Basics of Engineering Economy 1st Edition by Leland Blank,Anthony Tarquin

Edition 1ISBN: 9780073401294

Basics of Engineering Economy 1st Edition by Leland Blank,Anthony Tarquin

Edition 1ISBN: 9780073401294 Exercise 7

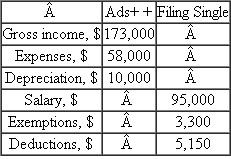

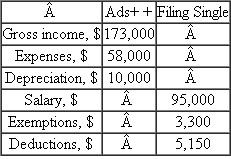

CJ operates Ads + +, a legally registered Internet ad business.Assume he can file his federal income tax return as a small corporation or as a single individual.The GI of $73,000 is for Ads + + as a corporation, while the $5,000 salary is the amount CJ paid himself.(The excess of $0,000 between GI - E = $15,000 and CJ's salary is called retained earnings for Ads + +.Appendix B describes accounting reports.)

CJ estimates an effective federal tax rate of T e = 25% regardless of the method used to calculate taxes.For both methods of filing, determine (a) the estimated taxes using T e and ( b ) taxes using the tax rate tables.Which method results in lower taxes for CJ?

CJ estimates an effective federal tax rate of T e = 25% regardless of the method used to calculate taxes.For both methods of filing, determine (a) the estimated taxes using T e and ( b ) taxes using the tax rate tables.Which method results in lower taxes for CJ?

Explanation

Taxable income for corporation is determ...

Basics of Engineering Economy 1st Edition by Leland Blank,Anthony Tarquin

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255