McGraw-Hill's Taxation of Business Entities 3rd Edition by Connie Weaver, Brian Spilker, Edmund Outslay, John Robinson, Ronald Worsham, Benjamin Ayers, John Barrick

Edition 3ISBN: 9780077924522

McGraw-Hill's Taxation of Business Entities 3rd Edition by Connie Weaver, Brian Spilker, Edmund Outslay, John Robinson, Ronald Worsham, Benjamin Ayers, John Barrick

Edition 3ISBN: 9780077924522 Exercise 23

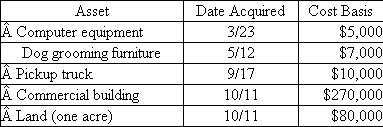

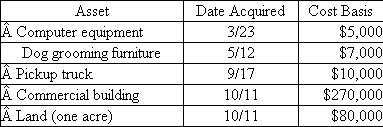

At the beginning of the year, Poplock began a calendar-year dog boarding business called Griff's Palace. Poplock bought and placed in service the following assets during the year:

Assuming Poplock does not elect §179 expensing or bonus depreciation, answer the following questions:

Assuming Poplock does not elect §179 expensing or bonus depreciation, answer the following questions:

What is Poplock's year 1 depreciation expense for each asset What is Poplock's year 2 depreciation expense for each asset

Assuming Poplock does not elect §179 expensing or bonus depreciation, answer the following questions:

Assuming Poplock does not elect §179 expensing or bonus depreciation, answer the following questions:What is Poplock's year 1 depreciation expense for each asset What is Poplock's year 2 depreciation expense for each asset

Explanation

Cost Recovery

The cost of an asset is r...

McGraw-Hill's Taxation of Business Entities 3rd Edition by Connie Weaver, Brian Spilker, Edmund Outslay, John Robinson, Ronald Worsham, Benjamin Ayers, John Barrick

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255