McGraw-Hill's Taxation of Business Entities 3rd Edition by Connie Weaver, Brian Spilker, Edmund Outslay, John Robinson, Ronald Worsham, Benjamin Ayers, John Barrick

Edition 3ISBN: 9780077924522

McGraw-Hill's Taxation of Business Entities 3rd Edition by Connie Weaver, Brian Spilker, Edmund Outslay, John Robinson, Ronald Worsham, Benjamin Ayers, John Barrick

Edition 3ISBN: 9780077924522 Exercise 45

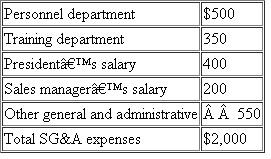

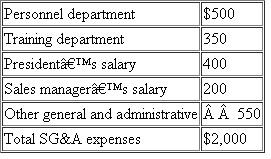

Falmouth Kettle Company, a U.S. corporation, sells its products in the United States and Europe. During 2011, selling, general, and administrative (SG A) expenses included:

Falmouth had $12,000 of gross sales to U.S. customers and $3,000 of gross sales to European customers. Gross profit (sales minus cost of goods sold) from domestic sales was $3,000 and gross profit from foreign sales was $1,000. ApportionFalmouth's's SG A expenses to foreign source income using the following methods:

Falmouth had $12,000 of gross sales to U.S. customers and $3,000 of gross sales to European customers. Gross profit (sales minus cost of goods sold) from domestic sales was $3,000 and gross profit from foreign sales was $1,000. ApportionFalmouth's's SG A expenses to foreign source income using the following methods:

a. Gross sales.

b. Gross income.

c. If Falmouth wants to maximize its foreign tax credit limitation, whichmethod produces the better outcome

Falmouth had $12,000 of gross sales to U.S. customers and $3,000 of gross sales to European customers. Gross profit (sales minus cost of goods sold) from domestic sales was $3,000 and gross profit from foreign sales was $1,000. ApportionFalmouth's's SG A expenses to foreign source income using the following methods:

Falmouth had $12,000 of gross sales to U.S. customers and $3,000 of gross sales to European customers. Gross profit (sales minus cost of goods sold) from domestic sales was $3,000 and gross profit from foreign sales was $1,000. ApportionFalmouth's's SG A expenses to foreign source income using the following methods:a. Gross sales.

b. Gross income.

c. If Falmouth wants to maximize its foreign tax credit limitation, whichmethod produces the better outcome

Explanation

Foreign tax credit

Foreign tax credit c...

McGraw-Hill's Taxation of Business Entities 3rd Edition by Connie Weaver, Brian Spilker, Edmund Outslay, John Robinson, Ronald Worsham, Benjamin Ayers, John Barrick

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255