McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

Edition 3ISBN: 9780078111068

McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

Edition 3ISBN: 9780078111068 Exercise 47

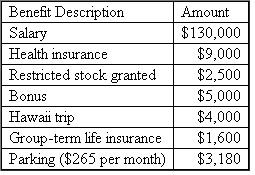

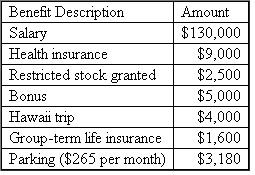

Santini's new contract for 2011 indicates the following compensation and benefits:  Santini is 54 years old at the end of 2011.He is single and has no dependents.The restricted stock grant is 500 shares granted when the market price was $5 per share.Assume that the stock vests on December 31, 2011, and that the market price on that date is $7.0 per share.Also assume that Santini is willing to make any elections to reduce equity-based compensation taxes.The Hawaii trip was given to him as the outstanding sales person for2011.The group-term life policy gives him $150,000 of coverage.Assume that Santini does not itemize deductions for the year.Determine Santini's taxable income and income tax liability for 2011.

Santini is 54 years old at the end of 2011.He is single and has no dependents.The restricted stock grant is 500 shares granted when the market price was $5 per share.Assume that the stock vests on December 31, 2011, and that the market price on that date is $7.0 per share.Also assume that Santini is willing to make any elections to reduce equity-based compensation taxes.The Hawaii trip was given to him as the outstanding sales person for2011.The group-term life policy gives him $150,000 of coverage.Assume that Santini does not itemize deductions for the year.Determine Santini's taxable income and income tax liability for 2011.

Santini is 54 years old at the end of 2011.He is single and has no dependents.The restricted stock grant is 500 shares granted when the market price was $5 per share.Assume that the stock vests on December 31, 2011, and that the market price on that date is $7.0 per share.Also assume that Santini is willing to make any elections to reduce equity-based compensation taxes.The Hawaii trip was given to him as the outstanding sales person for2011.The group-term life policy gives him $150,000 of coverage.Assume that Santini does not itemize deductions for the year.Determine Santini's taxable income and income tax liability for 2011.

Santini is 54 years old at the end of 2011.He is single and has no dependents.The restricted stock grant is 500 shares granted when the market price was $5 per share.Assume that the stock vests on December 31, 2011, and that the market price on that date is $7.0 per share.Also assume that Santini is willing to make any elections to reduce equity-based compensation taxes.The Hawaii trip was given to him as the outstanding sales person for2011.The group-term life policy gives him $150,000 of coverage.Assume that Santini does not itemize deductions for the year.Determine Santini's taxable income and income tax liability for 2011.Explanation

Santini's taxable income is $1...

McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255