Accounting 26th Edition by Carl Warren,James Reeve,Jonathan Duchac

Edition 26ISBN: 978-1285743615

Accounting 26th Edition by Carl Warren,James Reeve,Jonathan Duchac

Edition 26ISBN: 978-1285743615 Exercise 1

Transactions

On April 1 of the current year, Andrea Byrd established a business to manage rental property. She completed the following transactions during April:

a. Opened a business bank account with a deposit of $45,000 from personal funds.

b. Purchased office supplies on account, $2,000.

c. Received cash from fees earned for managing rental property, $8,500.

d. Paid rent on office and equipment for the month, $5,000.

e. Paid creditors on account, $1,375.

f. Billed customers for fees earned for managing rental property, $11,250.

g. Paid automobile expenses (including rental charges) for month, $840, and miscellaneous expenses, $900.

h. Paid office salaries, $3,600.

i. Determined that the cost of supplies on hand was $550; therefore, the cost of supplies used was $1,450.

j. Withdrew cash for personal use, $2,000.

Instructions

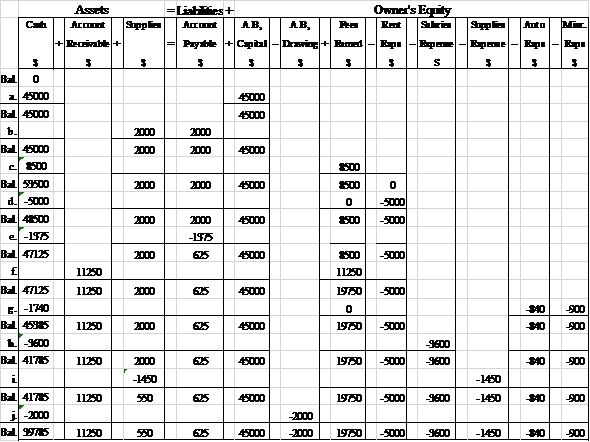

1. Indicate the effect of each transaction and the balances after each transaction, using the following tabular headings:

2. Briefly explain why the owner's investment and revenues increased owner's equity, while withdrawls and expenses decreased owner's equity.

3. Determine the net income for April.

4. How much did April's transactions increase or decrease Andrea Byrd's capital

On April 1 of the current year, Andrea Byrd established a business to manage rental property. She completed the following transactions during April:

a. Opened a business bank account with a deposit of $45,000 from personal funds.

b. Purchased office supplies on account, $2,000.

c. Received cash from fees earned for managing rental property, $8,500.

d. Paid rent on office and equipment for the month, $5,000.

e. Paid creditors on account, $1,375.

f. Billed customers for fees earned for managing rental property, $11,250.

g. Paid automobile expenses (including rental charges) for month, $840, and miscellaneous expenses, $900.

h. Paid office salaries, $3,600.

i. Determined that the cost of supplies on hand was $550; therefore, the cost of supplies used was $1,450.

j. Withdrew cash for personal use, $2,000.

Instructions

1. Indicate the effect of each transaction and the balances after each transaction, using the following tabular headings:

2. Briefly explain why the owner's investment and revenues increased owner's equity, while withdrawls and expenses decreased owner's equity.

3. Determine the net income for April.

4. How much did April's transactions increase or decrease Andrea Byrd's capital

Explanation

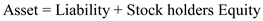

Answer: 1.

Accounting equation:

The accounting equation states that the assets of a business are always equal to the claims of owners and the outsiders. The claims also called equity of owners is termed as capital and that of outsiders, as liabilities.

Cash + Supplies + Accounts Receivable + Land = Account Payable + {Capital - Drawings ± Net Profit / Loss}

Cash + Supplies + Accounts Receivable + Land = Account Payable + {Capital - Drawings ± Net Profit / Loss}

Determination of balances in the accounting equation for every transaction:

Answer: 2.

Answer: 2.

Owner's Investments : - Amount invested by owner in the business is known as capital. It may be bought in the form of cash or assets by the owner for the business. Additional investment in capital increases the asset cash.

Revenue : - Revenues are the amounts of the business earned by selling its products or providing services. The excess of revenue over the expenses is called net income. Net income for period increase the owner's equity for the period.

Withdrawing : - Withdrawal of money by the owner from the business for personal use is known as drawings. This transaction is the opposite of an investment in the business by the owner. Drawing reduces the investment of the owners.

Expenses : - Costs incurred by a business in the process of earning revenue are known as expenses. The usual items of expenses are: rent, wages, salaries, telephone etc. The excess of expenses over the revenue is called net loss. A net loss for period decrease the owner's equity for the period.

Answer 3.

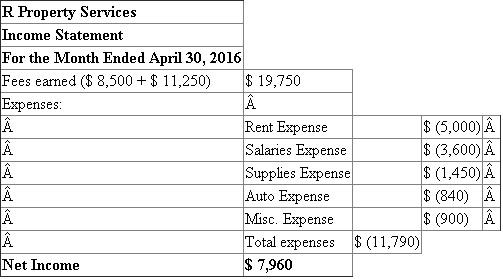

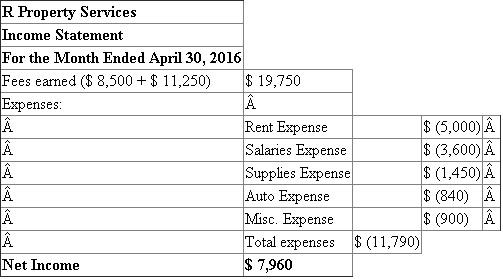

Income Statement :-

The income and expenses statement gives information about

(1) The revenue or income earned and other gains made by the concern

(2) Money spent to earn the revenues or incomes and other losses that may have been suffered.

The difference between (1) and (2) is net income, if (1) is bigger or net loss in the other case.

Prepare Income statement :-

Therefore, Net Income is $ 7,960.

Therefore, Net Income is $ 7,960.

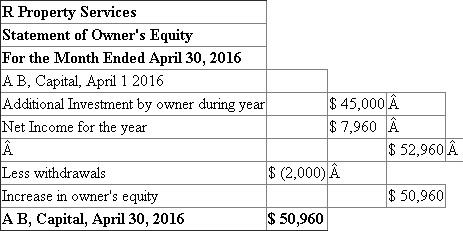

Answer: 4

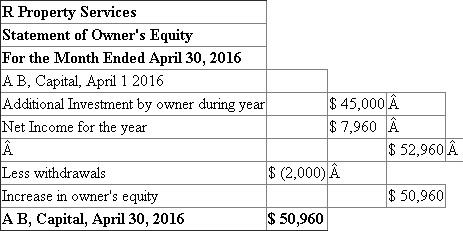

Statement of Owner's Equity :-

A Statement of Owner's Equity shows the owner's contribution (Capital) at the start of the period, the changes that affect capital, and the resulting capital at the end of the period. Capital is increased by owner contributions and income , and decreased by withdrawals and expenses.

Prepare Statement of owner's equity :-

Therefore, A B's Capital increased by $ 50, 960.

Therefore, A B's Capital increased by $ 50, 960.

Accounting equation:

The accounting equation states that the assets of a business are always equal to the claims of owners and the outsiders. The claims also called equity of owners is termed as capital and that of outsiders, as liabilities.

Cash + Supplies + Accounts Receivable + Land = Account Payable + {Capital - Drawings ± Net Profit / Loss}

Cash + Supplies + Accounts Receivable + Land = Account Payable + {Capital - Drawings ± Net Profit / Loss}Determination of balances in the accounting equation for every transaction:

Answer: 2.

Answer: 2. Owner's Investments : - Amount invested by owner in the business is known as capital. It may be bought in the form of cash or assets by the owner for the business. Additional investment in capital increases the asset cash.

Revenue : - Revenues are the amounts of the business earned by selling its products or providing services. The excess of revenue over the expenses is called net income. Net income for period increase the owner's equity for the period.

Withdrawing : - Withdrawal of money by the owner from the business for personal use is known as drawings. This transaction is the opposite of an investment in the business by the owner. Drawing reduces the investment of the owners.

Expenses : - Costs incurred by a business in the process of earning revenue are known as expenses. The usual items of expenses are: rent, wages, salaries, telephone etc. The excess of expenses over the revenue is called net loss. A net loss for period decrease the owner's equity for the period.

Answer 3.

Income Statement :-

The income and expenses statement gives information about

(1) The revenue or income earned and other gains made by the concern

(2) Money spent to earn the revenues or incomes and other losses that may have been suffered.

The difference between (1) and (2) is net income, if (1) is bigger or net loss in the other case.

Prepare Income statement :-

Therefore, Net Income is $ 7,960.

Therefore, Net Income is $ 7,960. Answer: 4

Statement of Owner's Equity :-

A Statement of Owner's Equity shows the owner's contribution (Capital) at the start of the period, the changes that affect capital, and the resulting capital at the end of the period. Capital is increased by owner contributions and income , and decreased by withdrawals and expenses.

Prepare Statement of owner's equity :-

Therefore, A B's Capital increased by $ 50, 960.

Therefore, A B's Capital increased by $ 50, 960.Accounting 26th Edition by Carl Warren,James Reeve,Jonathan Duchac

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255