Accounting 26th Edition by Carl Warren,James Reeve,Jonathan Duchac

Edition 26ISBN: 978-1285743615

Accounting 26th Edition by Carl Warren,James Reeve,Jonathan Duchac

Edition 26ISBN: 978-1285743615 Exercise 5

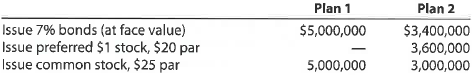

A Alternative financing plans

Owen Co. is considering the following alternative financing plans:

Income tax is estimated at 40% of income.

Determine the earnings per share of common stock, assuming income before bond interest and income tax is $750,000.

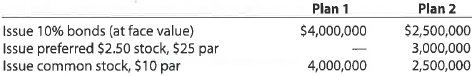

B Alternative financing plans

Brower Co. is considering the following alternative financing plans:

Income tax is estimated at 40% of income.

Determine the earnings per share of common stock, assuming income before bond interest and income tax is $2,000,000.

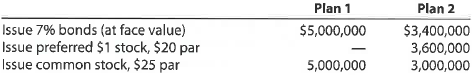

Owen Co. is considering the following alternative financing plans:

Income tax is estimated at 40% of income.

Determine the earnings per share of common stock, assuming income before bond interest and income tax is $750,000.

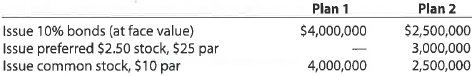

B Alternative financing plans

Brower Co. is considering the following alternative financing plans:

Income tax is estimated at 40% of income.

Determine the earnings per share of common stock, assuming income before bond interest and income tax is $2,000,000.

Explanation

1A

Computation of Earnings pe...

Accounting 26th Edition by Carl Warren,James Reeve,Jonathan Duchac

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255