McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

Edition 3ISBN: 9780078111068

McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

Edition 3ISBN: 9780078111068 Exercise 17

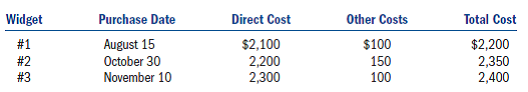

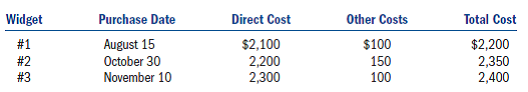

Suppose that David adopted the last-in, first-out (LIFO) inventory-flow method for his business inventory of widgets (purchase prices below).

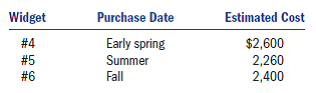

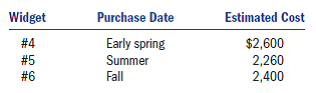

In late December, David sold widget #2 and next year David expects to purchase three more widgets at the following estimated prices:

a.What cost of goods sold and ending inventory would David record if he elects to use the LIFO method this year?

b.If David sells two widgets next year, what will be his cost of goods sold and ending inventory next year under the LIFO method?

c.How would you answer (a) and (b) if David had initially selected the first-in, first-out (FIFO) method instead of LIFO?

d.Suppose that David initially adopted the LIFO method, but wants to apply for a change to FIFO next year.What would be his §481 adjustment for this change, and in what year(s) would he make the adjustment?

In late December, David sold widget #2 and next year David expects to purchase three more widgets at the following estimated prices:

a.What cost of goods sold and ending inventory would David record if he elects to use the LIFO method this year?

b.If David sells two widgets next year, what will be his cost of goods sold and ending inventory next year under the LIFO method?

c.How would you answer (a) and (b) if David had initially selected the first-in, first-out (FIFO) method instead of LIFO?

d.Suppose that David initially adopted the LIFO method, but wants to apply for a change to FIFO next year.What would be his §481 adjustment for this change, and in what year(s) would he make the adjustment?

Explanation

Last-in-first-out:

• Last-in-first-out ...

McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255