McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

Edition 3ISBN: 9780078111068

McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

Edition 3ISBN: 9780078111068 Exercise 14

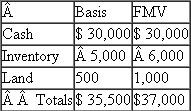

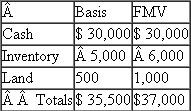

Megan and Matthew are equal partners in the J J partnership (calendar-year-end entity).On January 1 of the current year, they decide to liquidate the partnership.Megan's basis in her partnership interest is $100,000 and Matthew's is $35,000.The two partners receive identical distributions with each receiving the following assets:  ?a.What is the amount and character of Megan's recognized gain or loss?

?a.What is the amount and character of Megan's recognized gain or loss?

?b.What is Megan's basis in the distributed assets?

?c.What is the amount and character of Matthew's recognized gain or loss?

?d.What is Matthew's basis in the distributed assets?

?a.What is the amount and character of Megan's recognized gain or loss?

?a.What is the amount and character of Megan's recognized gain or loss??b.What is Megan's basis in the distributed assets?

?c.What is the amount and character of Matthew's recognized gain or loss?

?d.What is Matthew's basis in the distributed assets?

Explanation

In the current scenario of J J Partnersh...

McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255