and ships them to Houston for precision machining. Houston performs two machining operations on the housings. These are performed in two separate machining departments (Department 1 and Department 2). Both housings, A11 and D43, require machining in both Departments 1 and 2. Before the parts are machined, the machines must first be set up, which includes cleaning the machine, checking the tools in the machine, adjusting the tolerances, and then finally machining some trial parts. Houston's current accounting system tracks the number of setups and direct labor hours used by each part. Table 1 summarizes the indirect costs of producing A11 and D43. (The direct costs such as direct labor and materials are ignored to simplify the computations.)

Setup and machine hours in the two departments are pooled into two cost pools: setup and machining. Table 1 allocates the costs in these two pools to the two products. Under this accounting system, A11 has indirect costs of $8,600 and D43 has indirect costs of $6,400. Management believes that the current accounting system is not producing accurate costs for the two products because the two cost pools are too aggregated. They decide to disaggregate the data and use four cost pools. They collect some additional data, which are summarized in Table 2.

Required:

a. Calculate revised cost allocations based on the disaggregated data in Table 2. Number of setups is used to allocate the indirect cost of setups in both Departments 1 and 2 and direct labor hours are used to allocate the machining costs in Departments 1 and 2.

b. Prepare a short memo describing the pros and cons of the revised allocated indirect costs in ( a ) compared to those in Table 1.

TABLE 1 Houston Milling Allocated Indirect Costs of Producing Parts A11 and D43

TABLE 2 Houston Milling Disaggregated Cost Pool Data

TABLE 2 Houston Milling Disaggregated Cost Pool Data  TABLE 3 Houston Milling Setup Hours and Machine Hours in Departments 1 and 2

TABLE 3 Houston Milling Setup Hours and Machine Hours in Departments 1 and 2  c. After completing the analysis in ( a ) and ( b ), some additional data are collected from a special study of setup hours and machine hours in the two departments. These data are presented in Table 3. In particular, setup hours and machine hours are collected in the two departments. Management now believes that setup hours and machine hours more accurately reflect the true cause-and-effect relations of setup costs and machining costs in Departments 1 and 2 than number of setups and direct labor hours, respectively.

c. After completing the analysis in ( a ) and ( b ), some additional data are collected from a special study of setup hours and machine hours in the two departments. These data are presented in Table 3. In particular, setup hours and machine hours are collected in the two departments. Management now believes that setup hours and machine hours more accurately reflect the true cause-and-effect relations of setup costs and machining costs in Departments 1 and 2 than number of setups and direct labor hours, respectively.Based on the data presented in Table 3, calculate revised cost allocations for A11 and D43. Setup costs in Departments 1 and 2 are to be allocated based on setup hours, and machining costs in Departments 1 and 2 are to be allocated based on machine hours.

d. Compare the total product costs for A11 and D43 in Table 1 and parts ( a ) and ( c ). What conclusions can you draw?

Explanation

Cost of Goods sold:

It represents the c...

Accounting for Decision Making and Control 8th Edition by Jerold Zimmerman

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255