Accounting 26th Edition by Carl Warren,James Reeve,Jonathan Duchac

Edition 26ISBN: 978-1285743615

Accounting 26th Edition by Carl Warren,James Reeve,Jonathan Duchac

Edition 26ISBN: 978-1285743615 Exercise 2

Budgeted income statement and supporting budgets

The budget director of Gold Medal Athletic Co., with the assistance of the conirdler, treasurer, production manager, and sales manager, has gathered the following data for use in developing the budgeted income statement for March 2016:

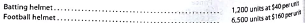

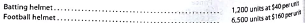

a. Estimated sales for March:

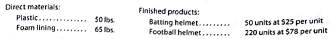

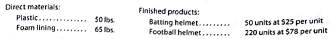

b. Estimated inventories at March 1:

c. Desired inventories at March 31:

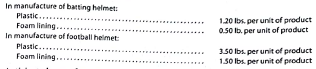

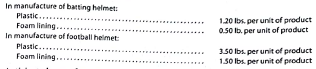

d. Direct materials used in production:

e. Anticipated cost of purchases and beginning and ending inventory of direct materials:

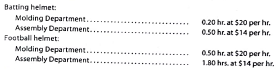

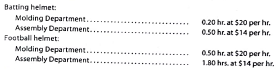

f. Direct labor requirements:

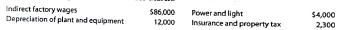

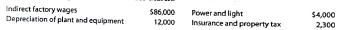

g. Estimated factory overhead costs for March:

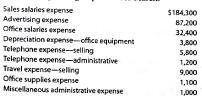

h. Estimated operating expenses for March:

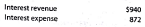

i. Estimated other income and expense for March:

j. Estimated tax rate: 30%

Instructions

1. Prepare a sales budget for March.

2. Prepare a production budget for March.

3. Prepare a direct materials purchases budget for March.

4. Prepare a direct labor cost budget for March.

5. Prepare a factory - overhead cost budget for March.

6. Prepare a cost of goods sold budget for March. Work in process at the beginning of March is estimated to be $15,300, and work in process at the end of March is desired to be $14,800.

7. Prepare a selling and administrative expenses budget for March.

8. Prepare a budgeted income statement for March.

The budget director of Gold Medal Athletic Co., with the assistance of the conirdler, treasurer, production manager, and sales manager, has gathered the following data for use in developing the budgeted income statement for March 2016:

a. Estimated sales for March:

b. Estimated inventories at March 1:

c. Desired inventories at March 31:

d. Direct materials used in production:

e. Anticipated cost of purchases and beginning and ending inventory of direct materials:

f. Direct labor requirements:

g. Estimated factory overhead costs for March:

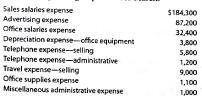

h. Estimated operating expenses for March:

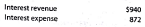

i. Estimated other income and expense for March:

j. Estimated tax rate: 30%

Instructions

1. Prepare a sales budget for March.

2. Prepare a production budget for March.

3. Prepare a direct materials purchases budget for March.

4. Prepare a direct labor cost budget for March.

5. Prepare a factory - overhead cost budget for March.

6. Prepare a cost of goods sold budget for March. Work in process at the beginning of March is estimated to be $15,300, and work in process at the end of March is desired to be $14,800.

7. Prepare a selling and administrative expenses budget for March.

8. Prepare a budgeted income statement for March.

Explanation

1)

Budgeting is important for any busine...

Accounting 26th Edition by Carl Warren,James Reeve,Jonathan Duchac

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255