McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

Edition 3ISBN: 9780078111068

McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

Edition 3ISBN: 9780078111068 Exercise 51

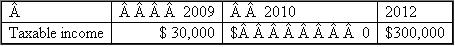

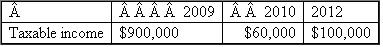

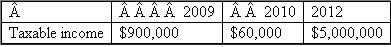

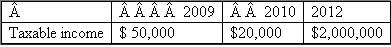

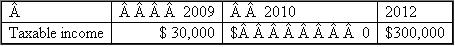

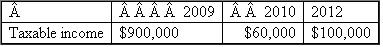

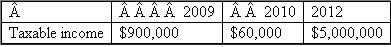

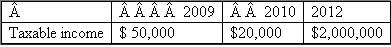

{Planning} WCC, Inc.has a current year (2011) net operating loss of $100,000.It is trying to determine whether it should carry back the loss or whether it should elect to forgo the carryback.How would you advise WCC in each of the following alternative situations (ignore time value of money in your computations).

a. b.

b.  c.

c.  d.

d.

a.

b.

b.  c.

c.  d.

d.

Explanation

Case Fact :

When a business organization...

McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255