Accounting 26th Edition by Carl Warren,James Reeve,Jonathan Duchac

Edition 26ISBN: 978-1285743615

Accounting 26th Edition by Carl Warren,James Reeve,Jonathan Duchac

Edition 26ISBN: 978-1285743615 Exercise 51

Entries for bad debt expense under the direct write-off and allowance methods

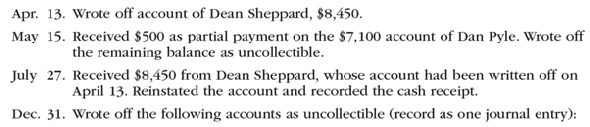

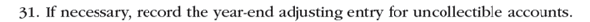

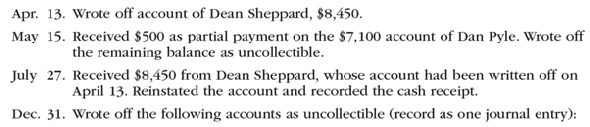

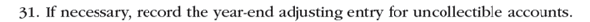

The following selected transactions were taken from the records of Shipway Company for the first year of its operations ending December 31:

a. Journalize the transactions under the direct write-off method.

b. Journalize the transactions under the allowance method. Shipway Company uses the percent of credit sales method of estimating uncollectible accounts expense. Based on past history and industry averages, ¾% of credit sales are expected to be uncollectible. Shipway Company recorded $3,778,000 of credit sales during the year.

c. How much higher (lower) would Shipway Company's net income have been under the direct write-off method than under the allowance method

The following selected transactions were taken from the records of Shipway Company for the first year of its operations ending December 31:

a. Journalize the transactions under the direct write-off method.

b. Journalize the transactions under the allowance method. Shipway Company uses the percent of credit sales method of estimating uncollectible accounts expense. Based on past history and industry averages, ¾% of credit sales are expected to be uncollectible. Shipway Company recorded $3,778,000 of credit sales during the year.

c. How much higher (lower) would Shipway Company's net income have been under the direct write-off method than under the allowance method

Explanation

This question doesn’t have an expert verified answer yet, let Examlex AI Copilot help.

Accounting 26th Edition by Carl Warren,James Reeve,Jonathan Duchac

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255