McGraw-Hill's Taxation of Individuals 3rd Edition by Brian Spilker,Benjamin Ayers,John Robinson,Edmund Outslay ,Ronald Worsham,John Barrick,Connie Weaver

Edition 3ISBN: 978-0077328368

McGraw-Hill's Taxation of Individuals 3rd Edition by Brian Spilker,Benjamin Ayers,John Robinson,Edmund Outslay ,Ronald Worsham,John Barrick,Connie Weaver

Edition 3ISBN: 978-0077328368 Exercise 15

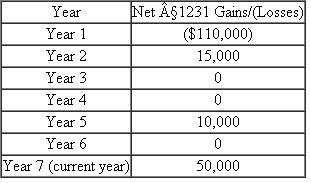

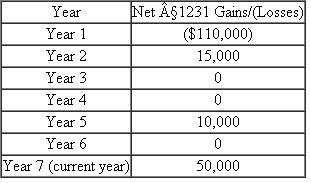

Han runs a sole proprietorship.Hans reported the following net §1231 gains and losses since he began business:

a.What amount, if any, of the year 7 (current year) $50,000 net §1231 gain is treated as ordinary income

a.What amount, if any, of the year 7 (current year) $50,000 net §1231 gain is treated as ordinary income

b.Assume that the $50,000 net §1231 gain occurs in year 6 instead of year 7.What amount of the gain would be treated as ordinary income in year 6

a.What amount, if any, of the year 7 (current year) $50,000 net §1231 gain is treated as ordinary income

a.What amount, if any, of the year 7 (current year) $50,000 net §1231 gain is treated as ordinary incomeb.Assume that the $50,000 net §1231 gain occurs in year 6 instead of year 7.What amount of the gain would be treated as ordinary income in year 6

Explanation

Section 1231 look-back rule

Section 123...

McGraw-Hill's Taxation of Individuals 3rd Edition by Brian Spilker,Benjamin Ayers,John Robinson,Edmund Outslay ,Ronald Worsham,John Barrick,Connie Weaver

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255