Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

Edition 5ISBN: 978-1260575910

Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

Edition 5ISBN: 978-1260575910 Exercise 7

Haynes, Inc., obtained 100 percent of Turner Company's common stock on January 1, 2012, by issuing 9,000 shares of $10 par value common stock. Haynes's shares had a $15 per share fair value. On that date, Turner reported a net book value of $100,000. However, its equipment (with a five-year remaining life) was undervalued by $5,000 in the company's accounting records. Also, Turner had developed a customer list with an assessed value of $30,000, although no value had been recorded on Turner's books. The customer list had an estimated remaining useful life of 10 years.

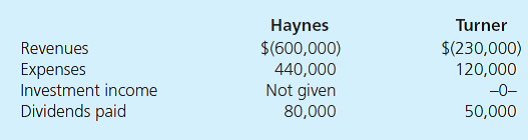

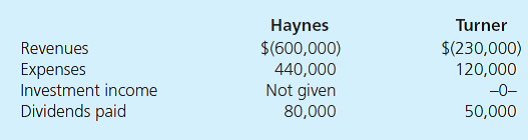

The following figures come from the individual accounting records of these two companies as of December 31, 2012:

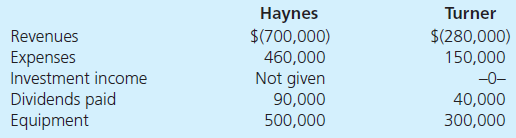

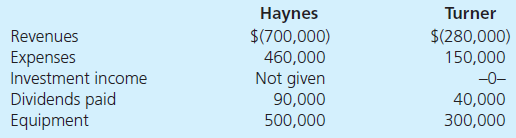

The following figures come from the individual accounting records of these two companies as of December 31, 2013:

a. What balance does Haynes's Investment in Turner account show on December 31, 2013, when the equity method is applied

b. What is the consolidated net income for the year ending December 31, 2013

c. What is the consolidated equipment balance as of December 31, 2013 How would this answer be affected by the investment method applied by the parent

d. If Haynes has applied the initial value method to account for its investment, what adjustment is needed to the beginning of the Retained Earnings on a December 31, 2013, consolidation worksheet How would this answer change if the partial equity method had been in use How would this answer change if the equity method had been in use

The following figures come from the individual accounting records of these two companies as of December 31, 2012:

The following figures come from the individual accounting records of these two companies as of December 31, 2013:

a. What balance does Haynes's Investment in Turner account show on December 31, 2013, when the equity method is applied

b. What is the consolidated net income for the year ending December 31, 2013

c. What is the consolidated equipment balance as of December 31, 2013 How would this answer be affected by the investment method applied by the parent

d. If Haynes has applied the initial value method to account for its investment, what adjustment is needed to the beginning of the Retained Earnings on a December 31, 2013, consolidation worksheet How would this answer change if the partial equity method had been in use How would this answer change if the equity method had been in use

Explanation

(A variety of questions on equ...

Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255