McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

Edition 3ISBN: 9780078111068

McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

Edition 3ISBN: 9780078111068 Exercise 33

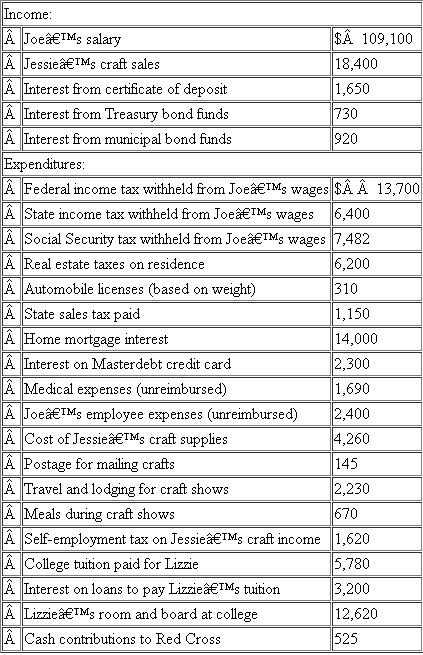

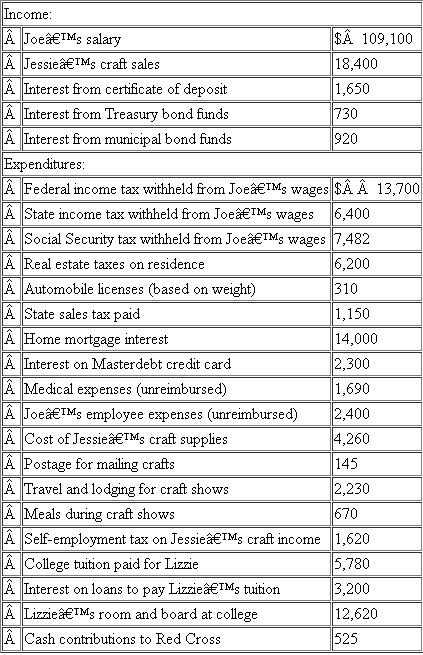

Joe and Jessie are married and have one dependent child, Lizzie.Lizzie is currently in college at State University.Joe works as a design engineer for a manufacturing firm while Jessie runs a craft business from their home.Jessie's craft business consists of making craft items for sale at craft shows that are held periodically at various locations.Jessie spends considerable time and effort on her craft business and it has been consistently profitable over the years.Joe and Jessie own a home and pay interest on their home loan (balance of $220,000) and a personal loan to pay for Lizzie's college expenses (balance of $35,000).

?Neither Joe nor Jessie is blind or over age 65, and they plan to file as married-joint.Based on their estimates, determine Joe and Jessie's AGI and taxable income for the year.They have summarized the income and expenses they expect to report this year as follows:

?Neither Joe nor Jessie is blind or over age 65, and they plan to file as married-joint.Based on their estimates, determine Joe and Jessie's AGI and taxable income for the year.They have summarized the income and expenses they expect to report this year as follows:

Explanation

Neither Joe nor Jessie is blind or over ...

McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255