McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

Edition 3ISBN: 9780078111068

McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

Edition 3ISBN: 9780078111068 Exercise 11

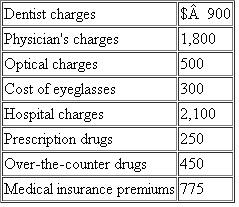

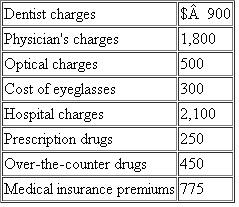

Simpson is a single individual who is employed full-time by Duff Corporation.This year Simpson reports AGI of $50,000 and has incurred the following medical expenses:  a.Calculate the amount of medical expenses that will be included with Simpson's itemized deductions after any applicable limitations.

a.Calculate the amount of medical expenses that will be included with Simpson's itemized deductions after any applicable limitations.

b.Suppose that Simpson was reimbursed for $650 of the physician's charges and $1,200 for the hospital costs.Calculate the amount of medical expenses that will be included with Simpson's itemized deductions after any applicable limitations

a.Calculate the amount of medical expenses that will be included with Simpson's itemized deductions after any applicable limitations.

a.Calculate the amount of medical expenses that will be included with Simpson's itemized deductions after any applicable limitations.b.Suppose that Simpson was reimbursed for $650 of the physician's charges and $1,200 for the hospital costs.Calculate the amount of medical expenses that will be included with Simpson's itemized deductions after any applicable limitations

Explanation

Medical Expenses

The medical expenses d...

McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255