McGraw-Hill's Taxation of Business Entities 3rd Edition by Connie Weaver, Brian Spilker, Edmund Outslay, John Robinson, Ronald Worsham, Benjamin Ayers, John Barrick

Edition 3ISBN: 9780077924522

McGraw-Hill's Taxation of Business Entities 3rd Edition by Connie Weaver, Brian Spilker, Edmund Outslay, John Robinson, Ronald Worsham, Benjamin Ayers, John Barrick

Edition 3ISBN: 9780077924522 Exercise 36

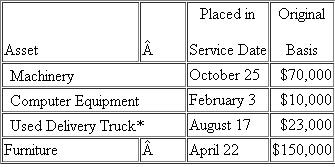

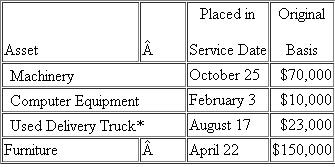

Evergreen Corporation (calendar year end) acquired the following assets during the current year (ignore §179 expense and bonus depreciation for this problem):

*The delivery truck is not a luxury automobile.

*The delivery truck is not a luxury automobile.

What is the allowable MACRS depreciation on Evergreen's property in the current year What is the allowable MACRS depreciation on Evergreen's property in the current year if the machinery had a basis of $170,000 rather than $70,000

*The delivery truck is not a luxury automobile.

*The delivery truck is not a luxury automobile.What is the allowable MACRS depreciation on Evergreen's property in the current year What is the allowable MACRS depreciation on Evergreen's property in the current year if the machinery had a basis of $170,000 rather than $70,000

Explanation

Determine the allowable MACRS depreciati...

McGraw-Hill's Taxation of Business Entities 3rd Edition by Connie Weaver, Brian Spilker, Edmund Outslay, John Robinson, Ronald Worsham, Benjamin Ayers, John Barrick

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255