Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

Edition 5ISBN: 978-1260575910

Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

Edition 5ISBN: 978-1260575910 Exercise 20

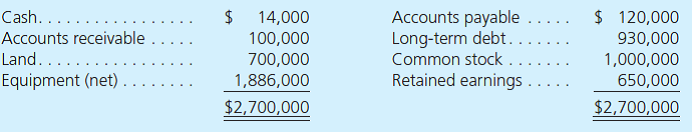

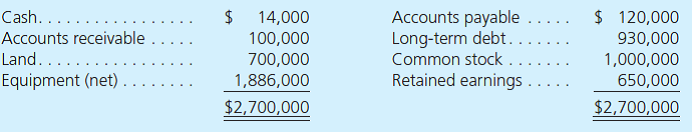

On January 1, 2012, Picante Corporation acquired 100 percent of the outstanding voting stock of Salsa Corporation for $1,765,000 cash. On the acquisition date, Salsa had the following balance sheet:

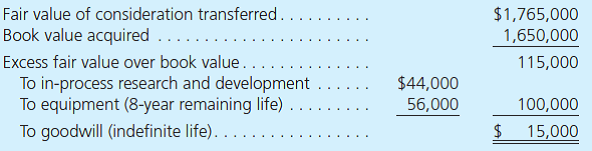

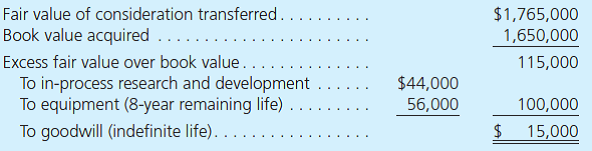

At the acquisition date, the following allocation was prepared:

Although at acquisition date Picante had expected $44,000 in future benefits from Salsa's in-process research and development project, by the end of 2012, it was apparent that the research project was a failure with no future economic benefits.

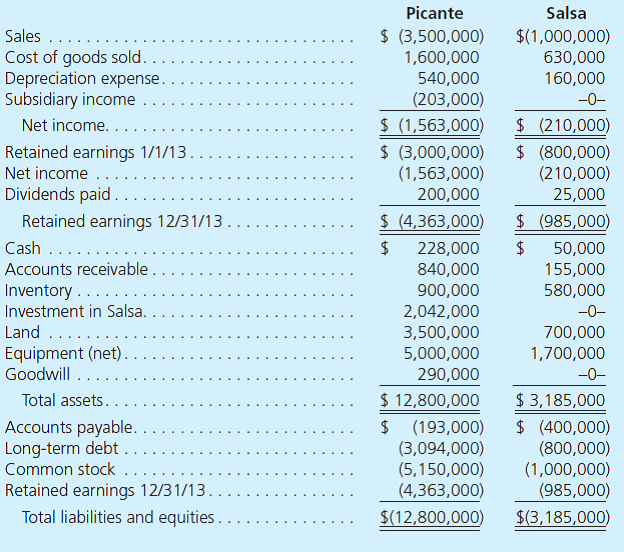

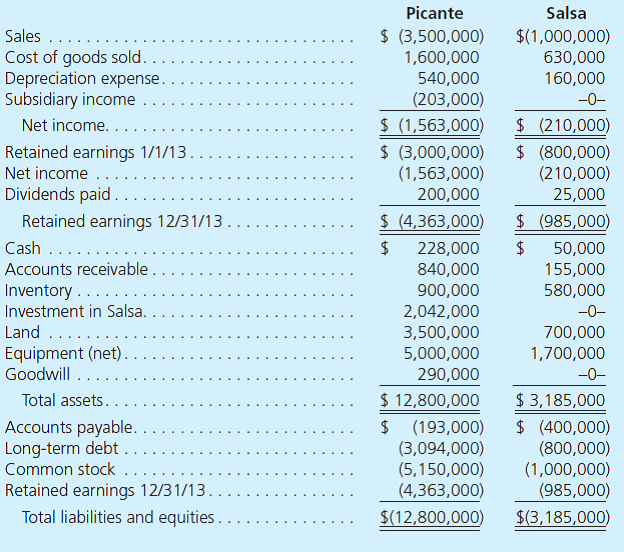

On December 31, 2013, Picante and Salsa submitted the following trial balances for consolidation:

a. Show how Picante derived its December 31, 2013, Investment in Salsa account balance.

b. Prepare a consolidated worksheet for Picante and Salsa as of December 31, 2013.

At the acquisition date, the following allocation was prepared:

Although at acquisition date Picante had expected $44,000 in future benefits from Salsa's in-process research and development project, by the end of 2012, it was apparent that the research project was a failure with no future economic benefits.

On December 31, 2013, Picante and Salsa submitted the following trial balances for consolidation:

a. Show how Picante derived its December 31, 2013, Investment in Salsa account balance.

b. Prepare a consolidated worksheet for Picante and Salsa as of December 31, 2013.

Explanation

a.

Calculate the P's investment in S's ...

Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255