Business Mathematics Brief 12th Edition by Stanley Salzman ,Gary Clendenen, Charles Miller

Edition 12ISBN: 978-0132605540

Business Mathematics Brief 12th Edition by Stanley Salzman ,Gary Clendenen, Charles Miller

Edition 12ISBN: 978-0132605540 Exercise 48

Explain the coinsurance clause and describe how coinsurance works. (See Objective.)

Use the coinsurance formula. Most fires damage only a portion of a building and the contents. Since complete destruction of a building is rare, many owners save money by buying insurance for only a portion of the value of the building and contents. Realizing this, insurance companies place a coinsurance clause in almost all fire insurance policies. Effectively, the business assumes part of the risk of a loss under coinsurance.

Replacement cost refers to the cost to replace (rebuild) a building in the event it is completely destroyed. It may surprise you to learn that the replacement cost for an older building is often far greater than the fair market value, since new construction costs often exceed the value of older buildings.

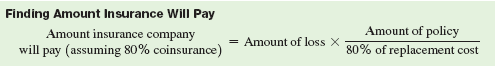

Most fire insurance contracts have an 80% coinsurance clause. This clause requires the owner of the building to have an insurance policy in effect with a face value that is at least 80% of the replacement cost of the building. If the policy has a face value greater than 80%, then the insurance companies pays for all losses caused by a fire. On the other hand, if the face value is less than 80%, then the insurance company will pay only a portion of any loss. The most the insurance company will pay is the smaller amount of the loss on the face value of the policy.

Finding amount insurance Will pay

Use the coinsurance formula. Most fires damage only a portion of a building and the contents. Since complete destruction of a building is rare, many owners save money by buying insurance for only a portion of the value of the building and contents. Realizing this, insurance companies place a coinsurance clause in almost all fire insurance policies. Effectively, the business assumes part of the risk of a loss under coinsurance.

Replacement cost refers to the cost to replace (rebuild) a building in the event it is completely destroyed. It may surprise you to learn that the replacement cost for an older building is often far greater than the fair market value, since new construction costs often exceed the value of older buildings.

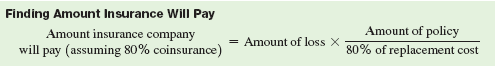

Most fire insurance contracts have an 80% coinsurance clause. This clause requires the owner of the building to have an insurance policy in effect with a face value that is at least 80% of the replacement cost of the building. If the policy has a face value greater than 80%, then the insurance companies pays for all losses caused by a fire. On the other hand, if the face value is less than 80%, then the insurance company will pay only a portion of any loss. The most the insurance company will pay is the smaller amount of the loss on the face value of the policy.

Finding amount insurance Will pay

Explanation

A coinsurance clause is a clause in whic...

Business Mathematics Brief 12th Edition by Stanley Salzman ,Gary Clendenen, Charles Miller

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255