Engineering Economy 16th Edition by William Sullivan ,Elin Wicks, Koelling,

Edition 16ISBN: 978-0133439274

Engineering Economy 16th Edition by William Sullivan ,Elin Wicks, Koelling,

Edition 16ISBN: 978-0133439274 Exercise 6

Explain the various degrees of dependency among two or more projects. If one or more projects seem desirable and are complementary to a given project, should those complementary projects be included in a proposal package or kept separate for review by management (Problem)

Problem

The price to earnings ( P/E ) ratio is an after-tax metric reflecting growth potential of the common stock of a corporation. P is the selling price (per share) of the common stock, and E is the after-tax earnings per year of a share of stock. A high P/E ratio, for example, indicates that a firm is in a high-growth industry (such as biotechnology) and that annual earnings are not as important to investors as the growth rate of the price of common stock is. Because a corporation can be assumed to have an indefinitely long life, the P/E ratio can be likened to the ( P/A , i %, N ) factor when N approaches infinity. For a certain transportation company, the P/E ratio is 12. What is the implied IRR for this relatively stable company (Problem 1)

Problem 1

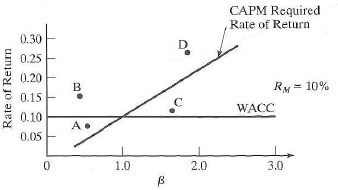

Refer to the associated graph. Identify when the WACC approach to project acceptability agrees with the CAPM approach. When do recommendations of the two approaches differ Explain why.

Problem

The price to earnings ( P/E ) ratio is an after-tax metric reflecting growth potential of the common stock of a corporation. P is the selling price (per share) of the common stock, and E is the after-tax earnings per year of a share of stock. A high P/E ratio, for example, indicates that a firm is in a high-growth industry (such as biotechnology) and that annual earnings are not as important to investors as the growth rate of the price of common stock is. Because a corporation can be assumed to have an indefinitely long life, the P/E ratio can be likened to the ( P/A , i %, N ) factor when N approaches infinity. For a certain transportation company, the P/E ratio is 12. What is the implied IRR for this relatively stable company (Problem 1)

Problem 1

Refer to the associated graph. Identify when the WACC approach to project acceptability agrees with the CAPM approach. When do recommendations of the two approaches differ Explain why.

Explanation

Degrees of dependency between two or mor...

Engineering Economy 16th Edition by William Sullivan ,Elin Wicks, Koelling,

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255