McGraw-Hill's Taxation of Business Entities 3rd Edition by Connie Weaver, Brian Spilker, Edmund Outslay, John Robinson, Ronald Worsham, Benjamin Ayers, John Barrick

Edition 3ISBN: 9780077924522

McGraw-Hill's Taxation of Business Entities 3rd Edition by Connie Weaver, Brian Spilker, Edmund Outslay, John Robinson, Ronald Worsham, Benjamin Ayers, John Barrick

Edition 3ISBN: 9780077924522 Exercise 15

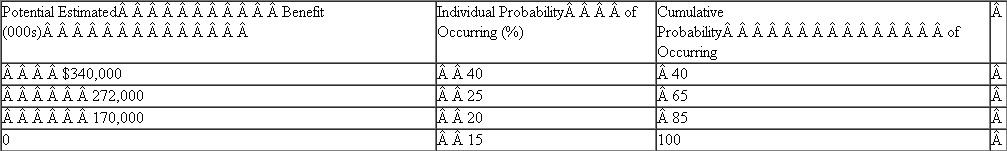

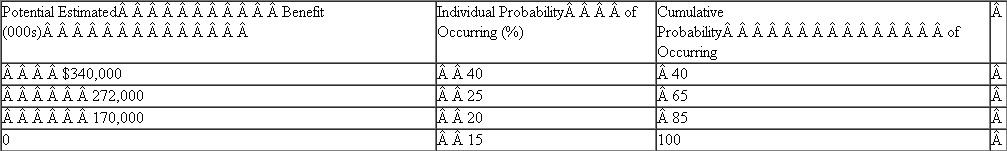

Cadillac Square Corporation determined that $1,000,000 of its domestic production activities deduction on its current year tax return was uncertain, but that it was more likely than not to be sustained on audit. Management made the following assessment of the Company's potential tax benefit from the deduction and its probability of occurring.

What amount of the tax benefit related to the uncertain tax position from the DPAD can Cadillac Square Corporation recognize in calculating its income tax provision in the current year

What amount of the tax benefit related to the uncertain tax position from the DPAD can Cadillac Square Corporation recognize in calculating its income tax provision in the current year

What amount of the tax benefit related to the uncertain tax position from the DPAD can Cadillac Square Corporation recognize in calculating its income tax provision in the current year

What amount of the tax benefit related to the uncertain tax position from the DPAD can Cadillac Square Corporation recognize in calculating its income tax provision in the current yearExplanation

Income Tax:

Income tax means tax on inc...

McGraw-Hill's Taxation of Business Entities 3rd Edition by Connie Weaver, Brian Spilker, Edmund Outslay, John Robinson, Ronald Worsham, Benjamin Ayers, John Barrick

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255