Business & Professional Ethics 7th Edition by Leonard Brooks,Paul Dunn

Edition 7ISBN: 978-1285182223

Business & Professional Ethics 7th Edition by Leonard Brooks,Paul Dunn

Edition 7ISBN: 978-1285182223 Exercise 43

In June 2002, Martha Stewart began to wrestle with allegations that she had improperly used inside information to sell a stock investment to an unsuspecting investing public. That was when her personal friend Sam Waksal was defending himself against Securities and Exchange Commission (SEC) allegations that he had tipped off his family members so they could sell their shares of ImClone Systems Inc. (ImClone) just before other investors learned that ImClone's fortunes were about to take a dive. Observers presumed that Martha was also tipped off and, even though she proclaimed her innocence, the rumors would not go away.

On TV daily as the reigning guru of homemaking, Martha is the multimillionaire proprietor, president, and driving force of Martha Stewart Living Omnimedia Inc. (MSO), of which, on March 18, 2002, she owned 30,713,475 (62.6 percent) of the class A, and 30,619,375 (100 percent) of the class B shares. On December 27, 2001, Martha's class A and class B shares were worth approximately $17 each, so on paper Martha's MSO class A shares alone were worth over $500 million. Class B shares are convertible into class A shares on a oneto- one basis.

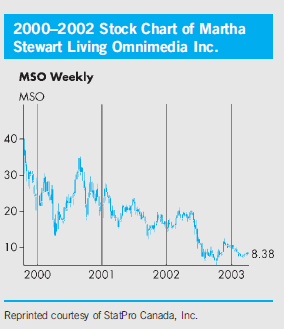

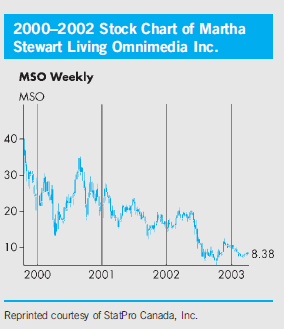

Martha's personal life became public. The world did not know that Martha Stewart had sold 3,928 shares of ImClone for $58 each on December 27, 2001,until it surfaced in June 2002. The sale generated only $227,824 for Martha, and she avoided losing $45,673 when the stock price dropped the next day, but it has caused her endless personal grief and humiliation, and the loss of reputation, as well as a significant drop to $5.26 in the MSO share price.

What Happened?

Martha had made an investment in ImClone, a company that was trying to get the approval of the U.S. Food and Drug Administration (FDA) to bring to market an anti-colon cancer drug called Erbitux. Samuel Waksal, then the CEO of ImClone and a personal friend of Martha's, was apparently warned on or close to December 25, 2001, that the FDA was going to refuse5 to review Erbitux. According to SEC allegations, Sam relayed the information to his family so they could dump their ImClone shares on an unsuspecting public before the official announcement. Martha claims that she didn't get any inside information early from Sam, but regulators believe that she may have or from her broker or her broker's aide. The activities of several of Sam's friends, including Martha, are under investigation by the SEC.

Sam was arrested on June 12, 2002, and charged with "nine criminal counts of conspiracy, securities fraud and perjury, and then freed on $10 million bail." In a related civil complaint, the SEC alleged that Sam "tried to sell ImClone stock and tipped family members before ImClone's official FDA announcement on Dec. 28."

According to the SEC, two unidentified members of Sam's family sold about $10 million worth of ImClone stock in a twoday interval just before the announcement. Moreover, Sam also tried for two days to sell nearly 80,000 ImClone shares for about $5 million, but two different brokers refused to process the trades.

Martha has denied any wrongdoing. She was quoted as saying: "In placing my trade I had no improper information…. My transaction was entirely lawful." She admitted calling Sam after selling her shares, but claimed: "I did not reach Mr. Waksal, and he did not return my call." She maintained that she had an agreement with her broker to sell her remaining ImClone shares "if the stock dropped below $60 per share."

Martha's public, however, was skeptical. She was asked embarrassing questions when she appeared on TV for a cooking segment, and she declined to answer saying: "I am here to make my salad." Martha's interactions with her broker, Peter Bacanovic, and his assistant, Douglas Faneuil, are also being scrutinized. Merrill Lynch Co. suspended Bacanovic (who was also Sam Waksal's broker) and Faneuil, with pay, in late June. Later, since all phone calls to brokerages are taped and emails kept, it appeared to be damning when Bacanovic initially refused to provide his cell phone records to the House Energy and Commerce Commission for their investigation. Moreover, on October 4, 2001, Faneuil "pleaded guilty to a charge that he accepted gifts from his superior in return for keeping quiet about circumstances surrounding Stewart's controversial stock sale." Faneuil admitted that he received extra vacation time, including a free airline ticket from a Merrill Lynch employee in exchange for withholding information from SEC and FBI investigators.

According to the Washington Post report of Faneuil's appearance in court:

On the morning of Dec. 27, Faneuil received a telephone call from a Waksal family member who asked to sell 39,472 shares for almost $2.5 million, according to court records. Waksal's accountant also called Faneuil in an unsuccessful attempt to sell a large bloc of shares, the records show. Prosecutors allege that those orders "constituted material non-public information." But they alleged that Faneuil violated his duty to Merrill Lynch by calling a "tippee" to relate that Waksal family members were attempting to liquidate their holdings in ImClone. That person then sold "all the Tippee's shares of ImClone stock, approximately 3,928 shares, yielding proceeds of approximately $228,000" the court papers said.

One day later, on October 5th, it was announced that Martha resigned from her post as a director of the New York Stock Exchange-a post she held only four months-and the price of MSO shares declined more than 7 percent to $6.32 in afternoon trading. From June 12th to October 12th, the share price of MSO had declined by approximately 61 percent.

Martha's future took a further interesting turn on October 15th, when Sam Waksal pleaded guilty to six counts of his indictment, including: bank fraud, securities fraud, conspiracy to obstruct justice, and perjury. But he did not agree to cooperate with prosecutors, and did not incriminate Martha. Waksal's sentencing was postponed until 2003 so his lawyers could exchange information with U.S. District Judge William Pauley concerning Waksal's financial records.

After October 15th, the price of MSO shares rose, perhaps as the prospect of Martha's going to jail appeared to become more remote, and/or people began to consider MSO to be more than just Martha and her reputation. The gain from the low point of the MSO share price in October to December 9, 2002, was about 40 percent.

Martha still had a lot to think about, however. Apparently the SEC gave Martha notice in September of its intent to file civil securities fraud charges against her. Martha's lawyers responded and the SEC deliberated. Even if Martha were to get off with a fine, prosecutors could still bring a criminal case against her in the future. It is an interesting legal question, how, if Martha were to plead guilty to the civil charges, she could avoid criminal liability.

On June 4, 2003, Stewart was indicted on charges of obstructing justice and securities fraud. She then quit as Chairman and CEO of her company, but stayed on the Board and served as Chief Creative Officer. She appeared in court on January 20, 2004, and watched the proceedings throughout her trial. In addition to the testimony of Mr. Faneuil, Stewart's personal friend Mariana Pasternak testified that Stewart told her Waksal was trying to dump his shares shortly after selling her Imclone stock.24 Ultimately, the jury did not believe the counterclaim by Peter Bacanovic, Stewart's broker, that he and Martha had a prior agreement to sell Imclone if it went below $60. Although Judge Cedarbaum dismissed the charge of securities fraud for insider trading, on March 5, 2004, the jury found Stewart guilty on one charge of conspiracy, one of obstruction of justice, and two of making false statements to investigators. 25 The announcement caused the share price of her company to sink by $2.77 to $11.26 on the NYSE.

Martha immediately posted the following on her website:

I am obviously distressed by the jury's verdict, but I continue to take comfort in knowing that I have done nothing wrong and that I have the enduring support of my family and friends. I will appeal the verdict and continue to fight to clear my name. I believe in the fairness of the judicial system and remain confident that I will ultimately prevail.

Martha was subsequently sentenced to 5 months in prison and 5 months of home detention-a lower than maximum sentence under the U.S. Sentencing Guidelines-and she did appeal. Although she could have remained free during the appeal, on September 15, 2004, she asked for her sentence to start so she could be at home in time for the spring planting season. Martha's appeal cited "prosecutorial misconduct, extraneous influences on the jury and erroneous evidentiary rulings and jury instructions" but on January 6, 2006, her conviction was upheld.

Impact on Reputation

Martha may still disagree with the verdict. But there is little doubt that the allegations and her convictions had a major impact on Martha personally, and on the fortunes of MSO and the other shareholders that had faith in her and her company. Assuming a value per share of $13.50 on June 12th, the decline to a low of $5.26 in early October 2003 represents a loss of market capitalization (i.e., reputation capital as defined by Charles Fombrun30) of approximately $250 million, or 61 percent. The value of MSO's shares did return to close at $35.51 on February 7, 2005,31 but fell off to under $20 in early 2006. According to a New York brand-rating company, Brand-Keys, the Martha Stewart brand reached a peak of 120 (the baseline is 100) in May 2002, and sank to a low of 63 in March 2004.

What will the future hold? Martha has returned to TV with a version of The Apprentice as well as her usual homemaking and design shows, and her products and magazines continue to be sold. Will Martha regain her earlier distinction? Would she do it again to avoid losing $45,673?

Questions

Why did MSO's stock price decline due to Martha Stewart's loss of reputation?

On TV daily as the reigning guru of homemaking, Martha is the multimillionaire proprietor, president, and driving force of Martha Stewart Living Omnimedia Inc. (MSO), of which, on March 18, 2002, she owned 30,713,475 (62.6 percent) of the class A, and 30,619,375 (100 percent) of the class B shares. On December 27, 2001, Martha's class A and class B shares were worth approximately $17 each, so on paper Martha's MSO class A shares alone were worth over $500 million. Class B shares are convertible into class A shares on a oneto- one basis.

Martha's personal life became public. The world did not know that Martha Stewart had sold 3,928 shares of ImClone for $58 each on December 27, 2001,until it surfaced in June 2002. The sale generated only $227,824 for Martha, and she avoided losing $45,673 when the stock price dropped the next day, but it has caused her endless personal grief and humiliation, and the loss of reputation, as well as a significant drop to $5.26 in the MSO share price.

What Happened?

Martha had made an investment in ImClone, a company that was trying to get the approval of the U.S. Food and Drug Administration (FDA) to bring to market an anti-colon cancer drug called Erbitux. Samuel Waksal, then the CEO of ImClone and a personal friend of Martha's, was apparently warned on or close to December 25, 2001, that the FDA was going to refuse5 to review Erbitux. According to SEC allegations, Sam relayed the information to his family so they could dump their ImClone shares on an unsuspecting public before the official announcement. Martha claims that she didn't get any inside information early from Sam, but regulators believe that she may have or from her broker or her broker's aide. The activities of several of Sam's friends, including Martha, are under investigation by the SEC.

Sam was arrested on June 12, 2002, and charged with "nine criminal counts of conspiracy, securities fraud and perjury, and then freed on $10 million bail." In a related civil complaint, the SEC alleged that Sam "tried to sell ImClone stock and tipped family members before ImClone's official FDA announcement on Dec. 28."

According to the SEC, two unidentified members of Sam's family sold about $10 million worth of ImClone stock in a twoday interval just before the announcement. Moreover, Sam also tried for two days to sell nearly 80,000 ImClone shares for about $5 million, but two different brokers refused to process the trades.

Martha has denied any wrongdoing. She was quoted as saying: "In placing my trade I had no improper information…. My transaction was entirely lawful." She admitted calling Sam after selling her shares, but claimed: "I did not reach Mr. Waksal, and he did not return my call." She maintained that she had an agreement with her broker to sell her remaining ImClone shares "if the stock dropped below $60 per share."

Martha's public, however, was skeptical. She was asked embarrassing questions when she appeared on TV for a cooking segment, and she declined to answer saying: "I am here to make my salad." Martha's interactions with her broker, Peter Bacanovic, and his assistant, Douglas Faneuil, are also being scrutinized. Merrill Lynch Co. suspended Bacanovic (who was also Sam Waksal's broker) and Faneuil, with pay, in late June. Later, since all phone calls to brokerages are taped and emails kept, it appeared to be damning when Bacanovic initially refused to provide his cell phone records to the House Energy and Commerce Commission for their investigation. Moreover, on October 4, 2001, Faneuil "pleaded guilty to a charge that he accepted gifts from his superior in return for keeping quiet about circumstances surrounding Stewart's controversial stock sale." Faneuil admitted that he received extra vacation time, including a free airline ticket from a Merrill Lynch employee in exchange for withholding information from SEC and FBI investigators.

According to the Washington Post report of Faneuil's appearance in court:

On the morning of Dec. 27, Faneuil received a telephone call from a Waksal family member who asked to sell 39,472 shares for almost $2.5 million, according to court records. Waksal's accountant also called Faneuil in an unsuccessful attempt to sell a large bloc of shares, the records show. Prosecutors allege that those orders "constituted material non-public information." But they alleged that Faneuil violated his duty to Merrill Lynch by calling a "tippee" to relate that Waksal family members were attempting to liquidate their holdings in ImClone. That person then sold "all the Tippee's shares of ImClone stock, approximately 3,928 shares, yielding proceeds of approximately $228,000" the court papers said.

One day later, on October 5th, it was announced that Martha resigned from her post as a director of the New York Stock Exchange-a post she held only four months-and the price of MSO shares declined more than 7 percent to $6.32 in afternoon trading. From June 12th to October 12th, the share price of MSO had declined by approximately 61 percent.

Martha's future took a further interesting turn on October 15th, when Sam Waksal pleaded guilty to six counts of his indictment, including: bank fraud, securities fraud, conspiracy to obstruct justice, and perjury. But he did not agree to cooperate with prosecutors, and did not incriminate Martha. Waksal's sentencing was postponed until 2003 so his lawyers could exchange information with U.S. District Judge William Pauley concerning Waksal's financial records.

After October 15th, the price of MSO shares rose, perhaps as the prospect of Martha's going to jail appeared to become more remote, and/or people began to consider MSO to be more than just Martha and her reputation. The gain from the low point of the MSO share price in October to December 9, 2002, was about 40 percent.

Martha still had a lot to think about, however. Apparently the SEC gave Martha notice in September of its intent to file civil securities fraud charges against her. Martha's lawyers responded and the SEC deliberated. Even if Martha were to get off with a fine, prosecutors could still bring a criminal case against her in the future. It is an interesting legal question, how, if Martha were to plead guilty to the civil charges, she could avoid criminal liability.

On June 4, 2003, Stewart was indicted on charges of obstructing justice and securities fraud. She then quit as Chairman and CEO of her company, but stayed on the Board and served as Chief Creative Officer. She appeared in court on January 20, 2004, and watched the proceedings throughout her trial. In addition to the testimony of Mr. Faneuil, Stewart's personal friend Mariana Pasternak testified that Stewart told her Waksal was trying to dump his shares shortly after selling her Imclone stock.24 Ultimately, the jury did not believe the counterclaim by Peter Bacanovic, Stewart's broker, that he and Martha had a prior agreement to sell Imclone if it went below $60. Although Judge Cedarbaum dismissed the charge of securities fraud for insider trading, on March 5, 2004, the jury found Stewart guilty on one charge of conspiracy, one of obstruction of justice, and two of making false statements to investigators. 25 The announcement caused the share price of her company to sink by $2.77 to $11.26 on the NYSE.

Martha immediately posted the following on her website:

I am obviously distressed by the jury's verdict, but I continue to take comfort in knowing that I have done nothing wrong and that I have the enduring support of my family and friends. I will appeal the verdict and continue to fight to clear my name. I believe in the fairness of the judicial system and remain confident that I will ultimately prevail.

Martha was subsequently sentenced to 5 months in prison and 5 months of home detention-a lower than maximum sentence under the U.S. Sentencing Guidelines-and she did appeal. Although she could have remained free during the appeal, on September 15, 2004, she asked for her sentence to start so she could be at home in time for the spring planting season. Martha's appeal cited "prosecutorial misconduct, extraneous influences on the jury and erroneous evidentiary rulings and jury instructions" but on January 6, 2006, her conviction was upheld.

Impact on Reputation

Martha may still disagree with the verdict. But there is little doubt that the allegations and her convictions had a major impact on Martha personally, and on the fortunes of MSO and the other shareholders that had faith in her and her company. Assuming a value per share of $13.50 on June 12th, the decline to a low of $5.26 in early October 2003 represents a loss of market capitalization (i.e., reputation capital as defined by Charles Fombrun30) of approximately $250 million, or 61 percent. The value of MSO's shares did return to close at $35.51 on February 7, 2005,31 but fell off to under $20 in early 2006. According to a New York brand-rating company, Brand-Keys, the Martha Stewart brand reached a peak of 120 (the baseline is 100) in May 2002, and sank to a low of 63 in March 2004.

What will the future hold? Martha has returned to TV with a version of The Apprentice as well as her usual homemaking and design shows, and her products and magazines continue to be sold. Will Martha regain her earlier distinction? Would she do it again to avoid losing $45,673?

Questions

Why did MSO's stock price decline due to Martha Stewart's loss of reputation?

Explanation

Martha Stewart Omnimedia (MSO) stock dec...

Business & Professional Ethics 7th Edition by Leonard Brooks,Paul Dunn

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255