McGraw-Hill's Taxation of Business Entities 3rd Edition by Connie Weaver, Brian Spilker, Edmund Outslay, John Robinson, Ronald Worsham, Benjamin Ayers, John Barrick

Edition 3ISBN: 9780077924522

McGraw-Hill's Taxation of Business Entities 3rd Edition by Connie Weaver, Brian Spilker, Edmund Outslay, John Robinson, Ronald Worsham, Benjamin Ayers, John Barrick

Edition 3ISBN: 9780077924522 Exercise 35

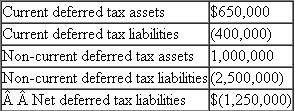

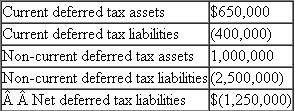

Beacon Corporation recorded the following deferred tax assets and liabilities:

All of the deferred tax accounts relate to temporary differences that arose as a result of the company's U.S. operations. Which of the following statements describes how Beacon should disclose these accounts on its balance sheet

All of the deferred tax accounts relate to temporary differences that arose as a result of the company's U.S. operations. Which of the following statements describes how Beacon should disclose these accounts on its balance sheet

A. Beacon reports a net deferred tax liability of $1,250,000 on its balance sheet

B. Beacon nets the deferred tax assets and the deferred tax liabilities and reports a net deferred tax asset of $1,650,000 and a net deferred tax liability of $2,900,000 on its balance sheet.

C. Beacon can elect to net the current deferred tax accounts and the non-current tax accounts and report a net current deferred tax asset of $250,000 and a net deferred tax liability of $1,500,000 on its balance sheet.

D. Beacon is required to net the current deferred tax accounts and the non-current tax accounts and report a net current deferred tax asset of $250,000 and a net deferred tax liability of $1,500,000 on its balance sheet.

All of the deferred tax accounts relate to temporary differences that arose as a result of the company's U.S. operations. Which of the following statements describes how Beacon should disclose these accounts on its balance sheet

All of the deferred tax accounts relate to temporary differences that arose as a result of the company's U.S. operations. Which of the following statements describes how Beacon should disclose these accounts on its balance sheet A. Beacon reports a net deferred tax liability of $1,250,000 on its balance sheet

B. Beacon nets the deferred tax assets and the deferred tax liabilities and reports a net deferred tax asset of $1,650,000 and a net deferred tax liability of $2,900,000 on its balance sheet.

C. Beacon can elect to net the current deferred tax accounts and the non-current tax accounts and report a net current deferred tax asset of $250,000 and a net deferred tax liability of $1,500,000 on its balance sheet.

D. Beacon is required to net the current deferred tax accounts and the non-current tax accounts and report a net current deferred tax asset of $250,000 and a net deferred tax liability of $1,500,000 on its balance sheet.

Explanation

Income Tax:

Income tax means tax on inc...

McGraw-Hill's Taxation of Business Entities 3rd Edition by Connie Weaver, Brian Spilker, Edmund Outslay, John Robinson, Ronald Worsham, Benjamin Ayers, John Barrick

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255