McGraw-Hill's Taxation of Business Entities 3rd Edition by Connie Weaver, Brian Spilker, Edmund Outslay, John Robinson, Ronald Worsham, Benjamin Ayers, John Barrick

Edition 3ISBN: 9780077924522

McGraw-Hill's Taxation of Business Entities 3rd Edition by Connie Weaver, Brian Spilker, Edmund Outslay, John Robinson, Ronald Worsham, Benjamin Ayers, John Barrick

Edition 3ISBN: 9780077924522 Exercise 39

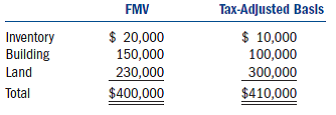

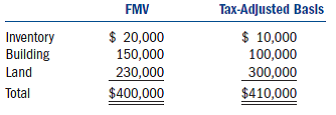

Zhang incorporated her sole proprietorship by transferring inventory, a building, and land to the corporation in return for 100 percent of the corporation's stock. The property transferred to the corporation had the following fair market values and tax-adjusted bases:

The corporation also assumed a mortgage of $100,000 attached to the building and land. The fair market value of the corporation's stock received in the exchange was $300,000. The transaction met the requirements to be tax-deferred under §351.

a. What amount of gain or loss does Zhang realize on the transfer of the property to her corporation

b. What amount of gain or loss does Zhang recognize on the transfer of the property to her corporation

c. What is Zhang's tax basis in the stock she receives in the exchange

d. What is the corporation's tax-adjusted basis in each of the assets received in the exchange

Assume the corporation assumed a mortgage of $500,000 attached to the building and land. Assume the fair market value of the building is now $250,000 and the fair market value of the land is $530,000. The fair market value of the stock remains $300,000.

e. How much, if any, gain or loss does Zhang recognize on the exchange assuming the revised facts

f. What is Zhang's tax basis in the stock she receives in the exchange

g. What is the corporation's tax-adjusted basis in each of the assets received in the exchange

The corporation also assumed a mortgage of $100,000 attached to the building and land. The fair market value of the corporation's stock received in the exchange was $300,000. The transaction met the requirements to be tax-deferred under §351.

a. What amount of gain or loss does Zhang realize on the transfer of the property to her corporation

b. What amount of gain or loss does Zhang recognize on the transfer of the property to her corporation

c. What is Zhang's tax basis in the stock she receives in the exchange

d. What is the corporation's tax-adjusted basis in each of the assets received in the exchange

Assume the corporation assumed a mortgage of $500,000 attached to the building and land. Assume the fair market value of the building is now $250,000 and the fair market value of the land is $530,000. The fair market value of the stock remains $300,000.

e. How much, if any, gain or loss does Zhang recognize on the exchange assuming the revised facts

f. What is Zhang's tax basis in the stock she receives in the exchange

g. What is the corporation's tax-adjusted basis in each of the assets received in the exchange

Explanation

Mortgage is a legal agreement through th...

McGraw-Hill's Taxation of Business Entities 3rd Edition by Connie Weaver, Brian Spilker, Edmund Outslay, John Robinson, Ronald Worsham, Benjamin Ayers, John Barrick

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255