Accounting 26th Edition by Carl Warren,James Reeve,Jonathan Duchac

Edition 26ISBN: 978-1285743615

Accounting 26th Edition by Carl Warren,James Reeve,Jonathan Duchac

Edition 26ISBN: 978-1285743615 Exercise 63

A Perpetual inventory using LIFO

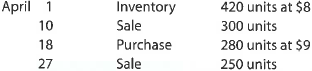

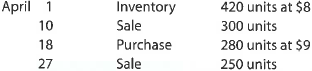

Beginning inventory, purchases, and sales for Item Zebra 9x are as follows:

Assuming a perpetual inventory system and using the last-in, first-out (LIFO) method, determine (a) the cost of merchandise sold on April 27 and (b) the inventory on April 30.

B Perpetual inventory using LIFO

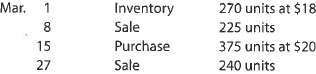

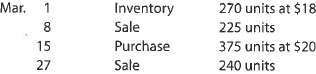

Beginning inventory, purchases, and sales for Item Foxtrot are as follows:

Assuming a perpetual inventory system and using the last-in, first-out (LIFO) method, determine (a) the cost of merchandise sold on March 27 and (b) the inventory on March 31.

Beginning inventory, purchases, and sales for Item Zebra 9x are as follows:

Assuming a perpetual inventory system and using the last-in, first-out (LIFO) method, determine (a) the cost of merchandise sold on April 27 and (b) the inventory on April 30.

B Perpetual inventory using LIFO

Beginning inventory, purchases, and sales for Item Foxtrot are as follows:

Assuming a perpetual inventory system and using the last-in, first-out (LIFO) method, determine (a) the cost of merchandise sold on March 27 and (b) the inventory on March 31.

Explanation

3A.

a)

Determination of cost of merchan...

Accounting 26th Edition by Carl Warren,James Reeve,Jonathan Duchac

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255