McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

Edition 3ISBN: 9780078111068

McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

Edition 3ISBN: 9780078111068 Exercise 44

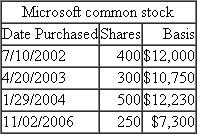

Dahlia is in the 28 percent tax rate bracket and has purchased the following shares of Microsoft common stock over the years:  If Dahlia sells 800 shares of Microsoft for $40,000 on December 20, 2011, what is her capital gain or loss in each of the following assumptions?

If Dahlia sells 800 shares of Microsoft for $40,000 on December 20, 2011, what is her capital gain or loss in each of the following assumptions?

a.She uses the FIFO method.b.She uses the specific identification method and she wants to minimize her current year capital gain.

If Dahlia sells 800 shares of Microsoft for $40,000 on December 20, 2011, what is her capital gain or loss in each of the following assumptions?

If Dahlia sells 800 shares of Microsoft for $40,000 on December 20, 2011, what is her capital gain or loss in each of the following assumptions?a.She uses the FIFO method.b.She uses the specific identification method and she wants to minimize her current year capital gain.

Explanation

Capital gains and losses

When investors...

McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255