Business Mathematics Brief 12th Edition by Stanley Salzman ,Gary Clendenen, Charles Miller

Edition 12ISBN: 978-0132605540

Business Mathematics Brief 12th Edition by Stanley Salzman ,Gary Clendenen, Charles Miller

Edition 12ISBN: 978-0132605540 Exercise 104

Explain how interest can result in a total cost that is over twice the original loan amount when a home is financed over 30 years. (See Example.)

Understanding the Effects of Rate and Term

After making a down payment, the Stringers need to borrow $140,000 to purchase a condominium. They want to know the effect of the interest rate and term of the loan on cost. (a) Find the monthly payment for both 15 and 30 years at 4% and 6%. Then find (b) the total cost of the home with each loan and (c) the finance charge for each loan.

Quick TIP

Be sure to divide the loan amount by $1000 before calculating the monthly payment.

SOLUTION

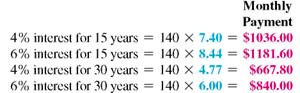

(a) The amount to be financed in thousands = $140,000 ÷ $1000 = 140. Multiply this value by the appropriate factor from the real estate amortization table.

Monthly payments range from $667.80 to $1181.60, depending on the interest rate and length of the loan. The lowest payment of $667.80 may look good at first, but read part (b) below.

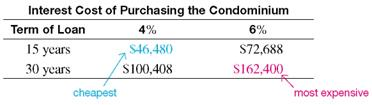

(b) The total cost of the home is the sum of all payments over the respective months and years.

(c) The finance charge, or interest cost, of each of the loans is the total cost found in part (b) minus the amount financed of $140,000.

Quick TIP

You can reduce your long-term cost of a mortgage by paying more than the required payment every month. Even an extra $60 per month can make a big difference over the long run.

First, notice that interest adds quite a bit to the cost of the $140,000 loan. The longer term of 30 years results in a significantly lower house payment, but it also results in a much higher eventual cost. So, the longer term loan of 30 years is not necessarily the best choice. Clearly, higher interest rates and longer terms ADD HUGE amounts to the interest that must be paid to purchase a property.

Understanding the Effects of Rate and Term

After making a down payment, the Stringers need to borrow $140,000 to purchase a condominium. They want to know the effect of the interest rate and term of the loan on cost. (a) Find the monthly payment for both 15 and 30 years at 4% and 6%. Then find (b) the total cost of the home with each loan and (c) the finance charge for each loan.

Quick TIP

Be sure to divide the loan amount by $1000 before calculating the monthly payment.

SOLUTION

(a) The amount to be financed in thousands = $140,000 ÷ $1000 = 140. Multiply this value by the appropriate factor from the real estate amortization table.

Monthly payments range from $667.80 to $1181.60, depending on the interest rate and length of the loan. The lowest payment of $667.80 may look good at first, but read part (b) below.

(b) The total cost of the home is the sum of all payments over the respective months and years.

(c) The finance charge, or interest cost, of each of the loans is the total cost found in part (b) minus the amount financed of $140,000.

Quick TIP

You can reduce your long-term cost of a mortgage by paying more than the required payment every month. Even an extra $60 per month can make a big difference over the long run.

First, notice that interest adds quite a bit to the cost of the $140,000 loan. The longer term of 30 years results in a significantly lower house payment, but it also results in a much higher eventual cost. So, the longer term loan of 30 years is not necessarily the best choice. Clearly, higher interest rates and longer terms ADD HUGE amounts to the interest that must be paid to purchase a property.

Explanation

This question doesn’t have an expert verified answer yet, let Examlex AI Copilot help.

Business Mathematics Brief 12th Edition by Stanley Salzman ,Gary Clendenen, Charles Miller

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255