McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

Edition 3ISBN: 9780078111068

McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

Edition 3ISBN: 9780078111068 Exercise 16

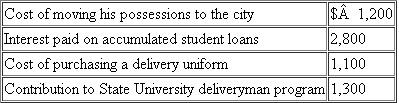

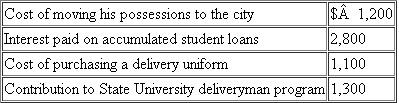

Evan graduated form college,and took a job as a deliveryman in the city.Evan was paid a salary of $63,00 and he received $700 in hourly pay for part-time work over the weekends.Evan summarized his expenses below.  Calculate Evan's AGI and taxable income if he files single with one personal exemption.

Calculate Evan's AGI and taxable income if he files single with one personal exemption.

Calculate Evan's AGI and taxable income if he files single with one personal exemption.

Calculate Evan's AGI and taxable income if he files single with one personal exemption.Explanation

Adjusted gross income and taxable income...

McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255