Accounting 26th Edition by Carl Warren,James Reeve,Jonathan Duchac

Edition 26ISBN: 978-1285743615

Accounting 26th Edition by Carl Warren,James Reeve,Jonathan Duchac

Edition 26ISBN: 978-1285743615 Exercise 56

Income statement and earnings per share for extraordinary items and discontinued operations

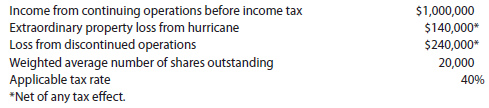

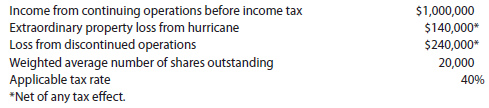

Apex Inc. reports the following for a recent year:

Income from continuing operations before income tax Extraordinary property loss from hurricane Loss from discontinued operations Weighted average number of shares outstanding Applicable tax rate *Net of any tax effect.

a. Prepare a partial income statement for Apex Inc., beginning with income from continuing operations before income tax.

b. Calculate the earnings per common share for Apex Inc., including per-share amounts for unusual items.

Apex Inc. reports the following for a recent year:

Income from continuing operations before income tax Extraordinary property loss from hurricane Loss from discontinued operations Weighted average number of shares outstanding Applicable tax rate *Net of any tax effect.

a. Prepare a partial income statement for Apex Inc., beginning with income from continuing operations before income tax.

b. Calculate the earnings per common share for Apex Inc., including per-share amounts for unusual items.

Explanation

a.

Partial Income Statement of Apex Inc...

Accounting 26th Edition by Carl Warren,James Reeve,Jonathan Duchac

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255