Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

Edition 5ISBN: 978-1260575910

Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

Edition 5ISBN: 978-1260575910 Exercise 32

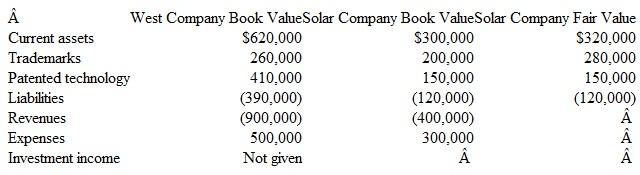

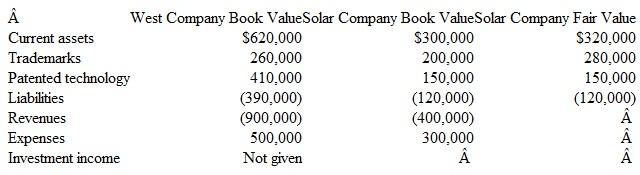

West Company acquired 60 percent of Solar Company for $300,000 when Solar's book value was $400,000. The newly comprised 40 percent noncontrolling interest had an assessed fair value of $200,000. Also at the acquisition date, Solar had a trademark (with a 10-year life) that was undervalued in the financial records by $60,000. Also, patented technology (with a 5-year life) was undervalued by $40,000. Two years later, the following figures are reported by these two companies (stockholders' equity accounts have been omitted):

What is the consolidated trademarks balance

A) $508,000.

B) $514,000.

C) $520,000.

D) $540,000.

What is the consolidated trademarks balance

A) $508,000.

B) $514,000.

C) $520,000.

D) $540,000.

Explanation

Step 1:

Calculate annual amortization on...

Fundamentals of Advanced Accounting 5th Edition by Joe Ben Hoyle,Thomas Schaefer,Timothy Doupnik

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255