Business Mathematics Brief 12th Edition by Stanley Salzman ,Gary Clendenen, Charles Miller

Edition 12ISBN: 978-0132605540

Business Mathematics Brief 12th Edition by Stanley Salzman ,Gary Clendenen, Charles Miller

Edition 12ISBN: 978-0132605540 Exercise 37

Solve the following application problems.

T-BILL AND STOCK INVESTING Joann Gretz (see Example, page) decides to place half of her $2000 deposit at the end of each year into the bond fund and half into the stock fund. Assume the bond fund earns 6% compounded annually and the stock fund earns 10% compounded annually. Find the amount available in 33 years. ____________

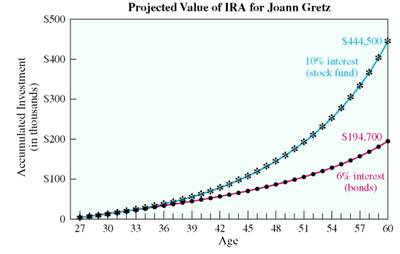

Finding the Value of an IRA

At 27, Joann Gretz sets up an IRA with online broker Charles Schwab, where she plans to deposit $2000 at the end of each year until age 60. Find the amount of the annuity if she invests in (a) a bond fund that has historically yielded 6% compounded annually versus (b) a stock fund that has historically yielded 10% compounded annually. Assume that future yields equal historical yields.

SOLUTION

Age 60 is 60 ? 27 = 33 years away , so she will make deposits at the end of each year for 33 years.

(a) Bond fund: Look down the left column of the amount of an annuity table on page for 33 years and across the top for 6% to find 97.34316.

Amount = $2000 × 97.34316 = $194,686.32

(b) Stock fund: Look down the left column of the table for 33 years and across the top for 10, to find 222.25154.

Amount = $2000 × 222.25154 = $ 444,503.08

Quick TIP

Investments can be risky. For example, stocks usually increase in value over the long term, but they may go down as well.

The differences in the two investments are shown in the figure. Gretz wants the larger amount, but she is worried she might lose money in the stock fund. See Exercise 20 at the end of this section to find her investment choice.

T-BILL AND STOCK INVESTING Joann Gretz (see Example, page) decides to place half of her $2000 deposit at the end of each year into the bond fund and half into the stock fund. Assume the bond fund earns 6% compounded annually and the stock fund earns 10% compounded annually. Find the amount available in 33 years. ____________

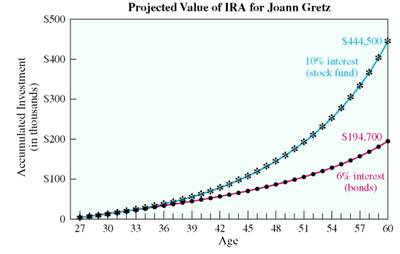

Finding the Value of an IRA

At 27, Joann Gretz sets up an IRA with online broker Charles Schwab, where she plans to deposit $2000 at the end of each year until age 60. Find the amount of the annuity if she invests in (a) a bond fund that has historically yielded 6% compounded annually versus (b) a stock fund that has historically yielded 10% compounded annually. Assume that future yields equal historical yields.

SOLUTION

Age 60 is 60 ? 27 = 33 years away , so she will make deposits at the end of each year for 33 years.

(a) Bond fund: Look down the left column of the amount of an annuity table on page for 33 years and across the top for 6% to find 97.34316.

Amount = $2000 × 97.34316 = $194,686.32

(b) Stock fund: Look down the left column of the table for 33 years and across the top for 10, to find 222.25154.

Amount = $2000 × 222.25154 = $ 444,503.08

Quick TIP

Investments can be risky. For example, stocks usually increase in value over the long term, but they may go down as well.

The differences in the two investments are shown in the figure. Gretz wants the larger amount, but she is worried she might lose money in the stock fund. See Exercise 20 at the end of this section to find her investment choice.

Explanation

Since the deposits are made at the end o...

Business Mathematics Brief 12th Edition by Stanley Salzman ,Gary Clendenen, Charles Miller

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255