McGraw-Hill's Taxation of Business Entities 3rd Edition by Connie Weaver, Brian Spilker, Edmund Outslay, John Robinson, Ronald Worsham, Benjamin Ayers, John Barrick

Edition 3ISBN: 9780077924522

McGraw-Hill's Taxation of Business Entities 3rd Edition by Connie Weaver, Brian Spilker, Edmund Outslay, John Robinson, Ronald Worsham, Benjamin Ayers, John Barrick

Edition 3ISBN: 9780077924522 Exercise 50

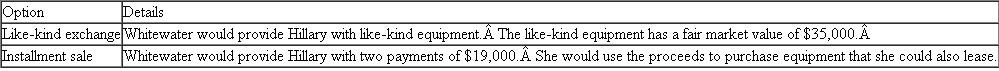

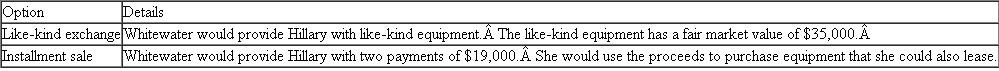

{Planning} Hillary is in the leasing business and faces a marginal tax rate of 35 percent. She has leased equipment to Whitewater Corporation for several years. Hillary bought the equipment for $50,000 and claimed $20,000 of depreciation deductions against the asset. The lease term is about to expire and Whitewater would like to acquire the equipment. Hillary has been offered two options to choose from:

Ignoring time value of money, which option provides the greatest after-tax value for Hillary, assuming she is indifferent between the proposals based on nontax factors

Ignoring time value of money, which option provides the greatest after-tax value for Hillary, assuming she is indifferent between the proposals based on nontax factors

Ignoring time value of money, which option provides the greatest after-tax value for Hillary, assuming she is indifferent between the proposals based on nontax factors

Ignoring time value of money, which option provides the greatest after-tax value for Hillary, assuming she is indifferent between the proposals based on nontax factorsExplanation

When an individual or an organization se...

McGraw-Hill's Taxation of Business Entities 3rd Edition by Connie Weaver, Brian Spilker, Edmund Outslay, John Robinson, Ronald Worsham, Benjamin Ayers, John Barrick

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255