Macroeconomics 20th Edition by Campbell McConnell,Stanley Brue,Sean Flynn

Edition 20ISBN: 978-0077660895

Macroeconomics 20th Edition by Campbell McConnell,Stanley Brue,Sean Flynn

Edition 20ISBN: 978-0077660895 Exercise 8

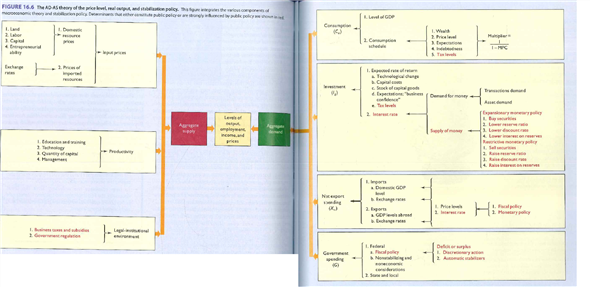

A personal income tax cut, combined with a reduction in corporate income and excise taxes, would:

A) increase consumption, investment, aggregate demand, and aggregate supply.

B) reduce productivity, raise input prices, and reduce aggregate supply.

C) increase government spending, reduce net exports, and increase aggregate demand

D) increase the supply of money, reduce interest rates, increase investment, and expand real output.

Explanation

Hence, the correct answer is a. increase...

Macroeconomics 20th Edition by Campbell McConnell,Stanley Brue,Sean Flynn

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255