Business Mathematics Brief 12th Edition by Stanley Salzman ,Gary Clendenen, Charles Miller

Edition 12ISBN: 978-0132605540

Business Mathematics Brief 12th Edition by Stanley Salzman ,Gary Clendenen, Charles Miller

Edition 12ISBN: 978-0132605540 Exercise 15

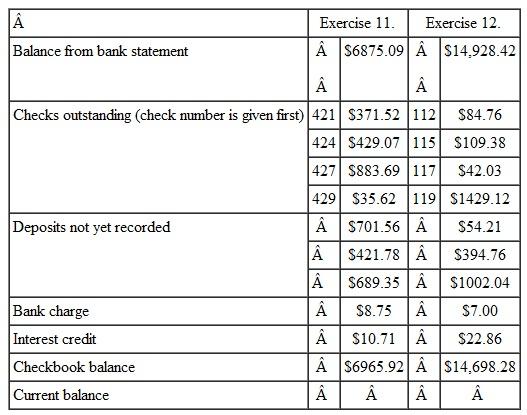

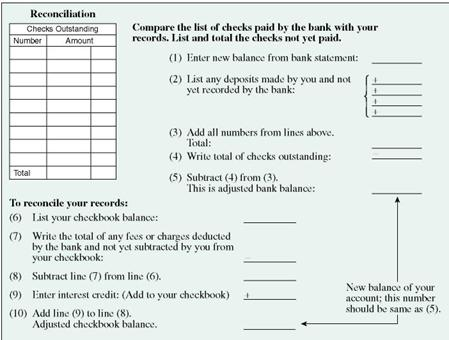

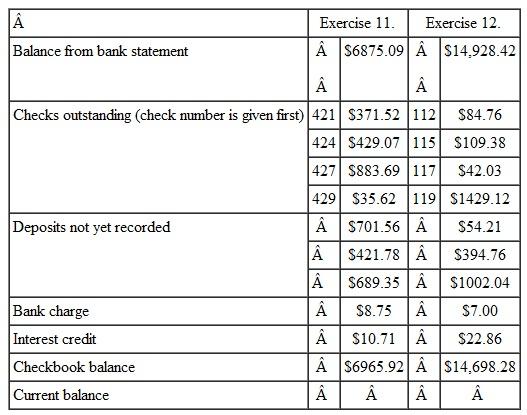

RECONCILING CHECKING ACCOUNTS Use the following table to reconcile each account and find the current balance.

RECONCILING CHECKING ACCOUNTS Use the following table to reconcile each account and find the current balance. (See Example.)

RECONCILING CHECKING ACCOUNTS Use the following table to reconcile each account and find the current balance. (See Example.)

Reconciling a Checking Account

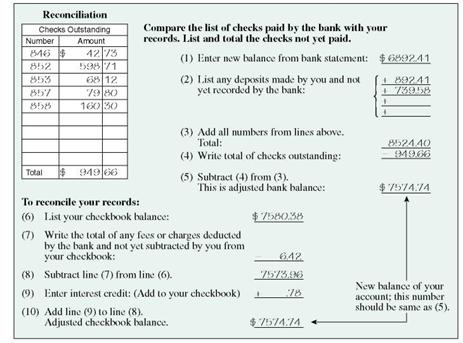

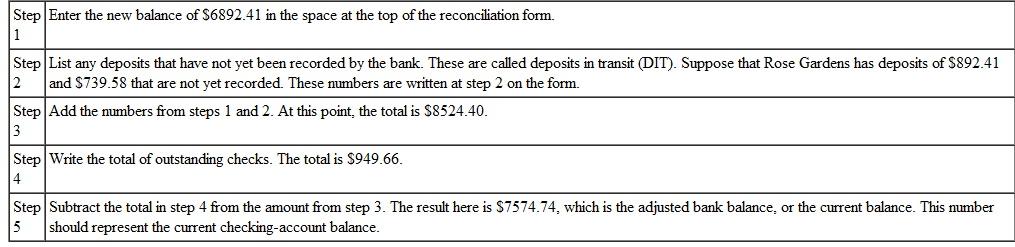

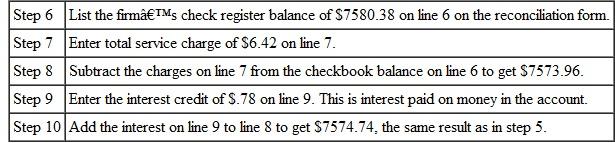

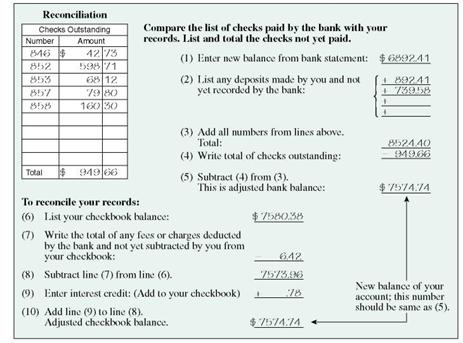

The bank statement for Rose Gardens shown on the previous page shows a balance of $6892.41 after a bank service charge of $6.42 and an interest credit of $.78. The check register for Rose Gardens shows a current balance of $7580.38. Reconcile the account as follows.

CASE IN POINT

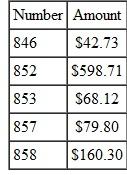

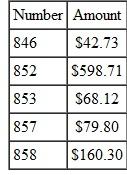

List the outstanding checks. Find the checks outstanding by comparing the list of checks on the bank statement against the list of checks written by the firm. You may wish to put a check mark on the bank statement and/or check register as you compare them. In particular, note any differences in the amounts for any check. Here are the outstanding checks.

After listing the outstanding checks in the space provided on the form, total them. The total is $949.66.

After listing the outstanding checks in the space provided on the form, total them. The total is $949.66.

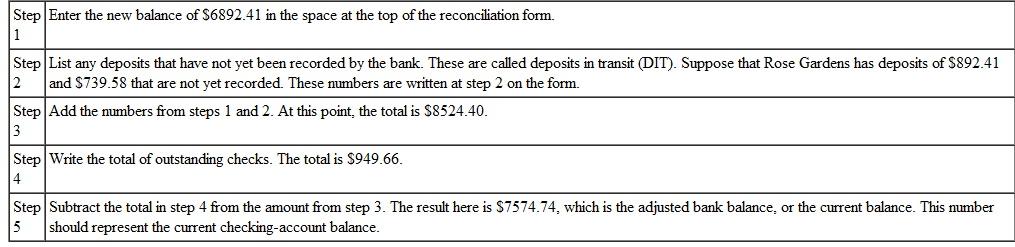

Find the adjusted bank balance or current balance. Follow the steps listed here and shown on the reconciliation form on the next page.

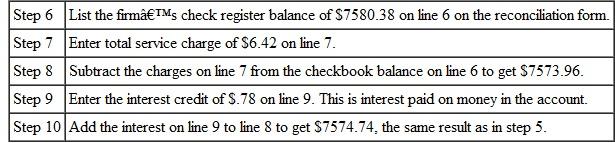

Now look at the firm's own records.

Now look at the firm's own records.

Since the result from step 10 is the same as the result from step 5, the account is balanced (reconciled). The correct current balance in the account is $7574.74.

Since the result from step 10 is the same as the result from step 5, the account is balanced (reconciled). The correct current balance in the account is $7574.74.

RECONCILING CHECKING ACCOUNTS Use the following table to reconcile each account and find the current balance. (See Example.)

RECONCILING CHECKING ACCOUNTS Use the following table to reconcile each account and find the current balance. (See Example.) Reconciling a Checking Account

The bank statement for Rose Gardens shown on the previous page shows a balance of $6892.41 after a bank service charge of $6.42 and an interest credit of $.78. The check register for Rose Gardens shows a current balance of $7580.38. Reconcile the account as follows.

CASE IN POINT

List the outstanding checks. Find the checks outstanding by comparing the list of checks on the bank statement against the list of checks written by the firm. You may wish to put a check mark on the bank statement and/or check register as you compare them. In particular, note any differences in the amounts for any check. Here are the outstanding checks.

After listing the outstanding checks in the space provided on the form, total them. The total is $949.66.

After listing the outstanding checks in the space provided on the form, total them. The total is $949.66.Find the adjusted bank balance or current balance. Follow the steps listed here and shown on the reconciliation form on the next page.

Now look at the firm's own records.

Now look at the firm's own records. Since the result from step 10 is the same as the result from step 5, the account is balanced (reconciled). The correct current balance in the account is $7574.74.

Since the result from step 10 is the same as the result from step 5, the account is balanced (reconciled). The correct current balance in the account is $7574.74.

Explanation

1. The new balance from the bank statem...

Business Mathematics Brief 12th Edition by Stanley Salzman ,Gary Clendenen, Charles Miller

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255