Macroeconomics 1st Edition by Dean Karlan,Jonathan Morduch

Edition 1ISBN: 978-0077332648

Macroeconomics 1st Edition by Dean Karlan,Jonathan Morduch

Edition 1ISBN: 978-0077332648 Exercise 15

Ike, an investor, is considering opening a margin account and investing $1,000 in Mike's mutual fund. The terms of the account require that he pay back the amount he borrowed on the margin by the end of the year with 10 percent interest. Ike is trying to decide what level of margin he wants. For example, if he chooses an account at the level of 50 percent, the bank will let him borrow and invest an additional $500, or 50 percent of his original $1,000.

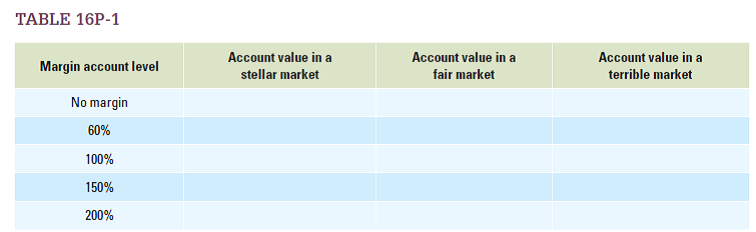

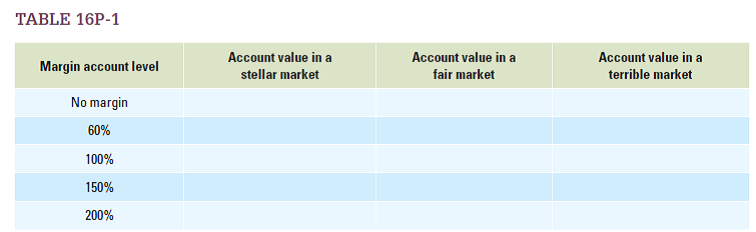

Complete Table 16P-1 by filling in Ike's account value at the end of the year, given varying levels of the margin account and mutual fund performance. Assume that Mike's mutual fund will return 40 percent per year in a stellar market and 5 percent per year in a fair market, and that in a terrible market, it will lose 30 percent.

Complete Table 16P-1 by filling in Ike's account value at the end of the year, given varying levels of the margin account and mutual fund performance. Assume that Mike's mutual fund will return 40 percent per year in a stellar market and 5 percent per year in a fair market, and that in a terrible market, it will lose 30 percent.

Explanation

Given:

• Investment in opening the marg...

Macroeconomics 1st Edition by Dean Karlan,Jonathan Morduch

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255