McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

Edition 3ISBN: 9780078111068

McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

Edition 3ISBN: 9780078111068 Exercise 30

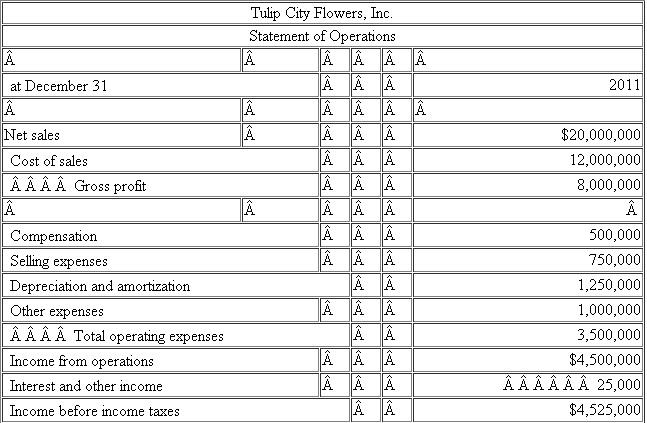

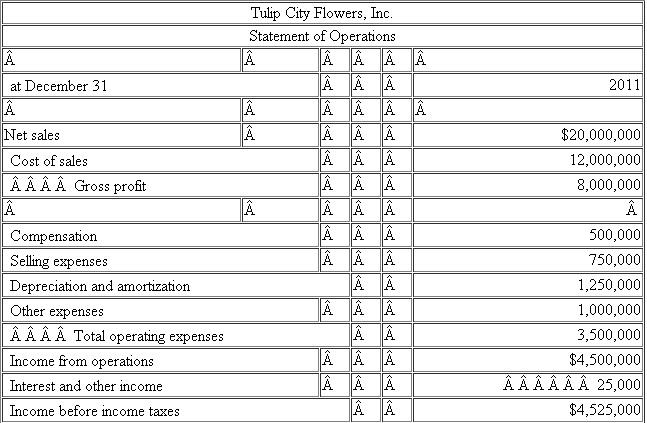

You have been assigned to compute the income tax provision for Tulip City Flowers, Inc.(TCF) as of December 31, 2011.The Company's federal income tax rate is 34%.The Company's Income Statement for 2011 is provided below:  You have identified the following permanent differences:

You have identified the following permanent differences:

Interest income from municipal bonds: $10,000

Nondeductible stock compensation: $5,000

Domestic production activities deduction: $8,000

Nondeductible fines: $1,000

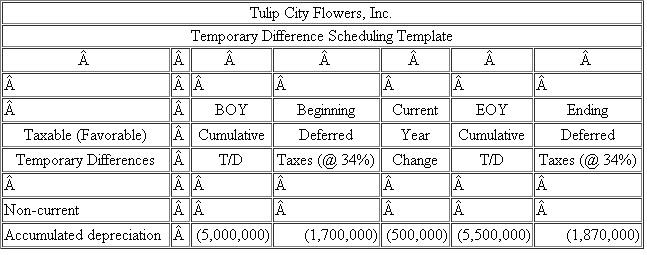

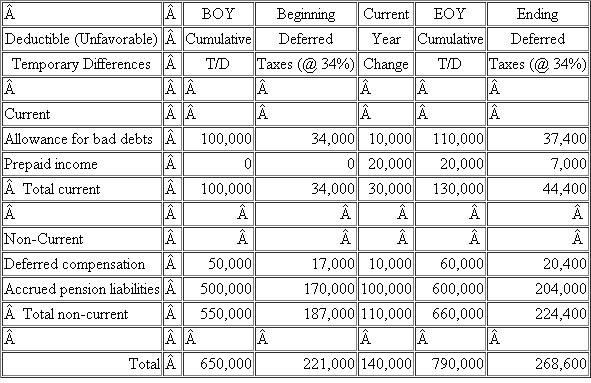

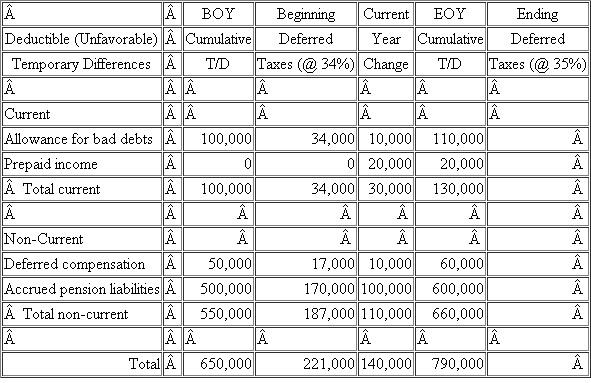

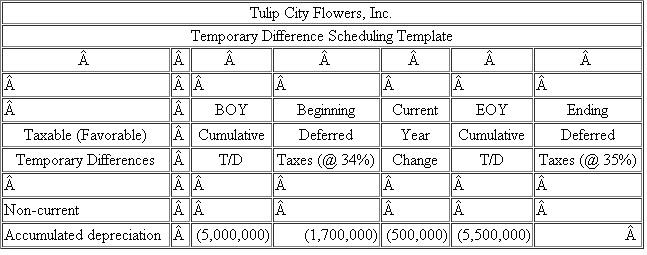

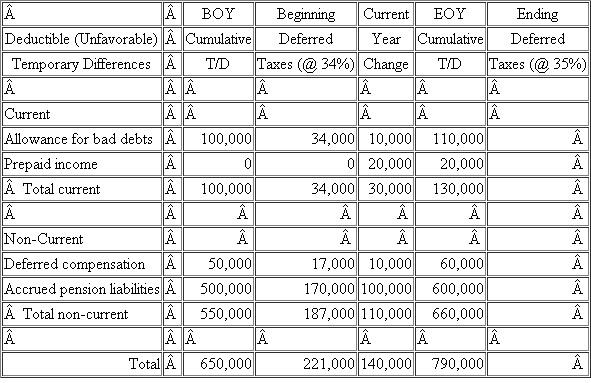

TCF prepared the following schedule of temporary differences from the beginning of the year to the end of the year:

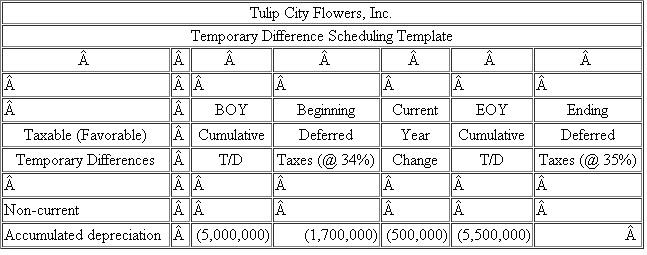

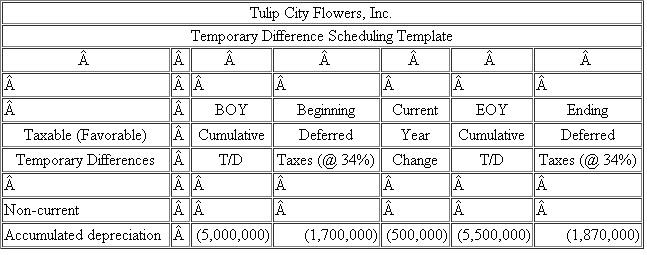

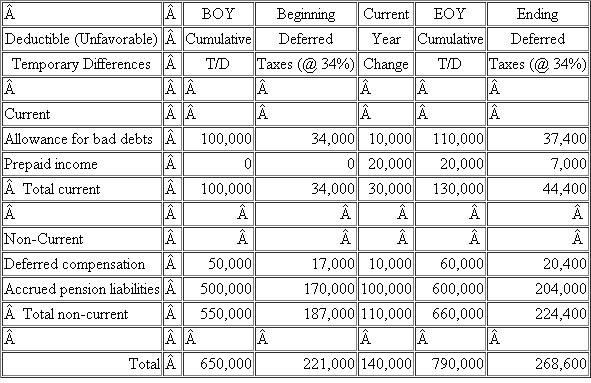

a.Compute TCF's current income tax expense or benefit for 2011.b.Compute TCF's deferred income tax expense or benefit for 2011.c.Prepare a reconciliation of TCF's total income tax provision with its hypothetical income tax expense in both dollars and rates.d.Assume TCF's tax rate increased to 35% in 2011.Recompute TCF's deferred income tax expense or benefit for 2011 using the following template:

a.Compute TCF's current income tax expense or benefit for 2011.b.Compute TCF's deferred income tax expense or benefit for 2011.c.Prepare a reconciliation of TCF's total income tax provision with its hypothetical income tax expense in both dollars and rates.d.Assume TCF's tax rate increased to 35% in 2011.Recompute TCF's deferred income tax expense or benefit for 2011 using the following template:

You have identified the following permanent differences:

You have identified the following permanent differences:Interest income from municipal bonds: $10,000

Nondeductible stock compensation: $5,000

Domestic production activities deduction: $8,000

Nondeductible fines: $1,000

TCF prepared the following schedule of temporary differences from the beginning of the year to the end of the year:

a.Compute TCF's current income tax expense or benefit for 2011.b.Compute TCF's deferred income tax expense or benefit for 2011.c.Prepare a reconciliation of TCF's total income tax provision with its hypothetical income tax expense in both dollars and rates.d.Assume TCF's tax rate increased to 35% in 2011.Recompute TCF's deferred income tax expense or benefit for 2011 using the following template:

a.Compute TCF's current income tax expense or benefit for 2011.b.Compute TCF's deferred income tax expense or benefit for 2011.c.Prepare a reconciliation of TCF's total income tax provision with its hypothetical income tax expense in both dollars and rates.d.Assume TCF's tax rate increased to 35% in 2011.Recompute TCF's deferred income tax expense or benefit for 2011 using the following template:

Explanation

McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255