Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

Edition 5ISBN: 978-1260575910

Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

Edition 5ISBN: 978-1260575910 Exercise 43

On January 1, 2011, Pride Co. purchased 90 percent of the outstanding voting shares of Star Inc. for $540,000 cash. The acquisition-date fair value of the noncontrolling interest was $60,000. At January 1, 2011, Star's net assets had a total carrying amount of $420,000. Equipment (8-year remaining life) was undervalued on Star's financial records by $80,000. Any remaining excess fair value over book value was attributed to a customer list developed by Star (4-year remaining life), but not recorded on its books. Star recorded income of $70,000 in 2011 and $80,000 in 2012. Each year since the acquisition, Star has paid a $20,000 dividend. At January 1, 2013, Pride's retained earnings show a $250,000 balance.

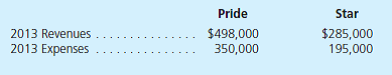

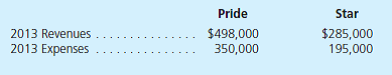

Selected account balances for the two companies from their separate operations were as follows:

What is consolidated net income for Pride and Star for 2013

a. $194,000.

b. $197,500.

c. $203,000.

d. $238,000.

Selected account balances for the two companies from their separate operations were as follows:

What is consolidated net income for Pride and Star for 2013

a. $194,000.

b. $197,500.

c. $203,000.

d. $238,000.

Explanation

This question doesn’t have an expert verified answer yet, let Examlex AI Copilot help.

Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255