McGraw-Hill's Taxation of Business Entities 3rd Edition by Connie Weaver, Brian Spilker, Edmund Outslay, John Robinson, Ronald Worsham, Benjamin Ayers, John Barrick

Edition 3ISBN: 9780077924522

McGraw-Hill's Taxation of Business Entities 3rd Edition by Connie Weaver, Brian Spilker, Edmund Outslay, John Robinson, Ronald Worsham, Benjamin Ayers, John Barrick

Edition 3ISBN: 9780077924522 Exercise 62

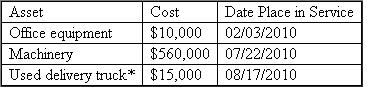

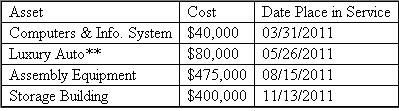

Back in Boston, Steve has been busy creating and managing his new company, Teton Mountaineering (TM), which is based out of a small town in Wyoming. In the process of doing so, TM has acquired various types of assets. Below is a list of assets acquired during 2010:

*Not considered a luxury automobile, thus not subject to the luxury automobile limitations

*Not considered a luxury automobile, thus not subject to the luxury automobile limitations

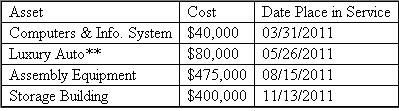

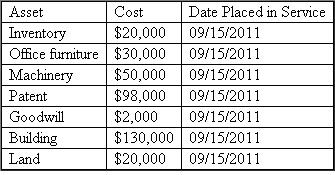

During 2010, TM had huge success (and had no §179 limitations and Steve acquired more assets the next year to increase its production capacity. These are the assets which were acquired during 2011:

**Used 100% for business purposes.

**Used 100% for business purposes.

TM did extremely well during 2011 by generating a taxable income before any §179 expense of $732,500.

Required

a. Compute 2010 depreciation deductions including §179 expense (ignoring bonus depreciation).

b. Compute 2011 depreciation deductions including §179 expense (ignoring bonus depreciation).

c. Compute 2011 depreciation deductions including §179 expense (ignoring bonus depreciation), but now assume that Steve acquired a new machine on October 2 nd for $400,000 plus $20,000 for delivery and setup costs.

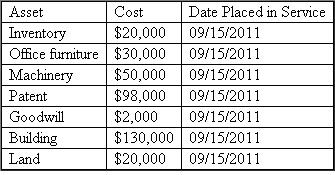

d. Ignoring part c, now assume that during 2011, Steve decides to buy a competitor's assets for a purchase price of $350,000. Steve purchased the following assets for the lump-sum purchase price.

e. Complete Part I of Form 4562 for part b.

e. Complete Part I of Form 4562 for part b.

*Not considered a luxury automobile, thus not subject to the luxury automobile limitations

*Not considered a luxury automobile, thus not subject to the luxury automobile limitationsDuring 2010, TM had huge success (and had no §179 limitations and Steve acquired more assets the next year to increase its production capacity. These are the assets which were acquired during 2011:

**Used 100% for business purposes.

**Used 100% for business purposes.TM did extremely well during 2011 by generating a taxable income before any §179 expense of $732,500.

Required

a. Compute 2010 depreciation deductions including §179 expense (ignoring bonus depreciation).

b. Compute 2011 depreciation deductions including §179 expense (ignoring bonus depreciation).

c. Compute 2011 depreciation deductions including §179 expense (ignoring bonus depreciation), but now assume that Steve acquired a new machine on October 2 nd for $400,000 plus $20,000 for delivery and setup costs.

d. Ignoring part c, now assume that during 2011, Steve decides to buy a competitor's assets for a purchase price of $350,000. Steve purchased the following assets for the lump-sum purchase price.

e. Complete Part I of Form 4562 for part b.

e. Complete Part I of Form 4562 for part b.Explanation

a)2010 depreciation is $513,00...

McGraw-Hill's Taxation of Business Entities 3rd Edition by Connie Weaver, Brian Spilker, Edmund Outslay, John Robinson, Ronald Worsham, Benjamin Ayers, John Barrick

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255