McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

Edition 3ISBN: 9780078111068

McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

Edition 3ISBN: 9780078111068 Exercise 16

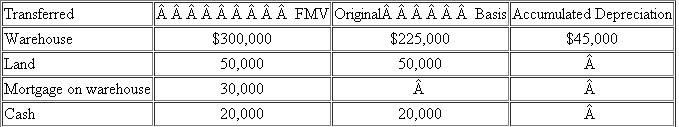

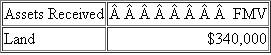

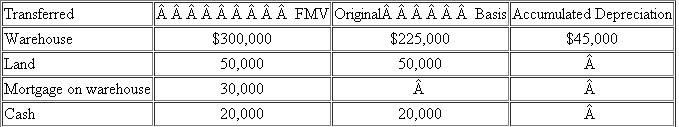

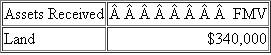

Prater Inc.enters into an exchange in which it gives up its warehouse on 10 acres of land and receives a tract of land.A summary of the exchange is as follows:

What is Prater's realized and recognized gain on the exchange and its basis in the assets it received in the exchange?

What is Prater's realized and recognized gain on the exchange and its basis in the assets it received in the exchange?

What is Prater's realized and recognized gain on the exchange and its basis in the assets it received in the exchange?

What is Prater's realized and recognized gain on the exchange and its basis in the assets it received in the exchange?Explanation

Like-kind exchange

It is a tax deferred...

McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255