Business Mathematics Brief 12th Edition by Stanley Salzman ,Gary Clendenen, Charles Miller

Edition 12ISBN: 978-0132605540

Business Mathematics Brief 12th Edition by Stanley Salzman ,Gary Clendenen, Charles Miller

Edition 12ISBN: 978-0132605540 Exercise 126

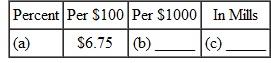

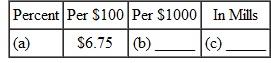

Write the given tax rate using the other three methods. (See Example.)

Finding the Property Tax

Find the taxes on each of the following pieces of property. Assessed values and tax rates are given.

(a) $58,975; 8.4%

(b) $875,400; $7.82 per $100

(c) $129,600; $64.21 per $1000

(d) $221,750; 94 mills

SOLUTION

Multiply the tax rate by the assessed value.

(a) 8.4% =.084

Tax = Tax rate × Assessed value

Tax =.084 × $58,975 = $4953.90

(b) $875,400 = 8754 hundreds

Tax = $7.82 × 8754 = $68,456.28

(c) $129,600 = 129.6 thousands

Tax = $64.21 × 129.6 = $8321.62

(d) 94 mills =.094

Tax =.094 × $221,750 = $20,844.50

Finding the Property Tax

Find the taxes on each of the following pieces of property. Assessed values and tax rates are given.

(a) $58,975; 8.4%

(b) $875,400; $7.82 per $100

(c) $129,600; $64.21 per $1000

(d) $221,750; 94 mills

SOLUTION

Multiply the tax rate by the assessed value.

(a) 8.4% =.084

Tax = Tax rate × Assessed value

Tax =.084 × $58,975 = $4953.90

(b) $875,400 = 8754 hundreds

Tax = $7.82 × 8754 = $68,456.28

(c) $129,600 = 129.6 thousands

Tax = $64.21 × 129.6 = $8321.62

(d) 94 mills =.094

Tax =.094 × $221,750 = $20,844.50

Explanation

Since the tax rate is

per

, the tax r...

Business Mathematics Brief 12th Edition by Stanley Salzman ,Gary Clendenen, Charles Miller

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255