McGraw-Hill's Taxation of Business Entities 3rd Edition by Connie Weaver, Brian Spilker, Edmund Outslay, John Robinson, Ronald Worsham, Benjamin Ayers, John Barrick

Edition 3ISBN: 9780077924522

McGraw-Hill's Taxation of Business Entities 3rd Edition by Connie Weaver, Brian Spilker, Edmund Outslay, John Robinson, Ronald Worsham, Benjamin Ayers, John Barrick

Edition 3ISBN: 9780077924522 Exercise 34

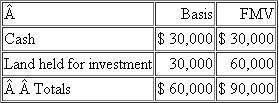

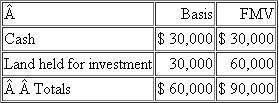

Allison, Keesha, and Steven each own equal interests in KAS partnership, a calendar year-end, cash-method entity. On January 1 of the current year, Steven's basis in his partnership interest is $27,000. During January and February, the partnership generates $30,000 of ordinary income and $4,500 of tax exempt income. On March 1, Steven sells his partnership interest to Juan for a cash payment of $45,000. The partnership has the following assets and no liabilities at the sale date:

a. Assuming KAS's operating agreement provides for an interim closing of the books when partners' interests change during the year, what is Steven's basis in his partnership interest on March 1 just prior to the sale

a. Assuming KAS's operating agreement provides for an interim closing of the books when partners' interests change during the year, what is Steven's basis in his partnership interest on March 1 just prior to the sale

b. What is the amount and character of Steven's recognized gain or loss on the sale

c. What is Juan's basis in the partnership interest

d. What is the partnership's basis in the assets following the sale

a. Assuming KAS's operating agreement provides for an interim closing of the books when partners' interests change during the year, what is Steven's basis in his partnership interest on March 1 just prior to the sale

a. Assuming KAS's operating agreement provides for an interim closing of the books when partners' interests change during the year, what is Steven's basis in his partnership interest on March 1 just prior to the sale b. What is the amount and character of Steven's recognized gain or loss on the sale

c. What is Juan's basis in the partnership interest

d. What is the partnership's basis in the assets following the sale

Explanation

Inside Outside Basis Partnership

Outsid...

McGraw-Hill's Taxation of Business Entities 3rd Edition by Connie Weaver, Brian Spilker, Edmund Outslay, John Robinson, Ronald Worsham, Benjamin Ayers, John Barrick

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255