McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

Edition 3ISBN: 9780078111068

McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

Edition 3ISBN: 9780078111068 Exercise 11

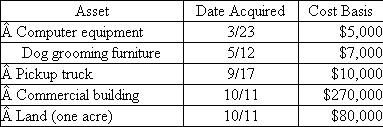

At the beginning of the year, Poplock began a calendar-year dog boarding business called Griff's Palace.Poplock bought and placed in service the following assets during the year:  Assuming Poplock does not elect §179 expensing or bonus depreciation, answer the following questions:

Assuming Poplock does not elect §179 expensing or bonus depreciation, answer the following questions:

What is Poplock's year 1 depreciation expense for each asset? What is Poplock's year 2 depreciation expense for each asset?

Assuming Poplock does not elect §179 expensing or bonus depreciation, answer the following questions:

Assuming Poplock does not elect §179 expensing or bonus depreciation, answer the following questions:What is Poplock's year 1 depreciation expense for each asset? What is Poplock's year 2 depreciation expense for each asset?

Explanation

Cost Recovery

The cost of an asset is r...

McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255