McGraw-Hill's Taxation of Business Entities 3rd Edition by Connie Weaver, Brian Spilker, Edmund Outslay, John Robinson, Ronald Worsham, Benjamin Ayers, John Barrick

Edition 3ISBN: 9780077924522

McGraw-Hill's Taxation of Business Entities 3rd Edition by Connie Weaver, Brian Spilker, Edmund Outslay, John Robinson, Ronald Worsham, Benjamin Ayers, John Barrick

Edition 3ISBN: 9780077924522 Exercise 87

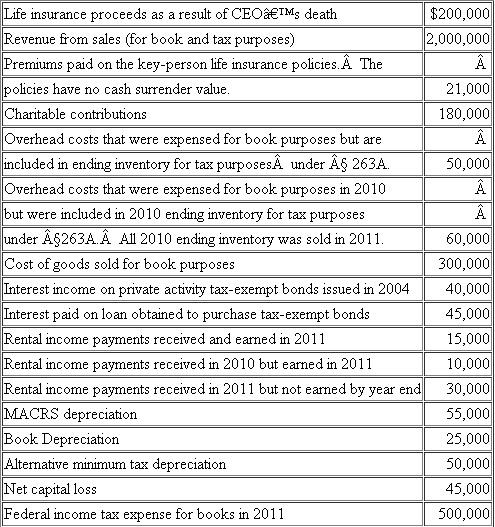

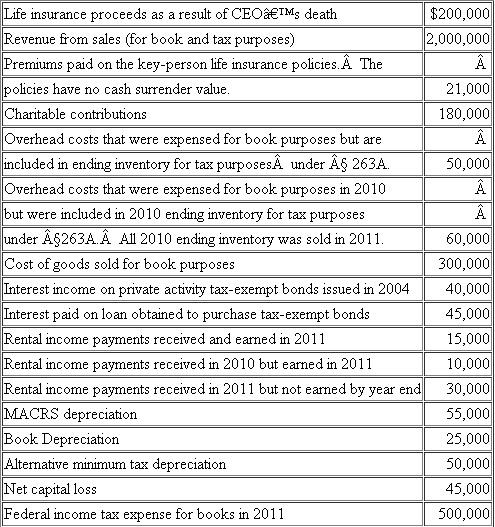

Timpanogos Inc. is an accrual-method calendar-year corporation. For 2011, it reported financial statement income after taxes of $1,149,000. Timpanogos provided the following information relating to its 2011 activities:

Timpanogos did not qualify for the domestic production activities deduction.

Timpanogos did not qualify for the domestic production activities deduction.

Required:

a. Reconcile book income to taxable income for Timpanogos Inc. Be sure to start with book income and identify all of the adjustments necessary to arrive at taxable income.

b. Identify each book-tax difference as either permanent or temporary.

c. Complete Schedule M-1 for Timpanogos.

d. Compute Timpanogos's regular tax liability for 2011.e. Determine Timpanogos's alternative minimum tax, if any.

Timpanogos did not qualify for the domestic production activities deduction.

Timpanogos did not qualify for the domestic production activities deduction.Required:

a. Reconcile book income to taxable income for Timpanogos Inc. Be sure to start with book income and identify all of the adjustments necessary to arrive at taxable income.

b. Identify each book-tax difference as either permanent or temporary.

c. Complete Schedule M-1 for Timpanogos.

d. Compute Timpanogos's regular tax liability for 2011.e. Determine Timpanogos's alternative minimum tax, if any.

Explanation

a.Timpanogos's taxable income is $1,512,...

McGraw-Hill's Taxation of Business Entities 3rd Edition by Connie Weaver, Brian Spilker, Edmund Outslay, John Robinson, Ronald Worsham, Benjamin Ayers, John Barrick

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255