McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

Edition 3ISBN: 9780078111068

McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

Edition 3ISBN: 9780078111068 Exercise 26

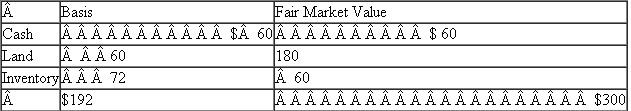

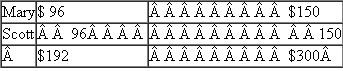

Mary and Scott formed a partnership that maintains its records on a calendar-year basis.The balance sheet of the MS Partnership at year-end is as follows

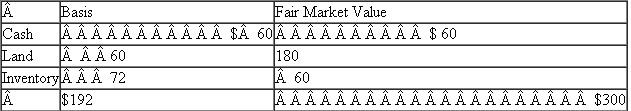

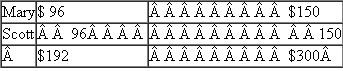

At the end of the current year, Kari will receive a one-third capital interest only in exchange for services rendered.Kari's interest will not be subject to a substantial risk of forfeiture and the costs for the type of services she provided are typically not capitalized by the partnership.For the current year, the income and expenses from operations are equal.Consequently, the only tax consequences for the year are those relating to the admission of Kari to the partnership.a.Compute and characterize any gain or loss Kari may have to recognize as a result of her admission to the partnership.b.Compute Kari's basis in her partnership interest.

c.Prepare a balance sheet of the partnership immediately after Kari's admission showing the partners' tax capital accounts and capital accounts stated at fair market value.d.Calculate how much gain or loss Kari would have to recognize if, instead of a capital interest, she only received a profits interest.

At the end of the current year, Kari will receive a one-third capital interest only in exchange for services rendered.Kari's interest will not be subject to a substantial risk of forfeiture and the costs for the type of services she provided are typically not capitalized by the partnership.For the current year, the income and expenses from operations are equal.Consequently, the only tax consequences for the year are those relating to the admission of Kari to the partnership.a.Compute and characterize any gain or loss Kari may have to recognize as a result of her admission to the partnership.b.Compute Kari's basis in her partnership interest.

c.Prepare a balance sheet of the partnership immediately after Kari's admission showing the partners' tax capital accounts and capital accounts stated at fair market value.d.Calculate how much gain or loss Kari would have to recognize if, instead of a capital interest, she only received a profits interest.

Explanation

a)Kari has received a capital interest i...

McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255